So, you’re looking to bring on an independent contractor, huh? That’s fantastic! Navigating the world of business often requires specialized skills, and sometimes, hiring someone full-time just isn’t the right fit. But before you jump in and start delegating tasks, it’s crucial to have a solid 1099 independent contractor agreement template in place. Think of it as the roadmap for your working relationship, ensuring everyone is on the same page and minimizing potential misunderstandings down the line. It’s a document that protects both you and the contractor, outlining expectations and responsibilities clearly.

A well-crafted agreement isn’t just a formality; it’s a critical tool for setting the foundation for a successful collaboration. It defines the scope of work, payment terms, confidentiality clauses, and intellectual property rights, among other things. Without a proper agreement, you could find yourself in a sticky situation if disagreements arise or if the contractor’s work doesn’t meet your expectations. Plus, clearly defining the relationship helps avoid misclassification issues with the IRS, which can lead to serious penalties. This ensures you’re compliant and the contractor understands their tax obligations.

This guide will walk you through the essential elements of a 1099 independent contractor agreement template, helping you understand why each section is important and what to include. We’ll also offer tips on how to customize the template to fit your specific needs. We will also discuss the importance of consulting with legal counsel to ensure your agreement is legally sound and compliant with all applicable laws. Let’s dive in and create a template that sets the stage for a productive and mutually beneficial partnership.

Key Elements of a Robust 1099 Independent Contractor Agreement

When crafting your 1099 independent contractor agreement, several key sections need careful attention. Think of it like building a house: each element is essential for a strong and stable structure. Let’s break down the critical components to ensure your agreement is comprehensive and protects your interests.

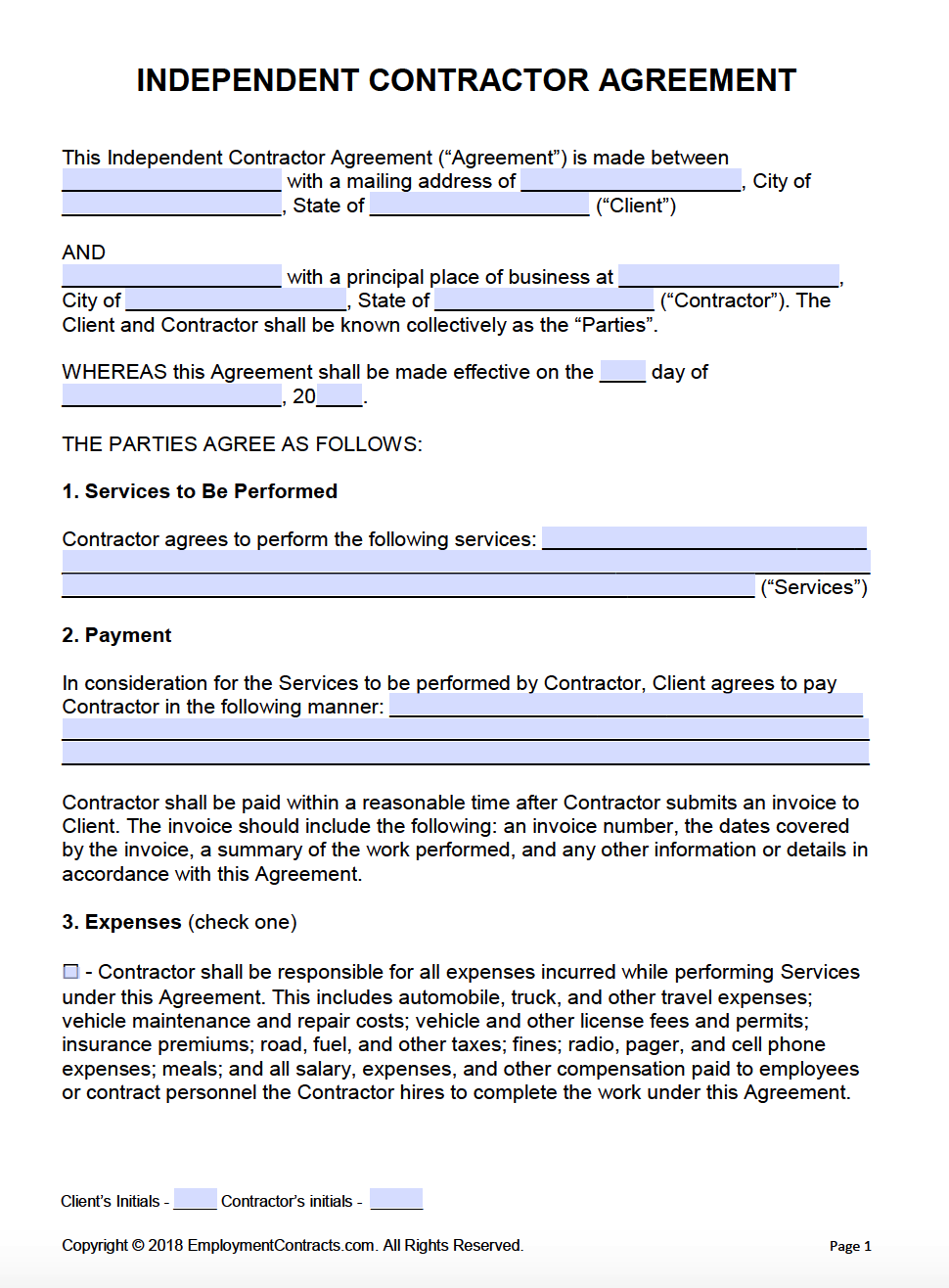

First and foremost, clearly identify the parties involved: your company and the independent contractor. Include full legal names, addresses, and contact information. This seems basic, but accuracy is paramount. Then, and perhaps most important, you must meticulously define the scope of work. What specific tasks or projects is the contractor responsible for? Be as detailed as possible, avoiding vague language that could lead to misinterpretations. The more precise you are, the less room there is for ambiguity. Specifying the deliverable, deadlines and expected quality is important.

Next, the agreement needs a section dedicated to payment terms. How much will the contractor be paid, and when? Will it be an hourly rate, a project-based fee, or some other arrangement? Outline the payment schedule clearly, specifying when invoices should be submitted and when payments will be processed. Also, include any expenses that will be reimbursed and the process for submitting expense reports. Transparency in payment matters is crucial for maintaining a positive working relationship.

Intellectual property ownership is another area that needs careful consideration. Who owns the work product created by the contractor? In most cases, you’ll want to ensure that your company owns the intellectual property rights to the work created. Clearly state that the work created by the contractor is considered “work for hire” and that your company owns all rights, title, and interest in the work. This section is vital for protecting your company’s assets.

Finally, include clauses addressing confidentiality, termination, and dispute resolution. A confidentiality clause protects your company’s sensitive information. Outline the contractor’s obligations to keep your company’s trade secrets and confidential information secure. The termination clause should specify the conditions under which either party can terminate the agreement, as well as the notice period required. The dispute resolution clause outlines the process for resolving any disagreements that may arise, such as mediation or arbitration.

Importance of Clearly Defining Independent Contractor Status

It’s crucial to emphasize that the agreement should explicitly state that the contractor is an independent contractor and not an employee. The agreement should highlight the fact that the contractor is responsible for their own taxes, insurance, and benefits. This section is important for avoiding misclassification issues with the IRS, which can lead to significant penalties.

Customizing Your 1099 Independent Contractor Agreement Template

While a template provides a solid foundation, it’s essential to tailor it to your specific circumstances. A one-size-fits-all approach rarely works when it comes to legal agreements. Think of the template as a starting point, and then customize it to reflect the unique aspects of your relationship with the independent contractor.

Start by revisiting the scope of work section. Are there any specific nuances or requirements that need to be addressed? For example, if the contractor will be working with sensitive data, you might need to include more stringent confidentiality provisions. Or, if the project has specific milestones or deliverables, outline them clearly in the agreement. The more tailored the scope of work section is, the less room there is for misunderstandings.

Next, consider the payment terms. Does the project require a deposit upfront? Will the contractor be paid in installments based on milestones achieved? Make sure the payment schedule accurately reflects the project’s timeline and deliverables. Additionally, specify the method of payment, such as check, electronic transfer, or other acceptable methods. If there are expenses the contractor can incur, define what expenses are allowed and how to submit the expense report. This will avoid confusion later on.

Review the intellectual property ownership clause carefully. Does your company need exclusive ownership of all work created by the contractor? Or are there certain exceptions or limitations? Ensure the clause accurately reflects your company’s needs and protects your intellectual property rights. Some projects might have unique requirements regarding intellectual property, so make sure to tailor the clause accordingly.

Finally, don’t hesitate to seek legal advice. An attorney can review your customized 1099 independent contractor agreement template and ensure it’s legally sound and compliant with all applicable laws. They can also help you identify any potential risks or loopholes in the agreement and make recommendations for improvement. While it might seem like an added expense, legal advice can save you significant time and money in the long run by preventing costly disputes or legal issues.

Remember, the goal is to create a clear, comprehensive, and legally sound agreement that protects both you and the independent contractor. A well-crafted agreement sets the stage for a successful and mutually beneficial working relationship. A 1099 independent contractor agreement template tailored to the specific needs of your engagement will lead to smooth operation.

Having a detailed agreement clarifies the expectations and obligations of both parties involved. It significantly minimizes the potential for misunderstandings or disagreements down the line. This proactive approach can save time, money, and stress in the long run, allowing everyone to focus on the work at hand.

A well-defined agreement also helps to ensure compliance with relevant laws and regulations. Consulting with legal counsel during the drafting process is invaluable for safeguarding your interests and fostering a positive working relationship with your independent contractors.