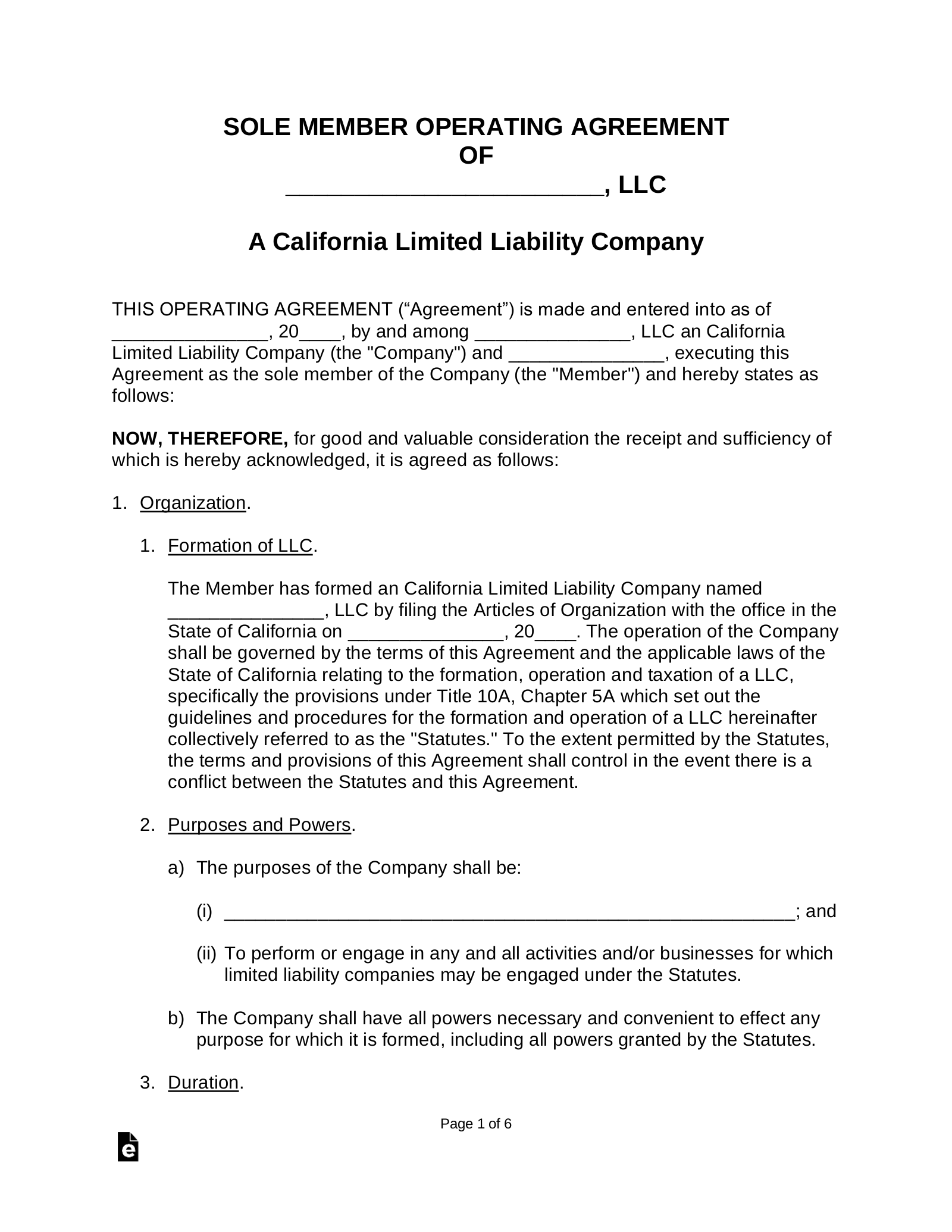

So, you’re diving into the world of entrepreneurship in the Golden State and starting a single member LLC? That’s fantastic! Setting up a Limited Liability Company (LLC) is a smart move for protecting your personal assets and giving your business a more professional structure. But before you get too caught up in the excitement of launching your venture, there’s a crucial document you need to nail down: the operating agreement. And if you’re running solo, a California single member LLC operating agreement template is exactly what you need.

Think of an operating agreement as the blueprint for your LLC. It outlines how your business will be run, managed, and owned. While California doesn’t legally mandate a single member LLC to have one, trust me, you absolutely want it. It clarifies the separation between you as an individual and your business entity, bolstering your limited liability protection. Without it, you risk your LLC being seen as an extension of yourself, potentially exposing your personal assets in legal battles.

Finding the right California single member LLC operating agreement template can feel daunting, but it doesn’t have to be. There are tons of resources available online, both free and paid, to help you craft a document that perfectly fits your business needs. This article will walk you through why you need one, what to include, and where to find the best templates, making the process as smooth as possible. Let’s get started!

Why You Absolutely Need a California Single Member LLC Operating Agreement

Even though California law doesn’t explicitly require a single member LLC to have an operating agreement, choosing to forgo one is a bit like sailing a boat without a rudder. You might get somewhere, but you’ll lack control and direction. The primary benefit of an operating agreement is that it reinforces the legal separation between you and your business. This is critical for maintaining your limited liability, the whole point of forming an LLC in the first place!

Without a clearly defined operating agreement, it can be easier for a court to argue that your LLC is simply an extension of yourself, leaving your personal assets vulnerable in the event of a lawsuit or debt collection. The operating agreement demonstrates that you’re treating your LLC as a distinct entity, operating it professionally and independently.

Consider also the scenario where you want to bring on investors or partners in the future. While you might be a single member now, your business goals could evolve. Having an operating agreement in place sets a foundation for future growth and provides a framework for how those new relationships would be structured. It clarifies how profits, losses, and management responsibilities would be shared.

Furthermore, an operating agreement can prevent misunderstandings and disputes, even when you’re the only member. It outlines important details like your business’s purpose, how it will be managed, and how profits will be distributed (even if that’s all to you!). It provides a clear record of your intentions and decisions regarding the business, which can be helpful for internal organization and demonstrating professionalism to banks, lenders, and other third parties.

Finally, an operating agreement can help you tailor your LLC to your specific needs and circumstances. While California law provides default rules for LLCs, those rules might not always be the best fit for your business. An operating agreement allows you to customize those rules to better align with your business goals and operational structure. In short, don’t skip the operating agreement – it’s a fundamental building block for a successful and protected business venture.

Key Elements to Include in Your Template

When selecting a California single member LLC operating agreement template, make sure it covers all the essential elements to provide comprehensive protection and clarity for your business. Each section serves a distinct purpose, ensuring that your LLC operates smoothly and within legal boundaries.

The first section should cover basic information about your LLC, including its name, registered agent, and principal place of business. The name should match what’s filed with the California Secretary of State. The registered agent is the individual or entity designated to receive legal documents on behalf of your LLC. The principal place of business is the primary location where your business operates.

Next, the operating agreement should define the purpose of your LLC. Be specific about the type of business activities your LLC will engage in. This helps establish the scope of your business and prevents confusion about its operations. Also, clearly state that you are the sole member of the LLC, as well as your rights, responsibilities, and powers related to the management of the company.

Another important section outlines how profits and losses will be allocated. In a single member LLC, this is typically straightforward: all profits and losses are allocated to you as the sole member. However, it’s still important to document this clearly. The agreement should also address how the LLC will be managed. As the sole member, you’ll likely be managing the LLC directly, but the agreement should outline your authority and responsibilities.

Finally, the operating agreement should include provisions for amendments, dissolution, and governing law. The amendment section explains how the agreement can be modified in the future. The dissolution section outlines the process for terminating the LLC. The governing law section specifies that California law will govern the interpretation and enforcement of the agreement. By including these key elements, your California single member LLC operating agreement will provide a solid foundation for your business, ensuring clarity, protection, and compliance with legal requirements.

Remember that an operating agreement is there to make your life easier as a business owner. With a well crafted California single member LLC operating agreement template, you can set yourself up for success and peace of mind.

It is advisable to consult with an attorney or legal professional to ensure that the operating agreement meets your specific needs and complies with California state laws. This is to guarantee that you are operating legally.