So, you’re thinking about offering an employee a forgivable loan? That’s a pretty cool move! It can be a fantastic way to attract and retain top talent, especially in competitive industries. Essentially, it’s a loan that the employee doesn’t have to repay if they meet certain conditions, usually staying with the company for a specific period. Think of it as a golden handcuff, but in a good way – it benefits both the employee and the employer when structured properly.

But before you start handing out cash, it’s absolutely crucial to have a solid employee forgivable loan agreement template in place. This document outlines all the terms and conditions of the loan, protecting both your interests and the employee’s. It’s not something you want to cobble together at the last minute, trust me. A well-drafted agreement can prevent misunderstandings, legal headaches, and potential tax issues down the road.

This article will walk you through the key elements of an employee forgivable loan agreement template, helping you understand what to include and why it’s important. We’ll break down the legalese into plain English, so you can confidently create a loan agreement that works for your business and your employees. Let’s dive in!

Key Elements of an Employee Forgivable Loan Agreement Template

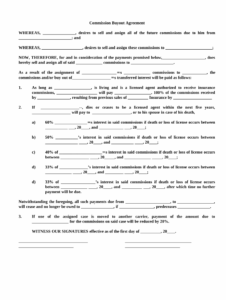

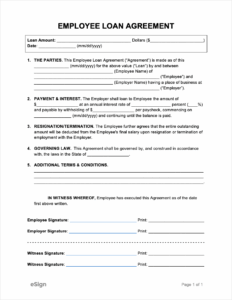

A comprehensive employee forgivable loan agreement template should cover several critical aspects. Failing to address these key elements can lead to ambiguity, disputes, and potential legal problems. The agreement should clearly define the loan amount, the interest rate (if any), the repayment schedule (if any, before forgiveness), and the specific conditions for forgiveness. Don’t leave anything to chance – clarity is your best friend here.

The forgiveness schedule is perhaps the most important part. How long does the employee need to stay with the company to have the loan fully forgiven? Is the forgiveness gradual, say, 20% per year over five years, or is it all at once after a certain period? Be specific! The schedule should be easy to understand and leave no room for interpretation. Consider including examples to illustrate how the forgiveness works in practice.

It’s also vital to outline what happens if the employee leaves the company before the loan is fully forgiven. Will they be required to repay the outstanding balance immediately? Will there be a grace period? What happens to any accrued interest? These scenarios need to be clearly addressed in the agreement. Think about different potential departure scenarios – voluntary resignation, termination for cause, termination without cause – and how each will affect the loan repayment.

Tax implications are another crucial consideration. The IRS views forgivable loans as income to the employee at the time of forgiveness. This means that the employee will owe taxes on the forgiven amount. The agreement should address how these taxes will be handled. Will the company gross up the employee’s pay to cover the taxes? Or will the employee be responsible for paying the taxes themselves? Consulting with a tax professional is highly recommended to ensure compliance and minimize tax liabilities for both parties.

Finally, the agreement should include standard legal clauses such as a choice of law provision (which state’s laws govern the agreement), a severability clause (if one part of the agreement is deemed unenforceable, the rest remains in effect), and an integration clause (the agreement constitutes the entire understanding between the parties). These clauses, while seemingly boilerplate, are essential for protecting your legal position.

Drafting a Clear and Effective Agreement

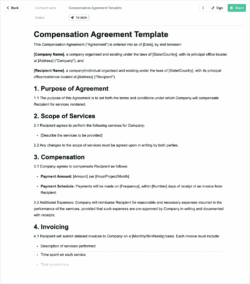

Once you understand the key elements, the next step is to draft a clear and effective employee forgivable loan agreement template. This means using plain language that both the employee and the employer can easily understand. Avoid jargon and overly complicated sentences. The goal is to create a document that is accessible and unambiguous.

Consider using headings and subheadings to break up the text and make it easier to read. Numbering sections can also help with clarity and organization. Visual aids, such as charts or tables, can be helpful for illustrating the forgiveness schedule or repayment terms. The more user-friendly the agreement, the less likely there will be misunderstandings or disputes.

Before finalizing the agreement, have it reviewed by an attorney who specializes in employment law. An attorney can identify potential legal issues and ensure that the agreement complies with all applicable laws and regulations. This is a small investment that can save you a lot of money and headaches in the long run. An attorney can also advise you on the specific language to use in the agreement to protect your interests.

It’s also a good idea to have the employee review the agreement with their own attorney or financial advisor. This ensures that they fully understand the terms and conditions of the loan and are comfortable with them. Encouraging employees to seek independent advice can help to build trust and transparency.

Remember, an employee forgivable loan agreement template is not a one-size-fits-all document. It should be tailored to the specific circumstances of each loan. Factors such as the loan amount, the employee’s role, and the company’s industry can all influence the terms of the agreement. Take the time to customize the template to meet your specific needs.

Offering an employee a forgivable loan can be a powerful tool for attracting and retaining talent, fostering loyalty, and aligning employee incentives with company goals. The benefits extend to both the company and the employee, creating a win-win situation when implemented correctly.

By carefully considering the key elements discussed and drafting a clear and effective agreement, you can minimize the risks and maximize the rewards of offering forgivable loans to your employees. It’s an investment in your people, and ultimately, in the success of your business.