Common Stock Purchase Agreement Template

So, you’re looking to buy or sell some common stock, huh? That’s a big step! Whether you’re an entrepreneur granting equity to early employees, or an investor acquiring a piece of a promising company, you’re going to need a solid common stock purchase agreement. Think of it as the rulebook for the transaction – it lays out all the terms and conditions, ensuring everyone is on the same page and minimizing the risk of disagreements down the road. It might sound intimidating, but it’s really just about clarity and protection for all involved.

Now, where do you start? The good news is you don’t have to reinvent the wheel. A common stock purchase agreement template can be a fantastic starting point. These templates provide a framework, outlining the essential clauses and sections you need to include. However, remember that every transaction is unique, so you’ll need to tailor the template to fit your specific circumstances. Don’t just blindly fill in the blanks! You’ll need to understand what each section means and how it applies to your deal.

Navigating the world of legal documents can feel like climbing Mount Everest. But with a little guidance and the right resources, you can conquer it! This article will explore what a common stock purchase agreement template is, why it’s crucial, and how to use it effectively. We’ll break down key sections and offer practical tips to help you protect your interests. Consider this your friendly guide to demystifying the document and ensuring a smooth transaction.

Understanding the Core Components of a Common Stock Purchase Agreement

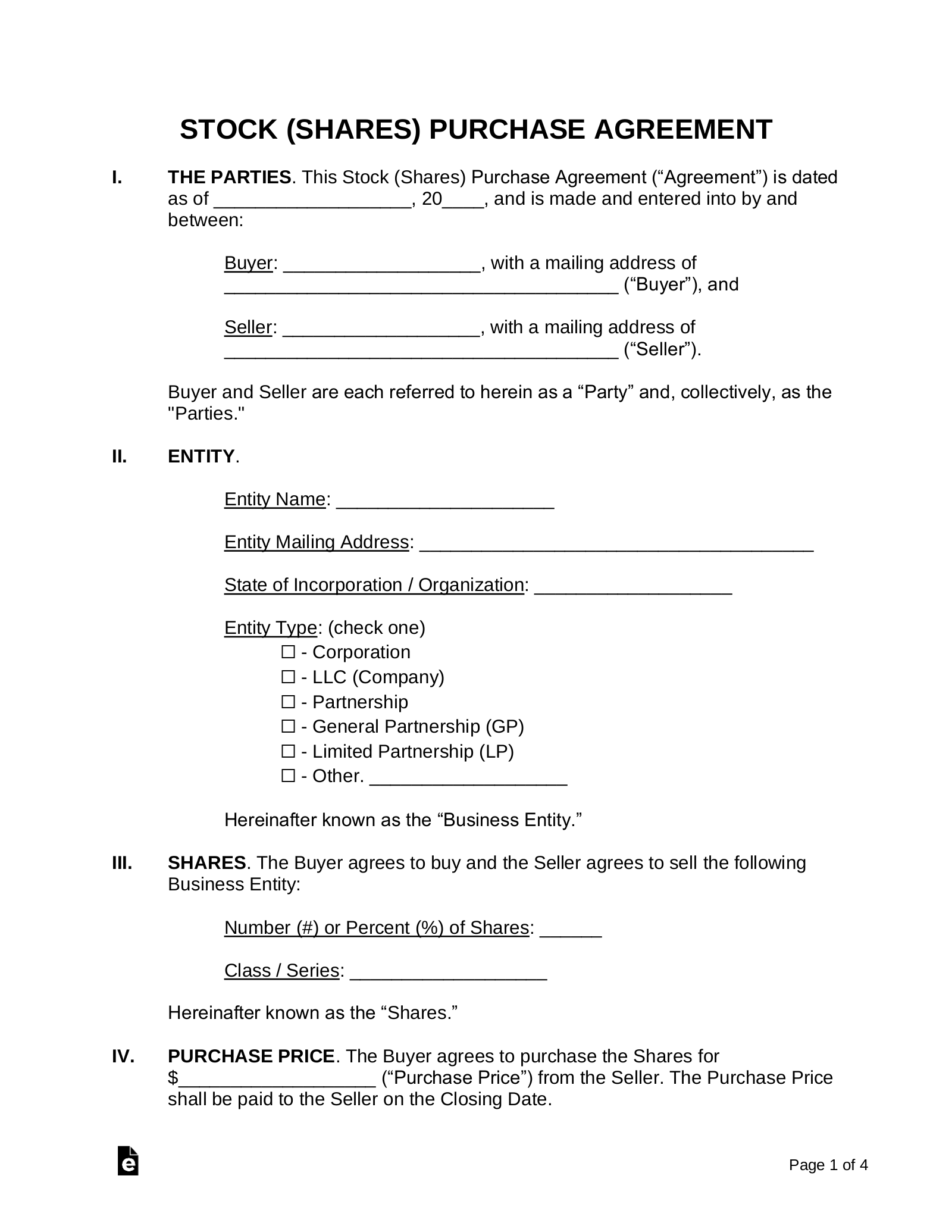

At its heart, a common stock purchase agreement is a contract. It’s a legally binding promise between a buyer and a seller, outlining the terms of a stock transaction. The agreement covers everything from the price of the stock to the closing date, and everything in between. It’s designed to protect both parties involved and to ensure that the transaction is carried out fairly and legally.

One of the most important aspects of the agreement is the identification of the parties. This section clearly states who the buyer and seller are, including their legal names and addresses. It also specifies the number of shares being sold, the type of stock (in this case, common stock), and the purchase price per share. These fundamental details form the foundation of the entire agreement, leaving no room for ambiguity about who is selling to whom, and what exactly is being sold and bought.

The agreement also includes representations and warranties from both the buyer and the seller. These are statements of fact that each party is asserting to be true. For example, the seller might represent that they have the full right and authority to sell the shares, and that the shares are free from any liens or encumbrances. The buyer might represent that they have the financial resources to complete the purchase. These representations and warranties provide assurance to each party and can be the basis for legal action if they turn out to be false.

Furthermore, the agreement will detail the closing process. This section outlines the steps that need to be taken to complete the transaction, including the date and location of the closing, the delivery of the stock certificates, and the payment of the purchase price. It may also include conditions that need to be met before the closing can occur, such as regulatory approvals or the completion of due diligence. A well-defined closing process ensures a smooth and orderly transfer of ownership.

Finally, a solid common stock purchase agreement will contain provisions regarding indemnification, governing law, and dispute resolution. Indemnification clauses outline who is responsible for covering losses or damages that may arise from the transaction. The governing law clause specifies which state’s laws will be used to interpret the agreement. And the dispute resolution clause outlines the process for resolving any disagreements that may arise, such as through arbitration or litigation.

Why a Template is a Great Starting Point

Using a common stock purchase agreement template offers a convenient and cost-effective starting point. These templates provide a structured framework covering essential clauses, saving you time and effort in drafting the agreement from scratch. However, remember that a template is a general guide and needs customization to reflect the specific details of your transaction.

Key Considerations When Using a Common Stock Purchase Agreement Template

While a common stock purchase agreement template is a helpful tool, it’s crucial to understand that it’s not a one-size-fits-all solution. Every stock transaction is unique, with its own set of circumstances and considerations. Therefore, it’s essential to carefully review and customize the template to ensure it accurately reflects the terms of your specific deal.

One of the most important considerations is the valuation of the stock. How was the purchase price determined? Was it based on a recent appraisal, a discounted cash flow analysis, or some other method? The agreement should clearly document the basis for the valuation to avoid any future disputes. It’s also crucial to consider any potential tax implications of the stock purchase, both for the buyer and the seller. Consult with a tax advisor to understand the tax consequences and to ensure that the agreement is structured in a tax-efficient manner.

Another important factor is the governance and control rights associated with the stock. Does the buyer have the right to vote on corporate matters? Are there any restrictions on the transfer of the stock? The agreement should clearly outline these rights and restrictions to avoid any misunderstandings down the road. You also need to consider the possibility of future funding rounds. Will the buyer’s ownership be diluted if the company issues more stock in the future? The agreement should address this issue and provide the buyer with some level of protection against dilution.

It’s also essential to consider the representations and warranties that each party is making. Are the representations and warranties appropriate for the specific situation? Are there any limitations on the scope or duration of the representations and warranties? The agreement should clearly define the scope and duration of the representations and warranties to avoid any ambiguity. Furthermore, consider adding provisions for confidentiality to protect sensitive information shared during the negotiation and closing of the agreement.

Ultimately, the key to using a common stock purchase agreement template effectively is to treat it as a starting point, not a finished product. Carefully review each section of the template and customize it to reflect the unique circumstances of your transaction. Don’t hesitate to seek legal advice from a qualified attorney to ensure that your interests are adequately protected. A well-drafted agreement can provide peace of mind and help to prevent costly disputes in the future.

The process of drafting a stock purchase agreement doesn’t have to be daunting. Approach it methodically, seek expert guidance when needed, and tailor the template to reflect the specifics of your deal. You’ll be well on your way to completing a successful stock transaction with a solid legal foundation.

Hopefully, this has shed some light on common stock purchase agreements and how templates can assist you. Remember, due diligence and professional guidance are your best friends in this process.