Business Purchase Deposit Agreement Template

So, you’re looking to buy a business or maybe you’re selling one and you’re at that exciting, but sometimes nerve-wracking stage of putting pen to paper. One of the key documents you’ll need is a business purchase deposit agreement. Think of it as the handshake agreement before the real deal, a promise to buy or sell, backed up by a good faith deposit. It’s a crucial step that shows both parties are serious about moving forward.

This document essentially lays out the preliminary terms of the business sale, protecting both the buyer and the seller. It ensures that the seller doesn’t entertain other offers while the buyer is performing their due diligence, and it gives the buyer some assurance that the business will be theirs if everything checks out. It’s more than just a formality; it’s a safety net for both sides.

Without a well-defined deposit agreement, things can get messy. What happens if the buyer backs out after the due diligence period? What if the seller receives a better offer? A properly drafted business purchase deposit agreement template will address these potential issues and provide a clear framework for resolving them. So, let’s dive into what this agreement entails and why it’s so important.

Understanding the Business Purchase Deposit Agreement

A business purchase deposit agreement, at its core, is a legally binding contract. It outlines the basic terms of a potential business sale and, most importantly, details the deposit amount, payment schedule, and conditions under which the deposit can be refunded or forfeited. It’s like a mini-contract leading up to the full-blown purchase agreement, setting the stage for a smooth transaction.

Think of it as an insurance policy for both the buyer and the seller. For the buyer, it secures their right to purchase the business, preventing the seller from entertaining other offers during a specified period. This allows the buyer time to conduct due diligence, review financial records, and assess the viability of the business without the fear of being gazumped. For the seller, the deposit provides some compensation if the buyer backs out of the deal without a legitimate reason, covering potential losses incurred during the exclusivity period.

The agreement typically includes key elements such as the names and addresses of both parties, a description of the business being sold, the agreed-upon purchase price, the deposit amount, and the conditions for the deposit’s refund or forfeiture. It will also specify the timeframe for due diligence, the closing date for the sale, and any other material terms that both parties agree upon. These terms need to be crystal clear to avoid future misunderstandings or disputes.

Crucially, the agreement should also address contingencies. What happens if the buyer is unable to secure financing? What if the due diligence reveals significant issues with the business? The agreement should outline the process for addressing these potential problems and the consequences for both parties. Including these contingencies provides a level of protection and clarity for everyone involved.

Using a business purchase deposit agreement template can save time and money, but it’s essential to customize it to fit the specific circumstances of the transaction. Consult with legal counsel to ensure that the agreement accurately reflects the intentions of both parties and complies with all applicable laws and regulations. Don’t just grab a template and run with it; take the time to tailor it to your unique situation. Neglecting this step could lead to costly problems down the road.

Key Components of a Solid Business Purchase Deposit Agreement Template

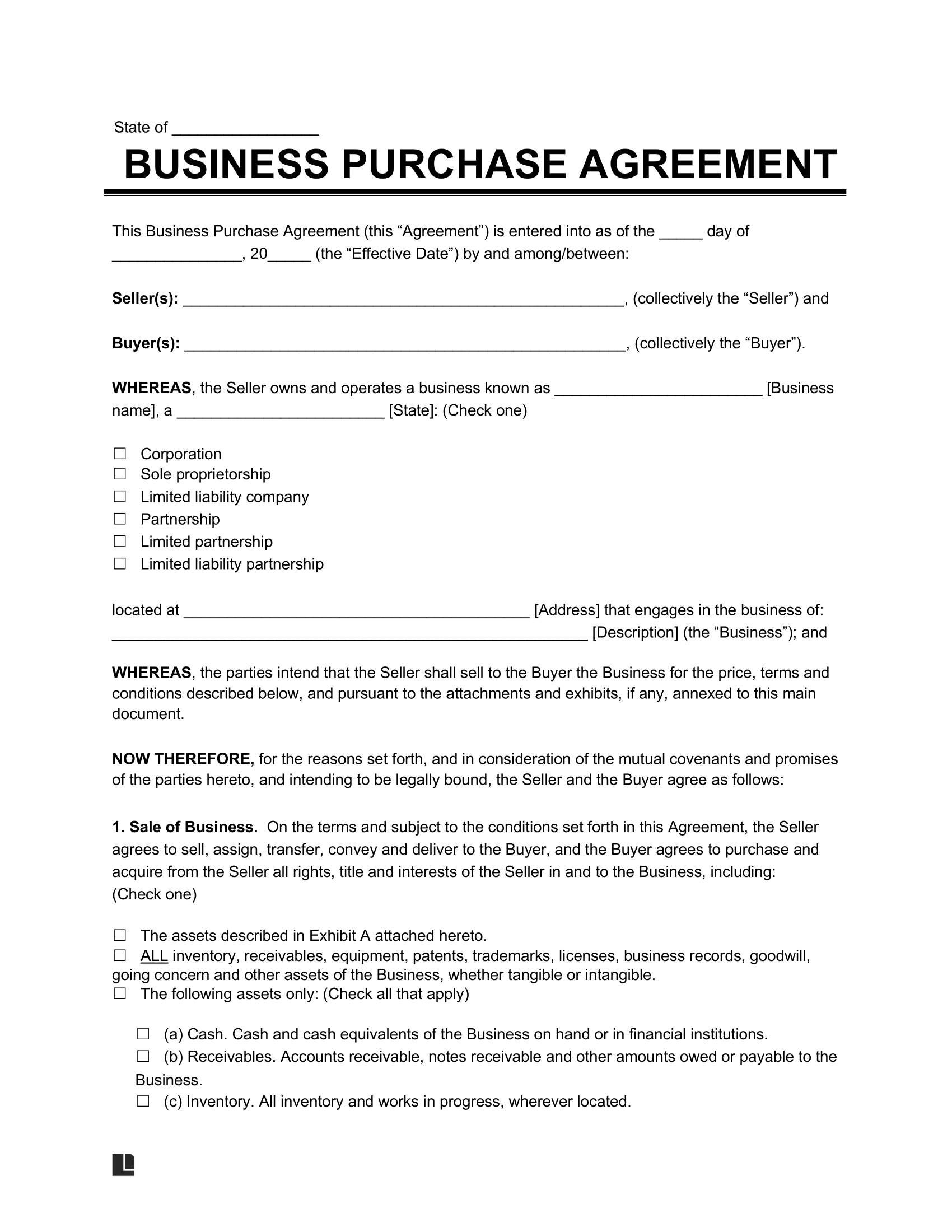

A well-structured business purchase deposit agreement template isn’t just a collection of legal jargon; it’s a carefully crafted document that addresses all the crucial aspects of the preliminary agreement. The agreement should always start with clear identification of the parties involved. State the full legal names and addresses of both the buyer and the seller. Accuracy is paramount here, as any errors can create confusion and potentially invalidate the agreement.

Next, clearly define the business being sold. Include the business name, address, and a brief description of its operations. Specify what assets are included in the sale. This might include inventory, equipment, intellectual property, customer lists, and goodwill. Be as detailed as possible to avoid any ambiguity about what the buyer is actually purchasing.

The purchase price and deposit details are, of course, central to the agreement. State the agreed-upon purchase price and the amount of the deposit. Clearly outline the payment schedule for the deposit, including when it’s due and how it should be paid (e.g., certified check, wire transfer). Specify whether the deposit will be held in escrow and, if so, identify the escrow agent. Also, clarify whether the deposit is refundable and under what conditions. This is where contingencies come into play. For example, if the buyer is unable to obtain financing despite good faith efforts, the deposit should typically be refunded.

The due diligence period is another vital element. Define the timeframe for the buyer to conduct due diligence. Specify what information the seller must provide to the buyer during this period, such as financial statements, tax returns, and customer contracts. The agreement should also outline the buyer’s rights to inspect the business premises and interview employees. This section needs to be detailed and unambiguous to ensure both parties understand their responsibilities during this critical phase.

Finally, include clauses addressing governing law, dispute resolution, and termination. Specify the jurisdiction whose laws will govern the agreement. Outline the process for resolving disputes, such as mediation or arbitration. And clearly define the conditions under which the agreement can be terminated by either party. Including these clauses helps protect both parties in case of unforeseen circumstances or disagreements. Using a comprehensive business purchase deposit agreement template, tailored to your specific circumstances, can significantly reduce the risk of disputes and ensure a smoother transaction.

Drafting this agreement carefully ensures that both parties are protected.

The most successful transactions start with a well-defined agreement.