Divorce Financial Settlement Agreement Template

Going through a divorce? It’s tough, no doubt about it. Amongst the emotional rollercoaster, you’ve also got to figure out the practical stuff, like dividing up your assets. That’s where a financial settlement agreement comes in. Think of it as a roadmap for how you and your soon-to-be-ex will split everything from your house and bank accounts to retirement funds and even those airline miles you’ve been hoarding. It’s about creating a clear, legally binding plan to help both of you move forward with financial security.

A divorce financial settlement agreement isn’t just a piece of paper; it’s a tool to avoid future disputes and potential court battles. It outlines exactly who gets what, when, and how. By having a detailed agreement in place, you can both gain peace of mind knowing that your financial future is secure and predictable, as much as it can be during such a life-altering time. Plus, it can save you a lot of money in legal fees down the line.

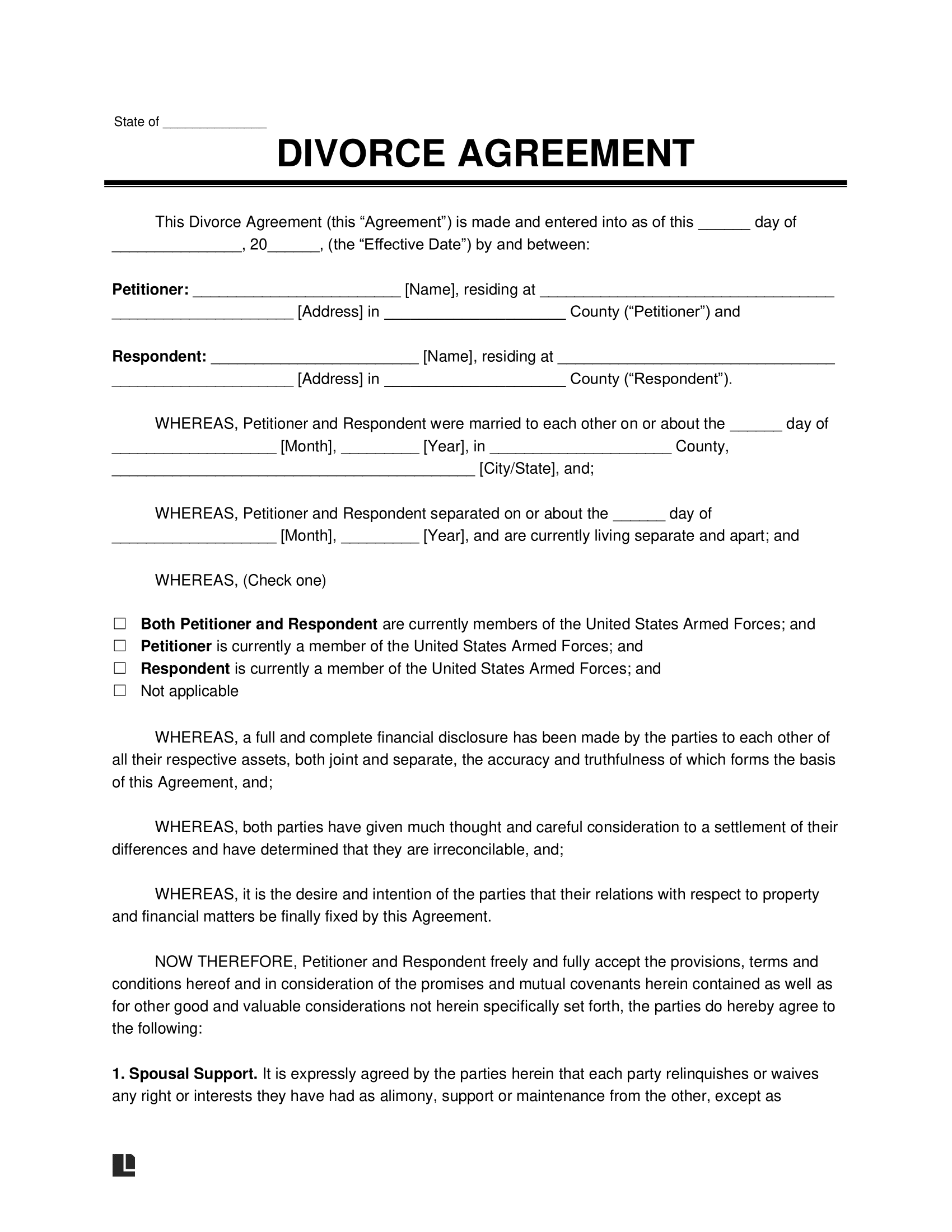

So, where do you even start? Many people find themselves searching for a divorce financial settlement agreement template to get a better understanding of what needs to be included and how to structure the agreement. It’s a great first step to familiarize yourself with the process and identify all the assets and liabilities you and your spouse have accumulated during your marriage. However, always remember that these templates should be used as a starting point, and seeking professional legal advice is highly recommended to ensure the agreement is tailored to your specific situation and complies with the relevant laws in your jurisdiction.

Understanding the Essentials of a Financial Settlement Agreement

A financial settlement agreement, also known as a property settlement agreement, is a legally binding contract that outlines how you and your spouse will divide your assets and debts during a divorce. It covers everything from real estate and personal property to bank accounts, investments, retirement funds, and even spousal support (alimony). The agreement should be comprehensive and address all aspects of your financial life together.

One crucial element is full disclosure. Both parties must be completely honest and transparent about their assets, income, and debts. Hiding assets or misrepresenting your financial situation can invalidate the agreement and lead to serious legal consequences. It’s best to gather all relevant financial documents, such as bank statements, tax returns, investment account statements, and property deeds, before you begin the negotiation process.

The agreement should clearly specify who gets which assets and who is responsible for which debts. For example, if you’re keeping the house, the agreement should state that you’re responsible for the mortgage payments and property taxes. If you’re splitting a retirement account, the agreement should outline the specific percentage or dollar amount each person will receive and how the transfer will be executed.

Spousal support, if applicable, should also be clearly defined in the agreement. This includes the amount of support, the duration of payments, and any conditions that might affect the payments (such as remarriage or cohabitation). It’s important to consult with an attorney to determine if spousal support is appropriate in your situation and to negotiate a fair and reasonable amount.

Navigating the creation of a sound and legally binding divorce financial settlement agreement can be complex. To assist you, using a divorce financial settlement agreement template is a good starting point; however, consider seeking advice from legal and financial professionals to ensure it accurately reflects your specific circumstances and complies with local laws. This professional guidance ensures the settlement is equitable and enforceable.

Key Considerations When Using a Template

While a divorce financial settlement agreement template can be helpful, remember that it’s just a starting point. It’s crucial to customize the template to reflect your specific circumstances and the laws in your jurisdiction. Don’t assume that a generic template will cover all the necessary details. Seek professional legal advice to ensure the agreement is comprehensive and enforceable.

Before using a template, carefully review it and make sure you understand all the terms and conditions. Pay attention to any clauses that seem unclear or ambiguous. If you’re unsure about something, ask an attorney for clarification. It’s better to ask questions upfront than to regret signing an agreement you don’t fully understand.

Steps to Creating a Solid Financial Settlement Agreement

The first step in creating a solid financial settlement agreement is gathering all your financial information. This includes bank statements, investment account statements, tax returns, property deeds, loan documents, and any other relevant financial records. The more information you have, the easier it will be to negotiate a fair and equitable settlement.

Once you’ve gathered your financial information, the next step is to identify all your assets and debts. This includes real estate, personal property, bank accounts, investments, retirement funds, loans, credit card debt, and any other assets or liabilities you and your spouse have accumulated during your marriage. Make a comprehensive list of everything, including the estimated value of each item.

Next, you and your spouse need to negotiate how you will divide your assets and debts. This can be done directly between you or through mediation or collaborative law. Mediation involves a neutral third party who helps you and your spouse reach an agreement. Collaborative law involves each of you hiring an attorney who is trained in collaborative negotiation techniques. The goal is to reach a settlement that is fair and acceptable to both of you.

Once you’ve reached an agreement, it’s important to put it in writing. This is where a divorce financial settlement agreement template can come in handy. However, remember to customize the template to reflect your specific agreement and the laws in your jurisdiction. It’s always a good idea to have an attorney review the agreement before you sign it to ensure that it’s legally sound and protects your interests.

Finally, once you and your spouse have signed the agreement, you’ll need to file it with the court as part of your divorce proceedings. The court will review the agreement to ensure that it’s fair and equitable. If the court approves the agreement, it will become a legally binding order that you and your spouse must follow.

Going your separate ways also means creating new financial futures. Careful planning now can avoid headaches down the road.

Ultimately, a fair and well-crafted agreement will provide a stable foundation for both parties as they begin their post-divorce lives.