Navigating the world of business partnerships can be a thrilling adventure, filled with shared successes and mutual growth. But what happens when the road forks, and partners decide to head in separate directions? That’s where a business partnership buyout agreement comes into play. Think of it as a prenuptial agreement for business partners – a clear, concise plan that outlines the process for one partner to buy out the other’s share of the company. It’s designed to minimize disputes, protect everyone’s interests, and ensure a smooth transition when a partnership dissolves.

Whether a partner is retiring, pursuing a new opportunity, or simply no longer aligned with the company’s vision, having a solid buyout agreement in place is crucial. It addresses vital questions such as how the departing partner’s share will be valued, the payment terms for the buyout, and the legal obligations each partner has after the transaction. Without such an agreement, disagreements can escalate quickly, leading to costly legal battles and potentially jeopardizing the future of the business.

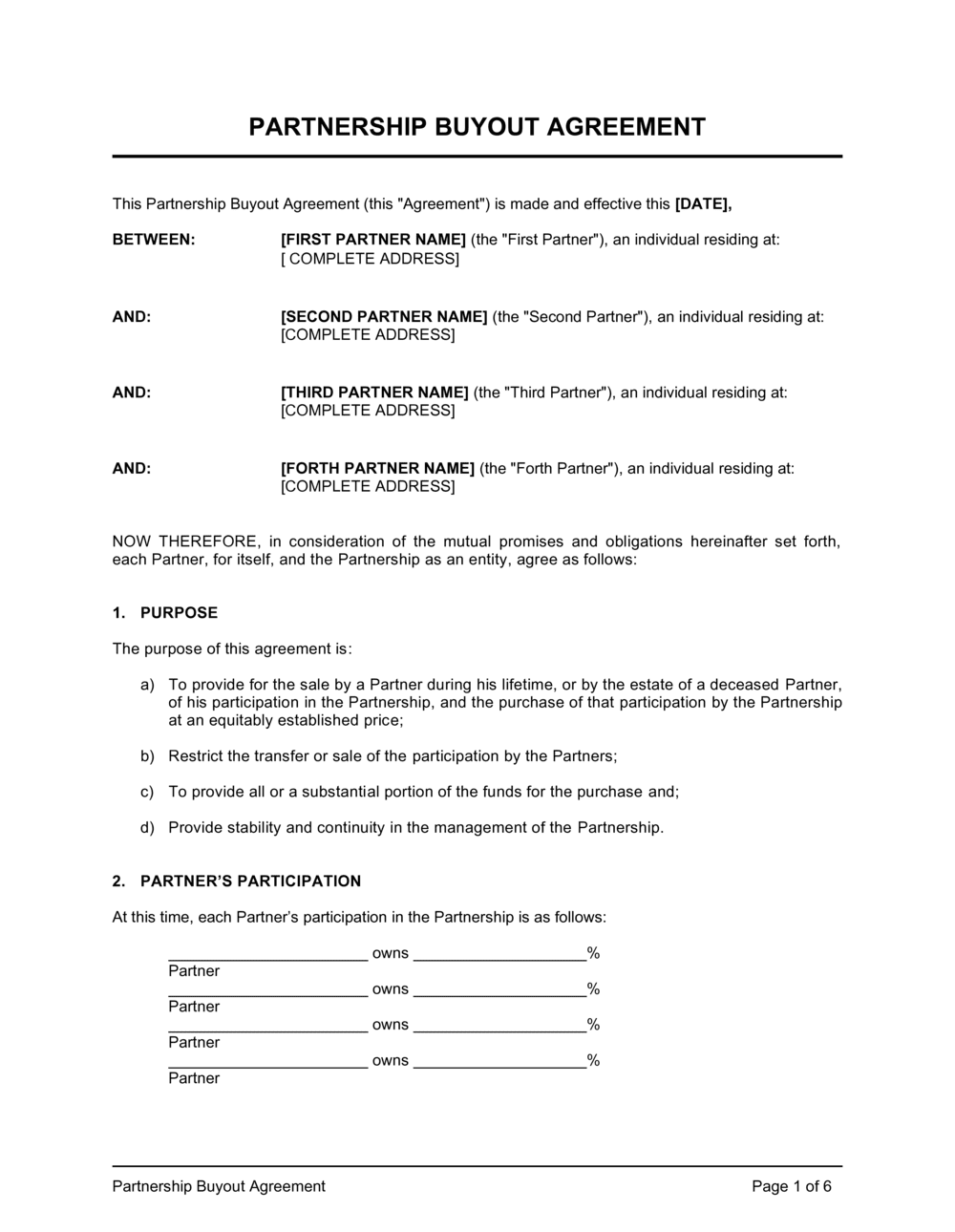

The good news is that you don’t have to start from scratch. A business partnership buyout agreement template can serve as a valuable starting point, providing a structured framework that you can customize to suit the specific needs of your partnership. It helps ensure that all critical aspects are considered, and that the final agreement accurately reflects the intentions of all parties involved. Let’s dive deeper into what makes up this important document and how you can use it effectively.

Why You Absolutely Need a Business Partnership Buyout Agreement

Imagine building a business from the ground up with a trusted partner. You’ve poured your heart and soul into it, sharing both the triumphs and the challenges. Now, imagine that partnership coming to an end without a clear plan for how to separate. The potential for conflict is enormous. A well-drafted buyout agreement is your insurance policy against those messy, drawn-out disputes. It clarifies the process, minimizes emotional turmoil, and protects the long-term health of the business.

One of the primary reasons for having this agreement is to establish a fair and objective method for valuing the departing partner’s share. This valuation process is often the biggest point of contention, and having it pre-defined in the agreement can prevent lengthy and expensive negotiations down the line. Common valuation methods include using a multiple of earnings, assessing the fair market value of assets, or employing an independent appraiser. The agreement should specify which method will be used and how it will be applied.

Furthermore, the agreement outlines the payment terms for the buyout. Will the remaining partner pay a lump sum, or will the payments be structured over a period of time? What interest rate, if any, will be applied to the outstanding balance? Clearly defining these terms ensures that the departing partner receives fair compensation while allowing the remaining partner to manage the financial burden of the buyout effectively. This foresight can keep the business running smoothly.

Beyond valuation and payment, the agreement also addresses critical issues such as non-compete clauses and confidentiality agreements. These clauses protect the remaining partner(s) from unfair competition by the departing partner, ensuring that they don’t immediately use their knowledge and experience to start a rival business or share confidential information with competitors. These provisions are essential for safeguarding the business’s competitive advantage.

Finally, a buyout agreement provides clarity on the legal obligations of both parties after the buyout. This includes issues such as indemnification, warranties, and dispute resolution mechanisms. By clearly outlining these responsibilities, the agreement minimizes the risk of future misunderstandings and provides a framework for resolving any disputes that may arise. In short, it provides legal certainty and helps everyone move forward with confidence.

Key Elements of a Solid Business Partnership Buyout Agreement Template

So, what exactly should be included in your business partnership buyout agreement template? Think of it as a comprehensive checklist of all the crucial aspects you need to consider. While every partnership is unique, there are certain essential elements that should be present in every agreement to ensure clarity, fairness, and legal enforceability.

First and foremost, the agreement should clearly identify the parties involved, including the full legal names and addresses of all partners. It should also include a detailed description of the business, including its name, legal structure (e.g., general partnership, limited partnership), and principal place of business. This foundational information sets the stage for the entire agreement.

Next, the agreement needs to define the triggering events that would initiate a buyout. These events could include a partner’s retirement, death, disability, voluntary withdrawal, or expulsion from the partnership. Clearly defining these triggers ensures that everyone understands the circumstances under which a buyout can occur. No one wants to argue over what is a valid reason for a business separation later.

The valuation methodology is another critical element. As mentioned earlier, the agreement should specify the method used to determine the fair market value of the departing partner’s share. This could involve using a multiple of earnings, assessing the value of assets, or engaging an independent appraiser. The more detailed and specific the valuation process, the less room there is for disagreement.

Finally, the agreement should address the legal ramifications of the buyout, including issues such as indemnification, warranties, and dispute resolution mechanisms. Indemnification clauses protect the remaining partner(s) from liability for the departing partner’s actions prior to the buyout, while warranties provide assurances about the accuracy of financial information. A clear dispute resolution process, such as mediation or arbitration, can help resolve disagreements efficiently and cost-effectively.

Using a business partnership buyout agreement template can significantly simplify this process, ensuring that all essential elements are addressed. However, it’s crucial to remember that a template is just a starting point. You should always consult with legal counsel to ensure that the final agreement is tailored to your specific circumstances and complies with all applicable laws. A small investment in legal advice upfront can save you significant time, money, and headaches down the road.

By taking the time to create a comprehensive and well-drafted buyout agreement, you can protect your business, preserve your relationships, and ensure a smooth transition when the time comes for a partner to move on. It’s an investment that pays dividends in the form of peace of mind and long-term stability.

Ultimately, proactively establishing a clear agreement is a sign of responsible business management. It demonstrates foresight and a commitment to fairness, setting the stage for a respectful and orderly separation when the time arises. This forward-thinking approach helps maintain the integrity of the business and minimizes the potential for conflict.

Taking these steps ensures that all parties are protected and that the business can continue to thrive, even in the face of change. It’s about planning for the future and fostering a culture of transparency and accountability within the partnership. A comprehensive business partnership buyout agreement template is a valuable tool in achieving these goals.