Buying a car is a big deal, right? It’s exciting to imagine cruising down the road in your new ride. But let’s be honest, the financial aspect can be a bit daunting. We are talking about a significant amount of money, and figuring out how to pay it back can sometimes feel like navigating a maze. One tool that can really help simplify things, especially if you are buying from a private seller or need a temporary payment arrangement, is a car payment plan agreement template. This document outlines the terms of your payment schedule, making sure everyone is on the same page.

Think of a car payment plan agreement template as a roadmap for your loan repayment journey. It clearly states how much you owe, when your payments are due, and what happens if you miss a payment. This can be especially useful when dealing with private car sales, where the financing might not be as straightforward as going through a traditional bank or dealership. Having a written agreement protects both the buyer and the seller, ensuring a transparent and fair transaction. It minimizes the risk of misunderstandings and potential disputes down the road.

Whether you’re the one buying the car or the one selling it, understanding the importance of a solid car payment plan agreement template can make the whole process much smoother. In the following sections, we’ll delve into what this template actually contains, why it is so vital, and how you can use it to your advantage. So, buckle up and let’s navigate the world of car payment plans together! We’ll break down everything you need to know to use it effectively and confidently.

Why You Need a Car Payment Plan Agreement Template

So, why can’t you just shake hands and trust each other? Well, while trust is important, when it comes to money, it’s always better to have everything in writing. A car payment plan agreement template serves as a legally binding document that outlines all the details of the payment arrangement. It minimizes ambiguity and protects both the buyer and seller in case any disagreements arise later on. It’s like having an insurance policy for your transaction.

Imagine this: you’re selling your car to a friend. You verbally agree on a payment plan, but a few months down the line, there’s a misunderstanding about the due date of a payment. Without a written agreement, it becomes a “he said, she said” situation, potentially damaging your friendship. But, with a clearly defined car payment plan agreement template, everyone knows their responsibilities. The template leaves no room for misinterpretations. It includes a detailed payment schedule, interest rates (if any), late payment penalties, and the process for resolving disputes.

Another reason a car payment plan agreement template is essential is that it can provide clarity to third parties, such as insurance companies or legal authorities. If you ever need to prove the terms of your agreement, having a written document makes it much easier. It simplifies the process of resolving issues related to ownership, insurance claims, or legal disputes.

Beyond simply avoiding conflicts, a detailed agreement can help with managing the payments themselves. The buyer can use the agreement as a reminder of the payment schedule, which helps avoid unintentional late fees. The seller can use it to track the received payments and the remaining balance. It provides a clear picture of where you stand at any given point in time.

Essentially, a car payment plan agreement template is not just a piece of paper; it’s a tool that fosters transparency, protects your interests, and simplifies the financial aspect of buying or selling a car. Ignoring the use of such a template can expose you to unnecessary risks, legal complications, and even damaged relationships. So, take the time to create or use a template that meets your specific needs. It’s an investment in peace of mind.

Key Elements of a Car Payment Plan Agreement Template

Now that we understand why a car payment plan agreement template is so important, let’s take a look at the key elements that should be included. These elements ensure that the agreement is comprehensive, legally sound, and effectively protects the interests of both parties.

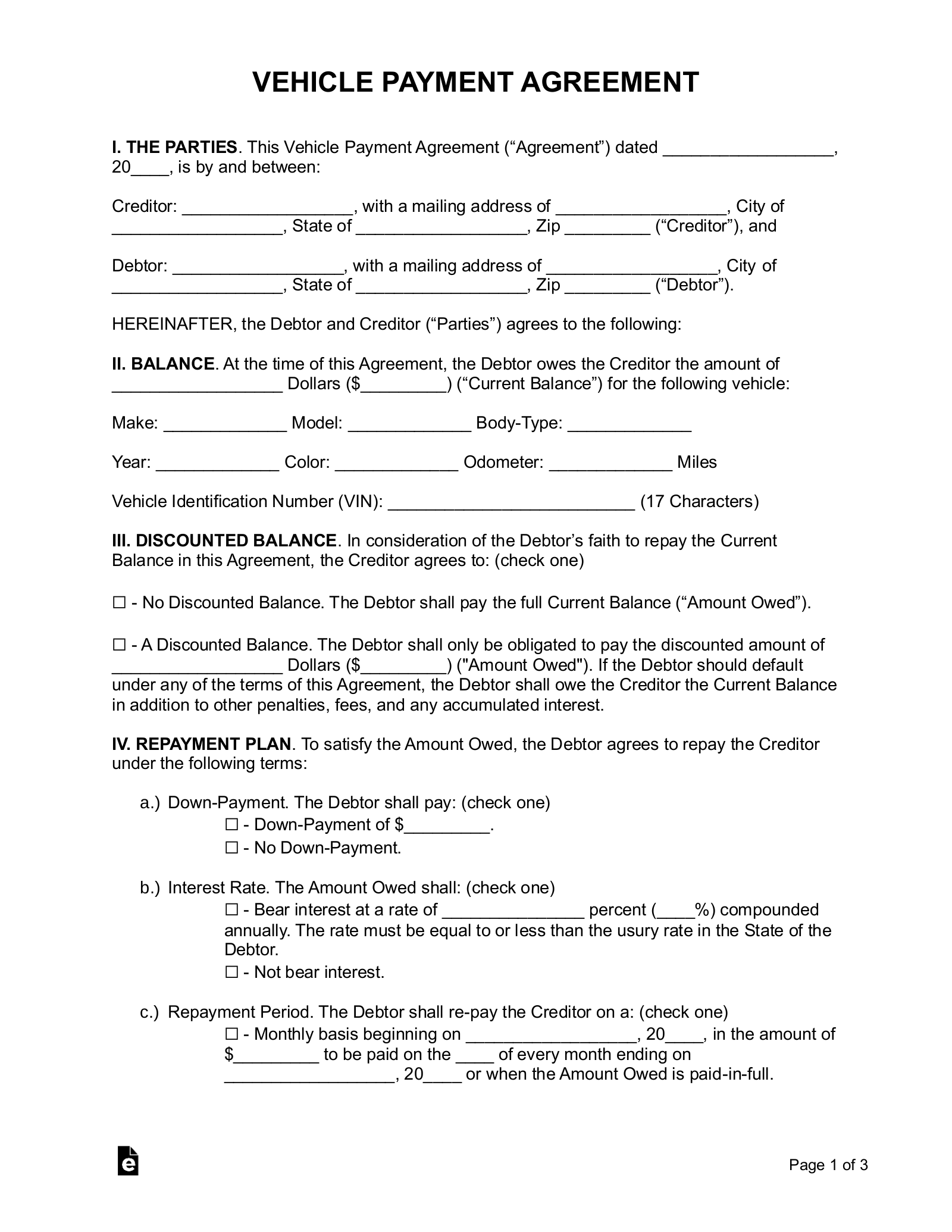

First and foremost, the agreement should clearly identify the buyer and the seller, including their full legal names and addresses. This seems obvious, but it’s essential for establishing the identity of the parties involved. The agreement should also include a detailed description of the vehicle being sold. This should include the year, make, model, VIN (Vehicle Identification Number), and current mileage. The more specific you are, the less room there is for confusion about which car is being sold.

Next, the agreement should specify the total purchase price of the vehicle. This is the agreed-upon price that the buyer will pay to the seller. The agreement should also clearly outline the payment schedule, including the amount of each payment, the due dates, and the method of payment (e.g., cash, check, electronic transfer). A detailed payment schedule can prevent misunderstandings and facilitate effective tracking of payments. Furthermore, the agreement should state the amount of any down payment made and how it will be credited towards the total purchase price.

Interest rates, if applicable, should also be clearly stated in the agreement. If the seller is charging interest on the unpaid balance, the interest rate should be specified, along with how the interest will be calculated (e.g., simple interest, compound interest). The agreement should also address late payment penalties. This should include the amount of the late fee, the grace period (if any), and the consequences of repeated late payments. For instance, it should clearly state if the seller has the right to repossess the vehicle if the buyer defaults on the payments.

Finally, the agreement should include provisions for dispute resolution. This could involve mediation, arbitration, or legal action. The agreement should specify how disputes will be resolved and which jurisdiction will govern the agreement. In addition to these core elements, you might also consider including clauses related to vehicle insurance, maintenance responsibilities, and transfer of ownership. By including these elements in your car payment plan agreement template, you can create a comprehensive and legally sound document that protects your interests and promotes a smooth and transparent transaction.

Using a well crafted car payment plan agreement template can make the payment process more understandable, and will help set you on a path of success for both buyer and seller. In closing, you will be equipped to address all financial needs, from unexpected repairs to future investments with greater confidence.

It’s about taking control of your financial future and ensuring that you have the resources you need to pursue your goals. Remember, financial planning is not a one-time event. It’s an ongoing process that requires regular review and adjustments to reflect changes in your life and the economy.