So, you’re looking into getting some help from your company to further your education? That’s fantastic! Many employers offer tuition reimbursement as a perk, and it can be a real game-changer for your career. However, before you jump headfirst into that master’s program or specialized certification, it’s essential to understand the fine print, specifically the tuition reimbursement payback agreement.

Think of a tuition reimbursement payback agreement as a safety net for both you and your employer. It outlines the terms under which the company will cover your education expenses and what happens if you leave the company before a certain period after completing your studies. It’s not meant to scare you away from taking advantage of the benefit; instead, it ensures everyone is on the same page and protects the company’s investment in your development. A well-crafted agreement protects you as well.

Navigating these agreements can seem a bit daunting, but don’t worry! This guide will break down everything you need to know about tuition reimbursement payback agreements. We’ll cover what they are, why they’re important, and how you can find and use a tuition reimbursement payback agreement template to create a clear and fair agreement. By the end, you’ll be well-equipped to understand and confidently approach this crucial document.

Understanding Tuition Reimbursement Payback Agreements: A Comprehensive Guide

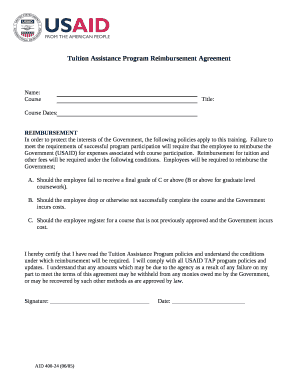

A tuition reimbursement payback agreement is essentially a contract between you and your employer. In exchange for the company paying for your education (tuition, books, fees, etc.), you agree to remain employed with them for a specified period after you complete your course or degree. This is the basic premise, but the details are what truly matter. The agreements can come in different forms so you should always read carefully.

Why do companies even bother with these agreements? The simple answer is investment. By investing in your education, companies hope to enhance your skills and knowledge, making you a more valuable asset to the organization. However, if you were to leave shortly after receiving that education, the company wouldn’t see a return on its investment. The payback agreement protects them from losing out on that investment.

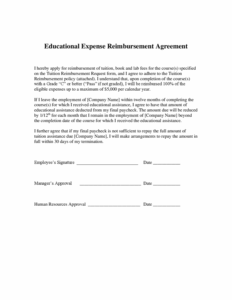

What happens if you *do* leave before the agreed-upon timeframe? That’s where the “payback” part comes in. Typically, the agreement will stipulate that you must repay a portion or all of the tuition reimbursement received. The amount you owe usually decreases over time, so the longer you stay with the company, the less you’ll have to repay if you decide to leave eventually. This is often structured as a prorated repayment schedule.

It’s crucial to carefully review the terms of the agreement before signing. Pay close attention to the length of the required employment period, the repayment schedule, and any circumstances that might trigger a waiver of the repayment obligation (such as layoffs or disability). Don’t be afraid to ask questions and clarify any points that are unclear. You should completely understand the agreement before you sign it.

Finding a suitable tuition reimbursement payback agreement template can save you time and ensure that all the essential elements are included. Many online resources offer templates, but it’s important to choose one that is legally sound and tailored to your specific situation. You may want to consult with an attorney to review the agreement and ensure it complies with applicable state and federal laws. This is a critical step to make sure both parties are secure in the agreement.

Key Elements and Considerations for Your Agreement

When examining or creating a tuition reimbursement payback agreement, several key elements deserve careful consideration. First, the agreement must clearly define what expenses are covered. Does it include tuition only, or does it also cover books, fees, and other related costs? Be certain you know what the company will and will not cover.

The agreement should also explicitly state the required length of employment following the completion of your education. This is often expressed in months or years. Remember, this is the time commitment you are making in exchange for the financial assistance. Also, is the repayment prorated, or is there a step-down schedule?

A well-drafted agreement will also address potential scenarios that might lead to a waiver of the repayment obligation. For example, what happens if the company lays you off or if you become disabled and unable to work? These “escape clauses” can provide you with crucial protection in unforeseen circumstances. Often, these waivers are decided on a case-by-case basis but should be included in the agreement.

Another vital aspect is ensuring the agreement complies with all applicable state and federal laws. Some states have specific regulations regarding tuition reimbursement agreements, and you want to ensure your agreement is legally enforceable. This is why consulting with an attorney is often a good idea.

Finally, consider the overall fairness of the agreement. Does the required employment period seem reasonable in relation to the amount of tuition reimbursement you’re receiving? Are the terms clearly stated and easy to understand? A fair and transparent agreement will benefit both you and your employer, fostering a positive working relationship and ensuring everyone is on the same page. Look for a tuition reimbursement payback agreement template that is easy to understand.

Embarking on further education with the support of your employer is an amazing opportunity. A solid understanding of the tuition reimbursement payback agreement protects your interests while ensuring your company feels confident in their investment.

The key takeaway is to do your homework, read the fine print, and don’t hesitate to seek clarification. By taking the time to understand the terms and implications of the tuition reimbursement payback agreement, you can confidently pursue your educational goals and advance your career without unnecessary worry.