Ever felt a little uneasy lending money to a friend or family member? Or maybe you’re a freelancer who wants to ensure you get paid on time for your hard work? That’s where a basic simple payment agreement template comes in handy. It’s a straightforward, no-fuss document that clearly outlines the terms of a payment arrangement, helping to protect both the person making the payment and the person receiving it. It’s like a friendly handshake, but with all the important details written down for clarity.

Think of it as a simple insurance policy for your financial transactions. Instead of relying on verbal promises or vague understandings, a payment agreement provides a written record of the agreed-upon amount, payment schedule, and any potential penalties for late payments. This can save you a lot of headaches and awkward conversations down the road. No more guessing games about who owes what, and when it’s due. Everyone is on the same page, leading to a smoother and more professional experience.

A payment agreement isn’t just for formal business deals, it can be used in many situations. It could be for a loan between friends, installment payments for a large purchase, or a service contract. The key is to keep it simple, clear, and easy to understand. Avoid complicated legal jargon and focus on the essential details. With a well-crafted agreement, you can establish trust and ensure that everyone involved is protected.

Why Use a Basic Simple Payment Agreement Template?

Using a basic simple payment agreement template offers several benefits. First and foremost, it provides clarity and avoids misunderstandings. When everyone involved understands the terms of the agreement, there is less room for disputes and disagreements down the line. This clarity fosters trust and improves the overall relationship between the parties.

Secondly, a payment agreement template can help you stay organized. By outlining the payment schedule and amounts, you can track payments and ensure that everything is on track. This is especially useful for freelancers and small business owners who need to manage multiple invoices and payments. It allows for efficient record-keeping, making it easy to monitor cash flow and identify any potential issues early on.

Another significant advantage is that a payment agreement can help protect your legal rights. While a simple agreement might not be as comprehensive as a formal contract drafted by a lawyer, it can still provide evidence of the agreement if a dispute arises. Having the terms in writing can be invaluable if you ever need to take legal action to recover unpaid funds. It serves as a documented record of the obligations that were agreed upon by all parties.

Consider the case of a freelance web designer agreeing to build a website for a small business. A basic simple payment agreement template can outline the total cost of the project, the payment schedule (e.g., a percentage upfront, a percentage upon completion of the design, and the final payment upon launch), and what happens if the client doesn’t pay on time. This simple document protects the web designer’s income and clarifies the client’s obligations.

Finally, utilizing a template saves time and effort. Instead of creating a payment agreement from scratch, you can use a template as a starting point and customize it to fit your specific needs. This can save you hours of work and ensure that you don’t overlook any important details. A readily available basic simple payment agreement template is a valuable tool for anyone involved in financial transactions, big or small.

What Should Be Included in Your Template?

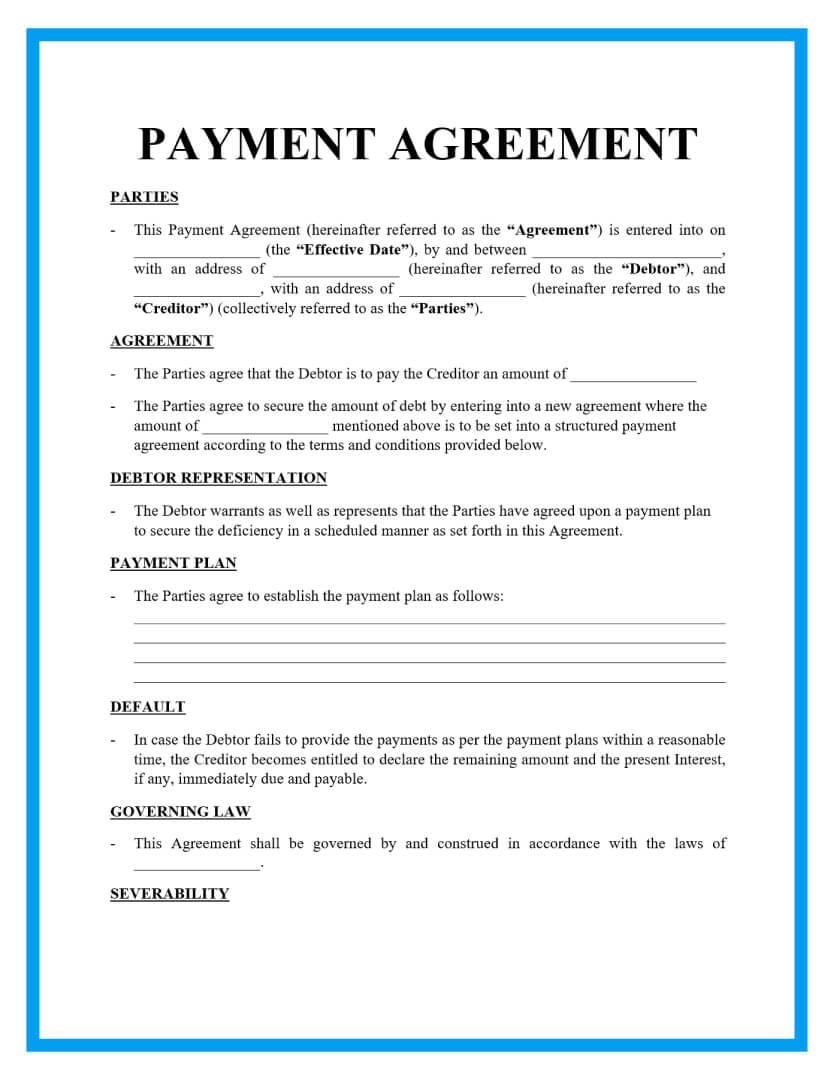

A good basic simple payment agreement template should include several key elements to ensure its effectiveness. First, clearly identify the parties involved. This includes the names and contact information of the person making the payment (the payer) and the person receiving the payment (the payee). This establishes who is responsible for fulfilling the agreement.

Next, specify the amount of the payment. This should be stated clearly in both numerical and written form to avoid any ambiguity. Be precise about the total amount due, whether it’s for a loan, service, or product. Vague wording can lead to misunderstandings later on, so clarity is crucial.

The payment schedule is another crucial element. Outline when payments are due, how often they should be made (e.g., weekly, monthly), and the method of payment (e.g., cash, check, online transfer). A detailed payment schedule helps both parties stay on track and ensures that payments are made in a timely manner. It also minimizes the risk of late payments and potential disputes.

Include a section that addresses late payments. Specify any penalties or interest charges that will be applied if payments are not made on time. This provides an incentive for the payer to adhere to the agreed-upon schedule. Clearly defining the consequences of late payments can help prevent delays and protect the payee’s financial interests.

Finally, include a section for signatures and dates. All parties involved should sign and date the agreement to indicate their acceptance of the terms. This creates a legally binding document that can be used as evidence of the agreement if necessary. Make sure each party receives a copy of the signed agreement for their records. This process ensures that everyone is aware of their obligations and has formally agreed to abide by them.

We hope that you found this information helpful. A well-crafted payment agreement can provide peace of mind and protect your interests in financial transactions. By taking the time to create a clear and comprehensive document, you can avoid misunderstandings and ensure that everyone is on the same page.

With the information above, you are well-equipped to create or use a basic simple payment agreement template that serves your needs and fosters positive financial relationships. Remember to always prioritize clarity, communication, and mutual understanding when entering into any payment agreement.