Ever dreamed of owning the perfect space for your business? Maybe you’ve outgrown your current location or are starting something completely new. Finding the right property can be tough, and securing financing can be even tougher. That’s where a commercial lease to own agreement template comes in handy. It’s like a test drive for a commercial property, letting you lease it with the option to buy it later. Think of it as a hybrid approach to securing your business’s future home, combining the benefits of renting with the potential for ownership.

This type of agreement can be a great stepping stone for businesses that might not be ready for a full-blown purchase just yet. It allows you to build equity over time while establishing your business in a desirable location. Plus, it gives you a chance to really see if the property is the right fit for your long-term needs. No one wants to be stuck with a property that doesn’t quite work, and a lease to own agreement can help you avoid that potential pitfall.

In this guide, we’ll explore the ins and outs of commercial lease to own agreements. We’ll break down the key components of a typical agreement, highlight the benefits and potential drawbacks, and provide insights on how to navigate this type of transaction successfully. Whether you’re a seasoned business owner or just starting out, understanding the nuances of a commercial lease to own agreement can empower you to make informed decisions about your business’s future.

Understanding the Commercial Lease to Own Agreement

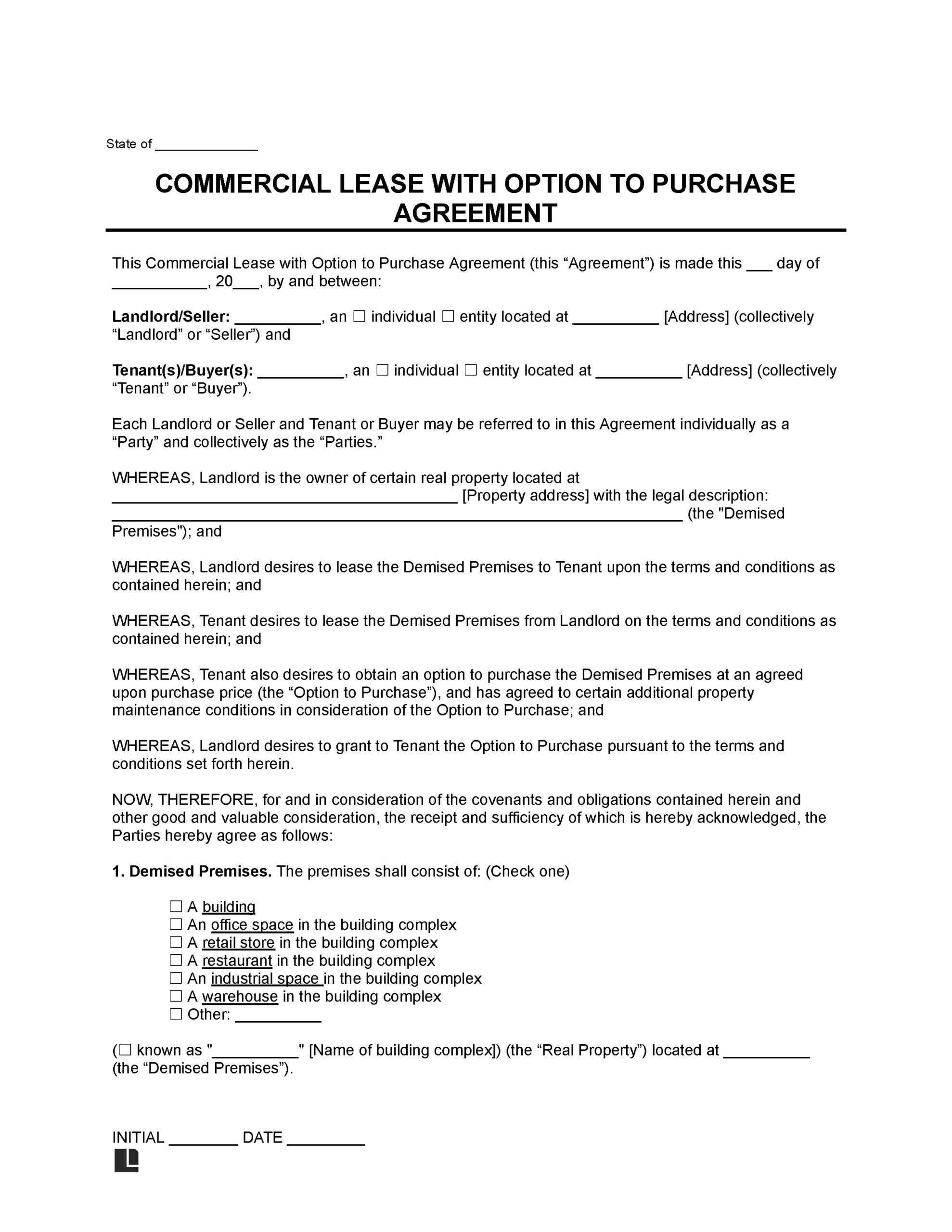

A commercial lease to own agreement, at its core, is a hybrid contract that combines elements of a standard lease agreement with an option to purchase the property at a later date. Think of it as a structured rental arrangement with a built-in exit strategy leading to potential ownership. This type of agreement is particularly appealing to businesses that may not have the immediate capital for a down payment or are seeking to establish a track record before committing to a large purchase.

The agreement typically outlines several crucial terms. First, there’s the lease term, which specifies the duration of the rental period. Next, the monthly rent is defined, and importantly, a portion of each payment may be credited towards the eventual purchase price. This “rent credit” is a key feature, effectively allowing the tenant to accumulate equity in the property over time. The purchase price, or the formula for determining it, is also clearly stated, along with the timeframe within which the tenant can exercise their option to buy.

There are generally two main types of commercial lease to own agreements. The first is a lease option, where the tenant has the right, but not the obligation, to purchase the property at the end of the lease term. The second is an installment sale, which is more akin to a financing agreement, where the tenant is obligated to purchase the property over time, with each payment contributing to the purchase price. The specific type of agreement will impact the tenant’s rights and obligations, so it’s crucial to understand the differences.

From the landlord’s perspective, a commercial lease to own agreement can attract reliable tenants who are invested in the long-term success of the property. It can also provide a steady stream of income while potentially achieving a higher sale price than if the property were sold outright. However, landlords also bear the risk that the tenant may not exercise the purchase option, leaving them to find another buyer. It’s a balanced equation with both potential rewards and risks for both parties involved.

Due diligence is paramount before entering into any commercial lease to own agreement. A thorough property inspection, a review of the landlord’s financial standing, and a careful examination of the agreement’s terms are essential. Seeking legal counsel from an attorney specializing in commercial real estate is highly recommended to ensure that your interests are protected and that you fully understand the implications of the agreement. A solid commercial lease to own agreement template can serve as a starting point, but legal review will tailor the contract to your unique circumstance.

Benefits and Considerations of a Commercial Lease to Own

One of the most significant advantages of a commercial lease to own agreement is the ability to test drive the property before committing to a purchase. This allows a business to assess the suitability of the location, the layout of the space, and the overall environment without the immediate financial burden of a down payment and mortgage. It’s a lower-risk approach to finding the perfect commercial space, particularly for startups or businesses experiencing rapid growth.

Building equity through rent credits is another compelling benefit. As a portion of each monthly payment contributes towards the eventual purchase price, the tenant essentially begins building ownership while operating their business. This can be a substantial advantage, especially if the property appreciates in value during the lease term. It’s a win-win scenario where the tenant is paying rent but also investing in their future ownership.

For businesses that may not qualify for traditional financing, a commercial lease to own agreement can be a viable alternative. The landlord may be more willing to offer flexible terms and financing options compared to a bank or other lending institution. This can open doors for businesses that might otherwise struggle to secure a commercial property. It provides an accessible pathway to ownership for those who may face challenges in the traditional lending market.

However, there are also important considerations to keep in mind. The purchase price in a lease to own agreement may be higher than if the property were purchased outright initially. This is because the landlord is essentially taking on more risk and potentially foregoing other opportunities to sell the property. Therefore, it’s crucial to carefully evaluate the purchase price and ensure that it aligns with the market value and your long-term financial goals. The agreement should clearly lay out how the purchase price is determined.

Finally, understanding your rights and responsibilities under the agreement is paramount. A poorly drafted agreement can lead to disputes and legal challenges down the road. Therefore, seeking legal advice from an experienced attorney is essential to ensure that the agreement is fair, comprehensive, and protects your interests. Using a commercial lease to own agreement template as a starting point is helpful, but always seek professional legal counsel to ensure it suits your specific circumstances. It is important to know that laws vary by jurisdiction, so consulting with an attorney in your area is crucial.

Ultimately, a commercial lease to own agreement can be a powerful tool for businesses seeking to secure their future. By carefully weighing the benefits and considerations, and by seeking professional guidance, you can navigate this type of transaction successfully and achieve your commercial real estate goals.

Choosing the right location is crucial for any business. A commercial lease to own agreement provides a unique pathway to achieving that goal, blending the flexibility of leasing with the long-term benefits of ownership. By understanding the terms and carefully considering your options, you can take a significant step towards building a successful and sustainable business.