Buying or selling a home in Florida? Congratulations! It’s a big step, and like any significant transaction, it involves a lot of paperwork. One of the most crucial documents in this process is the Florida real estate purchase agreement. Think of it as the roadmap to your real estate deal – it outlines all the terms and conditions that both the buyer and seller agree to, ensuring a smooth and legally sound transaction. Getting it right is key to avoiding potential headaches down the road.

Navigating the world of real estate contracts can seem daunting, especially with all the legal jargon involved. But don’t worry, it doesn’t have to be overwhelming. This article aims to demystify the Florida real estate purchase agreement and guide you through the essential elements you need to understand. We’ll explore the key sections, explain what they mean, and offer insights into how to use a Florida real estate purchase agreement template effectively.

Whether you’re a first-time homebuyer, a seasoned investor, or a seller looking to close a deal, understanding the ins and outs of this document is paramount. So, let’s dive in and explore what makes up a solid Florida real estate purchase agreement and how you can leverage a template to your advantage.

Understanding the Key Components of a Florida Real Estate Purchase Agreement

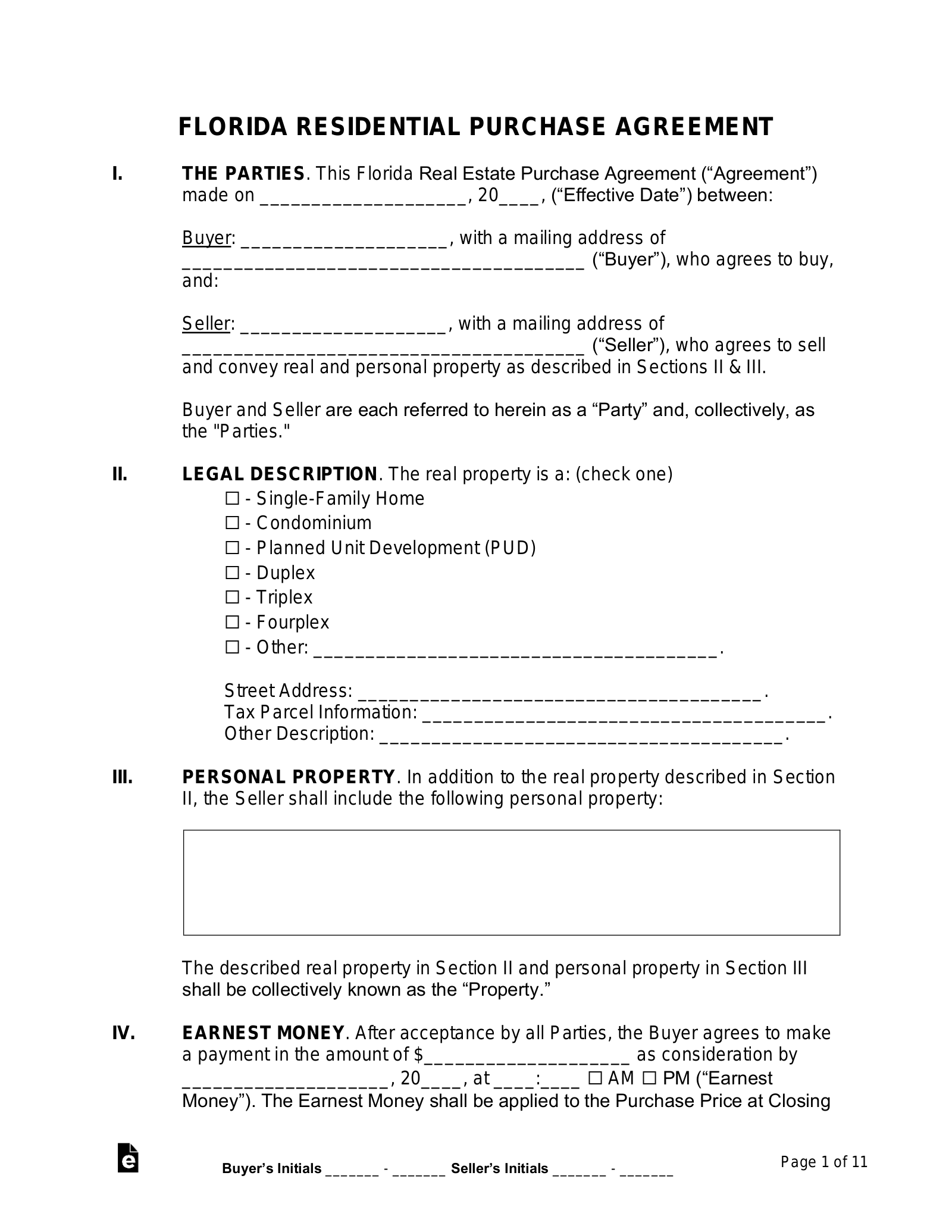

A Florida real estate purchase agreement is a legally binding contract that outlines the terms and conditions of a real estate transaction between a buyer and a seller. It’s a comprehensive document that covers everything from the purchase price and closing date to contingencies and disclosures. Let’s break down some of the most critical components.

First, you’ll find the identification of the parties involved: the buyer and the seller. This section clearly states the full legal names of everyone participating in the transaction. Next, there’s a detailed description of the property. This includes the street address, legal description, and often the parcel identification number. Accuracy here is crucial to avoid any future disputes about which property is actually being sold.

The purchase price is another key element, specifying the agreed-upon amount the buyer will pay for the property. This section also outlines the earnest money deposit, which is a good faith deposit the buyer puts down to show their seriousness about purchasing the property. The agreement also details how the purchase will be financed, whether through a mortgage, cash, or other means. Contingencies play a vital role, protecting both the buyer and the seller. Common contingencies include a financing contingency (allowing the buyer to back out if they can’t secure a mortgage), an inspection contingency (allowing the buyer to have the property professionally inspected and potentially renegotiate or withdraw if significant issues are found), and an appraisal contingency (ensuring the property appraises for at least the purchase price).

The closing date is the agreed-upon date when the ownership of the property will officially transfer from the seller to the buyer. This section also specifies the responsibilities of each party regarding closing costs, such as title insurance, recording fees, and transfer taxes. Finally, the agreement includes various disclosures, such as any known defects with the property, environmental hazards, or homeowner’s association rules. These disclosures are legally required and help ensure transparency in the transaction.

Utilizing a Florida Real Estate Purchase Agreement Template

A Florida real estate purchase agreement template can be a valuable tool for both buyers and sellers. It provides a standardized framework that covers all the essential elements of a real estate transaction. However, it’s crucial to remember that a template is just a starting point. Each real estate deal is unique, and the template should be carefully reviewed and customized to reflect the specific terms and conditions agreed upon by both parties. Working with a real estate attorney is highly recommended to ensure that the agreement accurately reflects your intentions and protects your interests.

Navigating Common Clauses and Contingencies

Understanding the common clauses and contingencies within a Florida real estate purchase agreement is essential for a successful transaction. Clauses define specific aspects of the agreement, while contingencies provide conditions that must be met for the deal to proceed. Let’s explore some of the most frequently encountered ones. A financing clause, as mentioned earlier, protects the buyer if they are unable to obtain a mortgage. It typically specifies the amount of the loan, the interest rate, and the timeframe for securing financing. If the buyer can’t get approved for a mortgage within the specified timeframe, they can usually back out of the deal and receive their earnest money deposit back.

The inspection contingency allows the buyer to have the property professionally inspected by a qualified inspector. The inspection report can reveal potential problems with the property, such as structural issues, plumbing problems, or electrical hazards. If the inspection reveals significant issues, the buyer can negotiate with the seller to have them repaired, reduce the purchase price, or terminate the agreement. An appraisal contingency ensures that the property appraises for at least the purchase price. If the appraisal comes in lower than the purchase price, the buyer may be able to renegotiate the price or terminate the agreement.

Another clause involves property condition. Often, the agreement specifies that the seller must maintain the property in its current condition until closing. This means the seller is responsible for making necessary repairs or preventing further damage to the property. A title clause outlines the requirements for providing a clear and marketable title to the buyer. This typically involves a title search to ensure there are no liens, encumbrances, or other issues that could affect the buyer’s ownership rights. There might also be clauses related to homeowners association rules and regulations, especially if the property is located in a community with an HOA. These clauses ensure that the buyer is aware of the HOA’s rules and fees.

Furthermore, a force majeure clause addresses unforeseen circumstances, such as natural disasters or other events beyond the control of either party, that could delay or prevent the closing. These clauses typically outline the procedures for dealing with such situations. Addendums are commonly used to modify or add to the terms of the original purchase agreement. For example, an addendum might be used to address repairs requested by the buyer or to extend the closing date.

Ultimately, carefully reviewing and understanding all the clauses and contingencies in a Florida real estate purchase agreement is crucial for protecting your interests and ensuring a smooth and successful transaction. Remember to consult with a real estate attorney to ensure that the agreement accurately reflects your intentions and complies with all applicable laws.

Working with a real estate professional will help ensure you’re on the right track. They’re familiar with the local market and can guide you through the intricacies of real estate transactions. They’ll also ensure you are using a current and legally sound Florida real estate purchase agreement template.

Remember to always carefully read and understand every section of the purchase agreement before signing. Don’t hesitate to ask questions or seek clarification from a real estate attorney or other qualified professional if anything is unclear. A well-understood and properly executed Florida real estate purchase agreement is the foundation for a successful real estate transaction.