So, you’re diving into the world of real estate, huh? Congratulations! Buying or selling a property is a huge step, and it’s exciting (and sometimes a little nerve-wracking). One of the first things you’ll likely encounter is the earnest money deposit. Think of it as a good-faith commitment from the buyer to the seller, saying, “Hey, I’m serious about buying this place!” But before any money changes hands, it’s crucial to have a clear, well-defined agreement in place. That’s where an earnest money deposit agreement template comes in handy.

Essentially, an earnest money deposit agreement template lays out all the important details surrounding the deposit, protecting both the buyer and the seller. It spells out the amount of the deposit, how it will be held, and under what circumstances it might be forfeited or returned. Using a template ensures you don’t miss any critical information and helps avoid potential misunderstandings or disputes down the line. It’s a simple document that can save you a lot of headaches.

Navigating real estate transactions can sometimes feel like navigating a maze of paperwork, but having the right tools and knowledge at your disposal makes the whole process much smoother. Let’s explore the ins and outs of earnest money deposit agreements, why they’re essential, and how an earnest money deposit agreement template can be your best friend in this process.

Understanding the Earnest Money Deposit Agreement

At its core, the earnest money deposit agreement is a legally binding document that formalizes the buyer’s intent to purchase a property. It’s a tangible expression of their commitment, offering the seller some assurance that the buyer is serious and less likely to back out of the deal without a valid reason. It’s not just a formality; it’s a crucial component of the real estate transaction.

The agreement outlines several key aspects: the amount of the earnest money deposit (typically a percentage of the purchase price), the method of payment (check, wire transfer, etc.), who will hold the deposit (often an escrow company or the seller’s agent), and the conditions under which the deposit can be refunded to the buyer or forfeited to the seller. These conditions are generally tied to contingencies within the purchase agreement, such as financing, inspection, or appraisal contingencies.

Without a clear agreement, confusion can arise regarding the rightful owner of the deposit if the deal falls through. Imagine a scenario where a buyer backs out because they couldn’t secure financing, but the agreement doesn’t explicitly state that financing failure allows for a refund. In such a case, a dispute is almost guaranteed, leading to potential legal battles and wasted time and money. The agreement aims to prevent these issues.

Furthermore, the agreement clarifies the timeline associated with the deposit. It specifies when the deposit must be made, how long the escrow company will hold it, and when it will be applied towards the purchase price at closing. Clarity on these points ensures that all parties are on the same page and helps avoid any delays or misunderstandings during the transaction.

Think of the earnest money deposit agreement template as a roadmap for the initial stages of the real estate deal. It provides a framework that protects everyone involved and sets the stage for a smoother, more transparent process. This template is essential when dealing with an earnest money deposit agreement.

Key Elements of an Earnest Money Deposit Agreement Template

When you’re looking at an earnest money deposit agreement template, there are specific clauses and sections you want to pay close attention to. These are the essential building blocks that make the agreement legally sound and protect your interests.

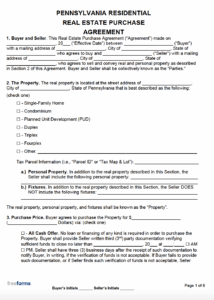

First and foremost, the template should clearly identify the parties involved: the buyer and the seller. It should include their full legal names and addresses. This might seem obvious, but accuracy is key. Any errors in these details could potentially lead to legal complications later on.

Next, the template must specify the property being purchased. This includes the full property address, including street number, city, state, and zip code. It might also include the legal description of the property, which can be found on the property deed. Again, precision is vital here. You want to ensure there’s no ambiguity about which property the agreement pertains to.

The heart of the agreement, of course, is the details surrounding the earnest money deposit itself. This section should state the exact amount of the deposit, the form of payment (check, wire transfer, etc.), and the name and contact information of the escrow agent or company that will be holding the funds. It should also outline the timeline for when the deposit must be made.

Perhaps the most critical part of the agreement is the section outlining the conditions under which the earnest money deposit will be refunded to the buyer or forfeited to the seller. These conditions are usually tied to contingencies such as financing, inspection, appraisal, or title clearance. The template should clearly define what constitutes a valid reason for the buyer to back out of the deal and receive their deposit back. Conversely, it should also specify the circumstances under which the seller is entitled to keep the deposit as compensation for the buyer’s breach of contract.

Finally, make sure the template includes signature lines for both the buyer and the seller, along with the date of signing. The document isn’t legally binding until it’s signed by all parties. It’s always a good idea to have a real estate attorney review the agreement before you sign it, just to ensure that it adequately protects your interests and complies with local laws and regulations.

Using an earnest money deposit agreement template will help you document the process. While real estate transactions can be complicated, you should protect yourself.