So, you’re thinking about starting a Limited Liability Company (LLC)? That’s fantastic! It’s a popular choice for small business owners for good reason: it offers liability protection while often being simpler to set up than a corporation. But here’s a crucial piece of the puzzle that often gets overlooked: the operating agreement. Think of it as the roadmap for your LLC, outlining how it will be run, who owns what, and what happens if things change.

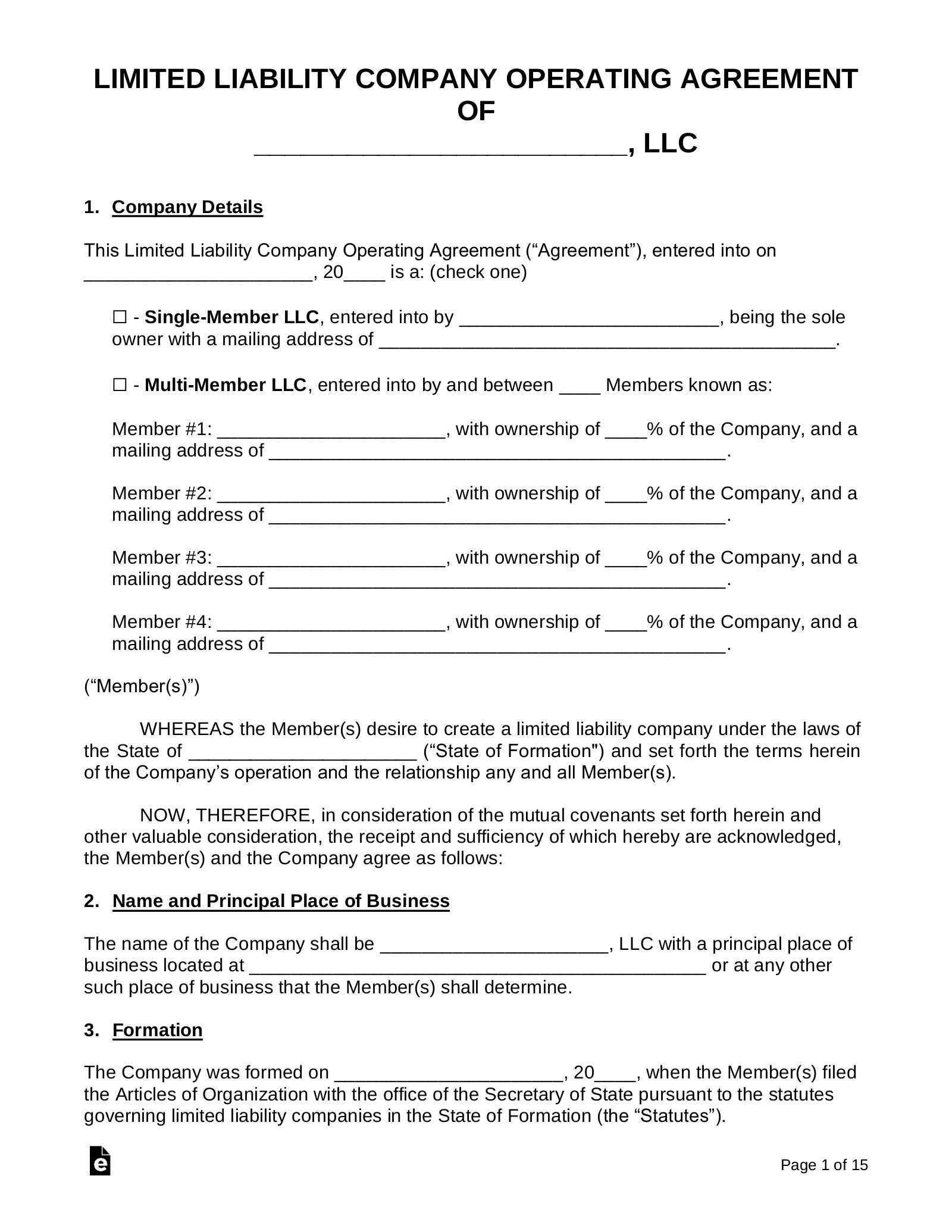

Now, the thought of drafting legal documents can feel intimidating, right? That’s where the idea of creating an llc operating agreement template comes in handy. It’s like having a pre-written framework to build upon, saving you time and potentially legal fees. But don’t just grab any template you find online! It needs to be tailored to your specific business and state laws.

This article will walk you through the process of creating an llc operating agreement template that actually works for you. We’ll cover the key elements you need to include, common pitfalls to avoid, and point you towards resources that can make the whole process a lot smoother. Let’s dive in and get your LLC set up for success!

Why Your LLC Needs a Solid Operating Agreement

Think of your operating agreement as the constitution for your LLC. It’s the foundational document that governs how your business operates, protecting your interests and setting clear expectations among members. Even if you’re the sole owner of your LLC, having a written operating agreement is still highly recommended. It reinforces the separation between your personal assets and your business liabilities, which is one of the primary benefits of forming an LLC in the first place. Without it, you might find it harder to prove that your business is a separate legal entity.

Beyond liability protection, an operating agreement spells out the ownership percentages of each member (if there’s more than one), how profits and losses will be distributed, and how decisions will be made. This is particularly important in multi-member LLCs, where disagreements can arise. By having these details clearly defined in advance, you can avoid costly disputes down the road and maintain a healthy working relationship with your business partners.

The document also outlines procedures for significant events like admitting new members, transferring ownership interests, or dissolving the LLC. These are important contingencies to plan for, as the composition of your business may change over time. By addressing these scenarios upfront, you can ensure a smooth transition and avoid potential legal headaches.

Furthermore, an operating agreement allows you to customize the management structure of your LLC. You can choose to be member-managed, where all members actively participate in the day-to-day operations, or manager-managed, where one or more designated managers are responsible for running the business. This flexibility allows you to structure your LLC in a way that best suits your specific needs and expertise.

Finally, many banks and financial institutions require a copy of your operating agreement when you open a business bank account or apply for a loan. They want to see that you have a well-defined business structure and a clear plan for managing your finances. So, while it might seem like just another piece of paperwork, your operating agreement is actually a crucial document for accessing the resources you need to grow your business. Creating an llc operating agreement template will save you time and give you peace of mind.

Key Elements to Include in Your LLC Operating Agreement

Now that you understand the importance of an operating agreement, let’s break down the key elements you’ll want to include when creating your own template. Keep in mind that this is not an exhaustive list, and you may need to add or modify sections based on the specific needs of your business.

First, you’ll need to clearly identify the name of your LLC, its registered agent, and its principal place of business. The registered agent is the person or entity responsible for receiving legal documents on behalf of your LLC, so make sure you choose someone reliable. The principal place of business is the primary location where your LLC conducts its business operations.

Next, you’ll need to define the purpose of your LLC. This should be a broad description of the type of business activities you’ll be engaging in. For example, you might state that your LLC is formed to “engage in the business of providing marketing services.” While you don’t need to be overly specific, it’s important to have a general statement of purpose.

The operating agreement should also detail the membership structure of your LLC, including the names and addresses of all members, their ownership percentages, and their initial contributions to the business. It’s crucial to accurately reflect each member’s investment and ownership stake to avoid future disputes. You also need to include how additional capital contributions will be handled, if needed.

As mentioned earlier, you’ll need to specify whether your LLC is member-managed or manager-managed. If it’s member-managed, the operating agreement should outline the roles and responsibilities of each member. If it’s manager-managed, it should identify the manager(s) and their authority to make decisions on behalf of the LLC.

Finally, the operating agreement should address how profits and losses will be allocated among the members, how meetings will be conducted, and how amendments to the operating agreement can be made. It should also include provisions for dispute resolution, such as mediation or arbitration, to avoid costly litigation. Carefully consider each of these elements when creating an llc operating agreement template to ensure it adequately protects your interests and sets your LLC up for success.

Crafting a well-defined operating agreement is a smart move. It allows you to establish clear guidelines for your LLC’s operations. This will bring structure and protect against potential future complications.

Remember, taking the time to create a comprehensive operating agreement is an investment in the long-term success and stability of your LLC. Seek professional legal advice when creating an llc operating agreement template to tailor it to your specific circumstances.