Thinking about getting a car but not quite ready for a traditional auto loan? A car rent to own agreement might be the perfect solution for you. It’s essentially a hybrid between renting and buying, giving you the chance to drive the car you want while building equity towards owning it outright. It can be a great option for people with less-than-perfect credit or those who simply want to test out a vehicle before committing to a long-term purchase.

But navigating the world of rent to own agreements can feel a bit daunting. What are your rights? What are the dealer’s responsibilities? And how do you protect yourself from potential pitfalls? The key is understanding the agreement itself, inside and out. That’s where a solid car rent to own agreement template comes in handy. It serves as a roadmap, ensuring both you and the dealer are on the same page regarding the terms of the arrangement.

This article will walk you through the ins and outs of car rent to own agreements, highlighting the essential components of a template and helping you understand what to look for before signing on the dotted line. We will help you navigate the potential benefits and drawbacks so you can make an informed decision that aligns with your financial goals.

Understanding the Car Rent To Own Agreement Template

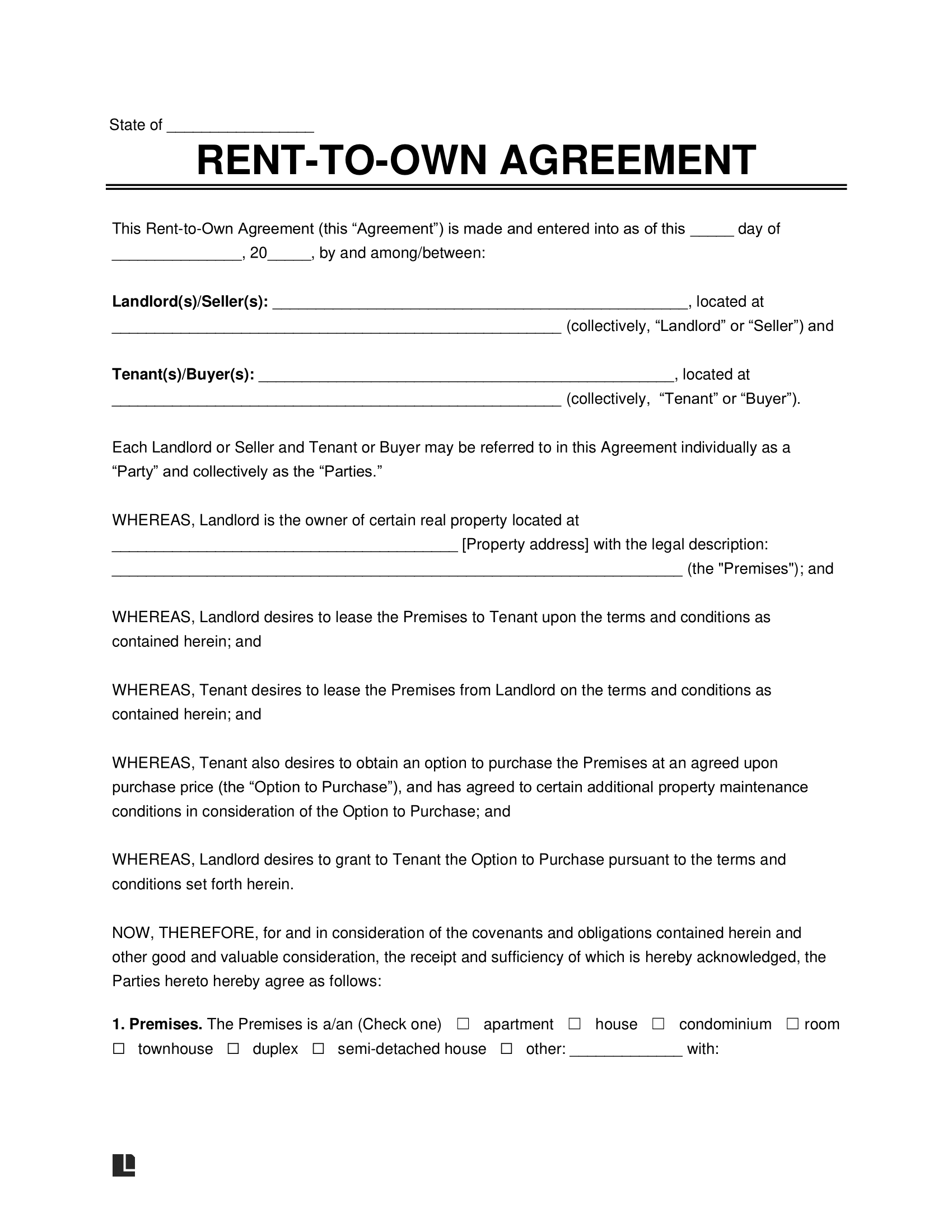

A car rent to own agreement template is a legally binding document outlining the terms and conditions of a rent to own arrangement for a vehicle. It is more than just a rental agreement; it’s a pathway to ownership. The template acts as a safeguard, protecting both the renter (potential buyer) and the dealer (seller) by clearly defining each party’s rights and obligations. It’s important to remember that details matter. Every clause should be carefully reviewed and understood before signing. Consider having a lawyer review it as well, particularly if you have any concerns or questions.

Several key components must be included in a comprehensive car rent to own agreement template. First and foremost, it should clearly identify the parties involved – the renter/potential buyer and the dealer/seller. It needs to provide their full legal names and addresses. Next, it should provide a detailed description of the vehicle. This includes the year, make, model, VIN (Vehicle Identification Number), and current mileage. This information is crucial for accurate identification and prevents any disputes about the specific vehicle in question.

Another essential element is the payment schedule. The agreement must specify the amount of each rental payment, the frequency of payments (weekly, bi-weekly, or monthly), and the due date for each payment. It should also clearly outline the accepted methods of payment (cash, check, money order, electronic transfer). Late payment penalties, if any, should be explicitly stated, including the amount of the fee and the timeframe for when it is applied. This section ensures transparency and prevents unexpected costs.

The agreement should also include a detailed explanation of how the rental payments contribute to the purchase price of the vehicle. How much of each payment goes towards the actual cost of the car versus interest and fees? This breakdown is critical for understanding how quickly you’re building equity in the vehicle. It should also clarify the final purchase price of the car, including any taxes, fees, and other charges. This ensures that there are no hidden costs or surprises when you decide to exercise your option to purchase.

Finally, a robust car rent to own agreement template will address issues such as insurance requirements, maintenance responsibilities, and what happens if the renter defaults on the agreement. Who is responsible for insuring the vehicle? What types of insurance coverage are required? Who is responsible for routine maintenance and repairs? What happens if the renter fails to make payments or violates other terms of the agreement? These clauses are essential for protecting both parties and preventing disputes down the road.

Benefits and Risks of Car Rent To Own

Opting for a car rent to own agreement presents a unique set of benefits, particularly for individuals who may face challenges with traditional auto financing. One of the most significant advantages is the accessibility it offers to those with poor or no credit history. Traditional lenders often deny loans to individuals with low credit scores, making it difficult to acquire reliable transportation. Rent to own programs typically have less stringent credit requirements, providing an opportunity for individuals to improve their creditworthiness while driving a car they need.

Another benefit is the ability to test drive a vehicle before making a long-term commitment. This “try before you buy” approach allows you to assess whether the car meets your needs and preferences without being locked into a traditional purchase agreement. You can experience the car’s performance, fuel efficiency, and comfort levels firsthand, ensuring it’s the right fit for your lifestyle. This can be especially valuable if you’re unsure about a particular make or model.

However, car rent to own arrangements also come with potential risks that need careful consideration. One of the primary concerns is the higher overall cost compared to traditional financing. Because rent to own agreements often cater to individuals with higher risk profiles, the interest rates and fees can be significantly higher than those offered by banks or credit unions. This means you could end up paying substantially more for the car over the term of the agreement.

Another risk is the possibility of losing the car and any accumulated equity if you miss payments or violate the terms of the agreement. Unlike a traditional auto loan, where you build equity over time, a rent to own agreement typically allows the dealer to repossess the vehicle if you default on your payments. In such a scenario, you could lose both the car and any money you’ve already paid, leaving you in a worse financial situation. It is absolutely critical to review all terms before signing a car rent to own agreement template.

Furthermore, the terms of the agreement may be less favorable to the renter than a traditional purchase. The dealer may retain ownership of the vehicle until all payments are made, giving them more control over the car and potentially limiting your rights. For instance, the agreement may restrict your ability to modify the vehicle or drive it outside of a certain geographic area. Therefore, a thorough understanding of the agreement’s terms is essential to avoid any unpleasant surprises. Make sure you get a detailed car rent to own agreement template to understand the agreement’s terms.

Understanding the intricacies of car rent to own agreements is crucial before committing. Taking the time to research, compare options, and carefully review the contract can help you determine if this financing method is right for you.

If you are considering a car rent to own agreement, it is a good idea to consult with a financial advisor or legal professional to ensure that you are making an informed decision. They can help you assess your financial situation, understand the terms of the agreement, and identify any potential risks. Remember, knowledge is power when it comes to making financial decisions.