Ever heard of a lease that practically lasts a lifetime? That’s essentially what a 99 year lease agreement is all about. It’s a long term rental agreement that gives the lessee the right to use a property for, well, 99 years! It’s a common arrangement, particularly in situations involving land use and property development, offering a unique balance between ownership and renting. Instead of purchasing the property outright, the lessee obtains the right to occupy and use it for an extended period. Think of it as a very, very long term rental.

But why 99 years? The duration is often chosen for practical and legal reasons. In many jurisdictions, a lease of 99 years is seen as a substantial enough period to provide security of tenure for the lessee while avoiding some of the complexities associated with freehold ownership. It’s a sweet spot that offers long term stability without permanently transferring ownership. This can be incredibly useful for various scenarios, from building developments to managing historical properties.

If you’re considering entering into such an agreement, either as a landlord or a tenant, understanding the intricacies is crucial. This article will guide you through the essential aspects of a 99 year lease agreement, what to include in a template, and what to watch out for. Let’s dive in and explore the world of near century long leases.

Understanding the Nitty-Gritty of a 99 Year Lease Agreement

A 99 year lease agreement, at its core, is a legally binding contract between a lessor (the property owner) and a lessee (the renter). This contract grants the lessee the right to use and occupy the property for a term of 99 years, subject to certain conditions and obligations. These obligations will always be specific to the situation, but often include paying rent, maintaining the property, and adhering to any restrictions outlined in the agreement. It is a complex legal document that requires careful consideration and should not be entered into lightly.

One of the key advantages of a 99 year lease is the security it provides to the lessee. Unlike shorter leases, a 99 year lease offers a long term stake in the property. This is particularly beneficial for businesses or individuals who plan to invest heavily in the property, such as building a structure or making significant renovations. The extended duration ensures that they have ample time to recoup their investment and benefit from the property’s use.

From the lessor’s perspective, a 99 year lease can provide a steady stream of income over a long period. It also allows them to retain ownership of the property while transferring the responsibility for its management and maintenance to the lessee. This can be an attractive option for landowners who want to generate income without relinquishing their ownership rights.

However, it’s crucial to understand the implications of such a long term commitment. The lease agreement should clearly outline the rights and responsibilities of both parties, including provisions for rent reviews, renewal options, termination clauses, and dispute resolution mechanisms. It should also address issues such as insurance, taxes, and the transferability of the lease.

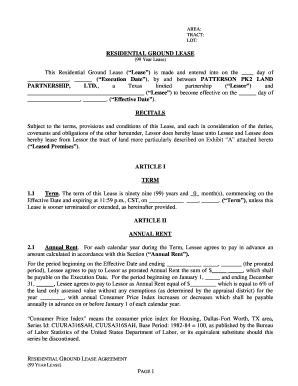

Therefore, a 99 year lease agreement template can be an invaluable starting point. However, it’s essential to customize the template to reflect the specific circumstances of the property and the needs of both the lessor and the lessee. Consulting with a legal professional is highly recommended to ensure that the agreement is legally sound and protects the interests of all parties involved.

Key Clauses and Considerations in a 99 Year Lease Agreement

When drafting or reviewing a 99 year lease agreement, there are several key clauses and considerations that warrant careful attention. These clauses dictate the rights, obligations, and potential liabilities of both the lessor and the lessee, and they can have a significant impact on the overall success of the lease arrangement.

First and foremost, the agreement should clearly define the property being leased, including its boundaries, any improvements, and any restrictions on its use. The rent payment schedule, including the amount, frequency, and method of payment, should also be clearly outlined. Moreover, the agreement should specify how and when rent reviews will occur, and what factors will be considered when determining the new rent amount.

Another important consideration is the responsibility for maintenance and repairs. The agreement should specify who is responsible for maintaining the property and who is responsible for making repairs. It should also address issues such as insurance coverage and liability for any damages or injuries that may occur on the property.

Furthermore, the agreement should include provisions for termination of the lease. These provisions should specify the circumstances under which either party can terminate the lease, such as breach of contract or unforeseen events. They should also outline the procedures for terminating the lease and the consequences of termination.

Finally, the agreement should address the issue of transferability. The agreement should specify whether the lessee has the right to transfer the lease to another party, and if so, under what conditions. It should also address the lessor’s rights in the event that the lessee wishes to transfer the lease. It’s a good idea to have a 99 year lease agreement template as a starting point for this.

Navigating the intricacies of property agreements requires patience and careful planning. Take your time, conduct thorough research, and seek professional guidance when needed. The key is to ensure that your agreement accurately reflects your intentions and protects your interests.

Ultimately, the goal is to create arrangements that are mutually beneficial and sustainable over the long term. By focusing on clarity, transparency, and fairness, you can lay the groundwork for successful property ventures that stand the test of time.