Thinking about sharing the wealth with your amazing employees? A profit sharing agreement can be a fantastic way to boost morale, increase productivity, and foster a real sense of ownership within your company. It’s a system where a portion of your company’s profits are distributed to your employees, typically based on pre determined criteria.

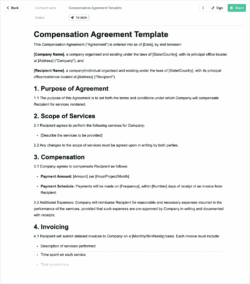

But before you start handing out checks, you need a solid plan. That’s where an employee profit sharing agreement template comes in handy. It provides a framework to outline the specific details of your plan, ensuring everyone is on the same page and minimizing potential misunderstandings down the road. It clearly defines the rules of engagement, making sure the distribution process is fair, transparent, and legally sound.

In this article, we’ll dive into the ins and outs of employee profit sharing agreements. We’ll cover what they are, why you might want one, and what key elements should be included in your template. We’ll also explore how to effectively communicate the details of the plan to your team, so they feel valued and motivated.

Why Use an Employee Profit Sharing Agreement?

Implementing an employee profit sharing plan, documented with a well drafted agreement, offers a multitude of benefits for both employers and employees. For starters, it’s a powerful incentive. When employees know that their hard work directly contributes to the company’s bottom line and that they’ll share in the profits, they’re more likely to be engaged, motivated, and committed to their jobs. This increased engagement can lead to higher productivity, better quality work, and reduced employee turnover.

A profit sharing plan can also align employee interests with the company’s goals. Instead of just clocking in and out, employees become invested in the company’s success. They’re more likely to look for ways to improve efficiency, reduce costs, and increase revenue because they know it will directly benefit them. This shared sense of purpose can create a more collaborative and innovative work environment.

From the employer’s perspective, a profit sharing plan can be a cost effective way to attract and retain top talent. In today’s competitive job market, employees are looking for more than just a salary. They want to work for companies that value them and offer opportunities for growth and financial security. A profit sharing plan can be a major differentiator, helping you attract the best and brightest minds to your organization.

Moreover, a well structured profit sharing plan can be a tax efficient way to compensate employees. Contributions to the plan are often tax deductible for the employer, and employees typically don’t have to pay taxes on the money until they withdraw it from the plan, usually at retirement. This can provide significant tax savings for both parties involved.

Furthermore, using an employee profit sharing agreement template ensures consistency and fairness in the implementation of the profit sharing plan. It spells out the eligibility criteria, the allocation formula, the payment schedule, and other important details, preventing any ambiguity or disputes. This level of clarity fosters trust and transparency between employers and employees.

Key Elements of an Employee Profit Sharing Agreement Template

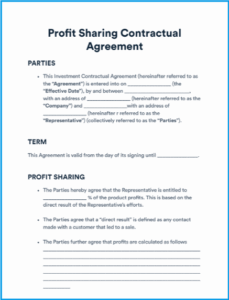

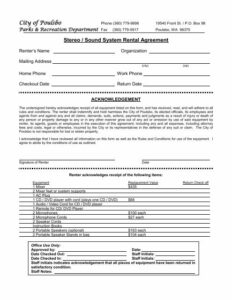

When crafting your employee profit sharing agreement template, several key elements should be included to ensure clarity, fairness, and legal compliance. First and foremost, clearly define eligibility requirements. Who is eligible to participate in the plan? Is it all employees, or are there specific criteria, such as length of service or job title? Be specific to avoid confusion and potential discrimination claims.

Next, outline the profit calculation method. How will the company’s profits be determined for the purpose of profit sharing? Will it be based on net income, gross revenue, or another metric? Make sure the calculation method is transparent and easily understandable. You might consider consulting with an accountant or financial advisor to ensure the method is accurate and compliant with accounting standards.

The allocation formula is another critical component. How will the profits be distributed among eligible employees? Will it be a percentage of their salary, a flat dollar amount, or some other formula? The allocation formula should be fair and equitable, taking into account factors such as employee contribution and seniority. It needs to feel balanced so all employees think the profit split is fair.

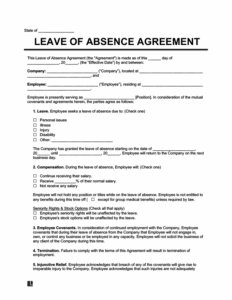

Also, be sure to specify the vesting schedule. This determines when employees become entitled to the profit sharing benefits. A common vesting schedule might be gradual, with employees becoming fully vested after a certain number of years of service. The vesting schedule should be clearly defined in the agreement to avoid any misunderstandings.

Finally, include details about the payment schedule and distribution method. When will the profit sharing payments be made? Will they be distributed annually, quarterly, or at some other interval? How will the payments be made, such as through direct deposit or check? Also, address what happens if an employee leaves the company before the payment date. Having a comprehensive employee profit sharing agreement template that addresses these points is a good way to protect all parties.

Implementing a profit sharing program is a great tool to bring more value to your business and provide opportunities to your workers. When the time comes to expand your business, you’ll want to have experienced and qualified staff who believe in the mission, and that can start with a profit sharing program.

Creating the best workplace for your team can translate to a happy and profitable business. A profit sharing agreement can be a great way to start.