Ever felt a little uneasy handing out company credit cards? It’s a necessary tool for many businesses, streamlining expenses and making life easier for employees on the go. But with great power comes great responsibility, and that’s where a solid company credit card use agreement template comes in. Think of it as the rulebook for your company cards, ensuring everyone is on the same page regarding acceptable use, spending limits, and reporting procedures. It’s not just about preventing misuse; it’s about protecting your company’s finances and maintaining a transparent and accountable environment.

Without a clear agreement, you’re leaving the door open for misunderstandings, overspending, and even potential fraud. Imagine an employee racking up personal expenses on the company dime, or consistently exceeding their spending limit without explanation. These situations can create headaches for your accounting department and damage trust within your team. A well-defined agreement eliminates ambiguity and sets clear expectations for cardholders.

So, where do you start? Creating a comprehensive company credit card use agreement might seem daunting, but it doesn’t have to be. Luckily, there are readily available templates that you can customize to fit your specific business needs. We’ll delve into what these templates should include and how to tailor them to your unique situation. Ready to create a policy that protects your company and empowers your employees? Let’s get started!

Crafting a Comprehensive Company Credit Card Use Agreement

A robust company credit card use agreement is more than just a piece of paper; it’s a vital tool for managing company finances and ensuring responsible spending. Think of it as a detailed roadmap for your employees, guiding them on the appropriate use of company credit cards. So, what essential elements should your agreement include? Let’s break it down.

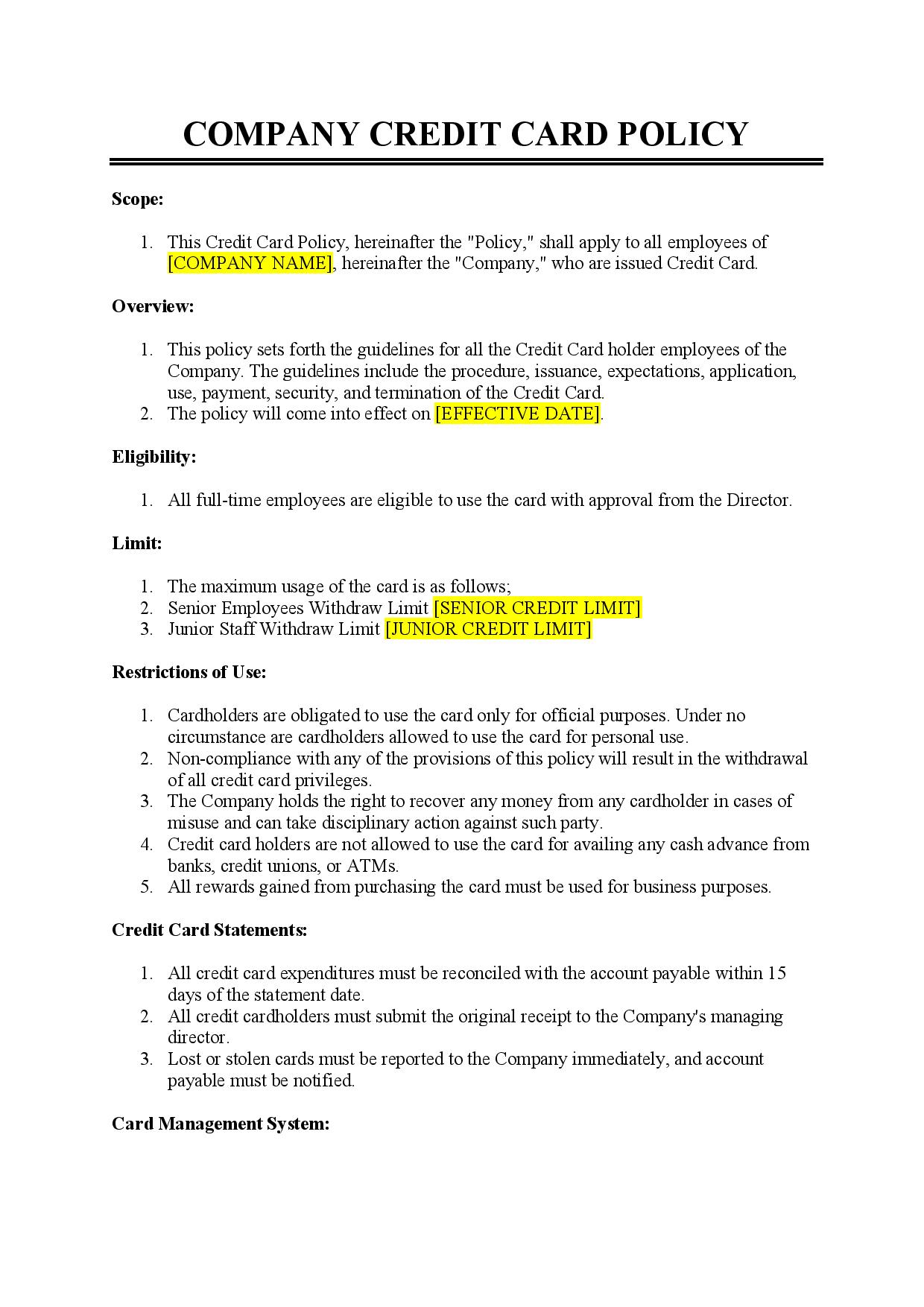

First and foremost, clearly define the purpose of the company credit card. Is it strictly for travel expenses? Client entertainment? Office supplies? Specifying the approved uses leaves no room for interpretation and helps prevent employees from using the card for personal purchases. Be as specific as possible; for example, instead of just saying “travel expenses,” list examples like “airfare, hotel accommodations, and meals related to business trips.”

Next, establish spending limits for each cardholder. This is crucial for controlling expenses and preventing overspending. Consider setting different limits based on employee roles and responsibilities. For example, a sales manager who frequently travels may need a higher limit than an administrative assistant who primarily uses the card for office supplies. Don’t forget to outline the procedure for requesting temporary increases to the spending limit, should the need arise. Also, specify what happens if the spending limit is exceeded.

Equally important is outlining the reporting procedures. Employees should be required to submit receipts and expense reports regularly, detailing each transaction made with the company credit card. Specify the frequency of these reports – monthly or quarterly, for example – and the format in which they should be submitted. Also, indicate the person or department to whom the reports should be sent. Clear and consistent reporting ensures accountability and makes it easier to track expenses and reconcile accounts. Make it clear that failure to provide adequate and timely reports is a breach of contract, with penalties.

Finally, address the consequences of misuse. What happens if an employee violates the agreement? Clearly outline the disciplinary actions that will be taken, ranging from a warning to termination. This demonstrates that your company takes the agreement seriously and helps deter employees from misusing the card. Make sure the penalties are realistic and consistently applied across the organization.

Important Clauses to Include

Beyond the basics, consider including clauses that address specific situations. For instance, what happens if the card is lost or stolen? Include a section that outlines the employee’s responsibility to immediately report the loss or theft to both the company and the credit card issuer. Also, address the issue of personal use. Make it abundantly clear that the company credit card is for business expenses only, and that any personal use will be considered a violation of the agreement.

Benefits of Using a Company Credit Card Use Agreement Template

Implementing a company credit card use agreement template is a smart move for businesses of all sizes. The benefits extend far beyond simply preventing misuse; it’s about establishing a culture of financial responsibility and protecting your company’s bottom line. Let’s delve into the key advantages you’ll reap.

Firstly, it provides clarity and consistency. A well-defined agreement ensures that all employees understand the rules and expectations surrounding company credit card usage. This reduces the risk of misunderstandings and inconsistencies in how the cards are used, making expense management smoother and more efficient. Everyone is operating under the same set of guidelines, minimizing confusion and potential disputes.

Secondly, it protects your company from financial losses. By setting spending limits, defining approved uses, and outlining reporting procedures, you’re taking proactive steps to prevent overspending and fraud. This can save your company significant amounts of money in the long run and safeguard against potential legal issues arising from misuse. It’s like having a safety net in place to catch any potential financial mishaps.

Thirdly, it streamlines expense reporting. With clear reporting requirements, employees are more likely to submit accurate and timely expense reports. This simplifies the reconciliation process for your accounting department and reduces the time and effort required to track expenses. A streamlined process translates to increased efficiency and reduced administrative costs.

Fourthly, it fosters accountability and transparency. When employees know they are responsible for their spending and that their transactions will be reviewed, they are more likely to use the company credit card responsibly. This creates a culture of accountability and transparency within the organization, promoting ethical behavior and responsible financial management. Employees understand that their actions have consequences, encouraging them to act responsibly.

Finally, a company credit card use agreement template demonstrates a commitment to responsible financial management. This can enhance your company’s reputation with stakeholders, including investors, lenders, and customers. It shows that you take financial matters seriously and are committed to protecting your company’s assets. A strong reputation can open doors to new opportunities and enhance your company’s overall success.

Even with the best intentions and detailed agreements, issues might arise. The key is to have processes in place to address these issues fairly and consistently. Regular reviews of the agreement can also help ensure it remains relevant and effective as your business evolves.

Ultimately, establishing clear guidelines and promoting open communication can help prevent misunderstandings and maintain a positive working relationship. The aim isn’t to catch people out but to create a framework that supports responsible spending and protects everyone involved.