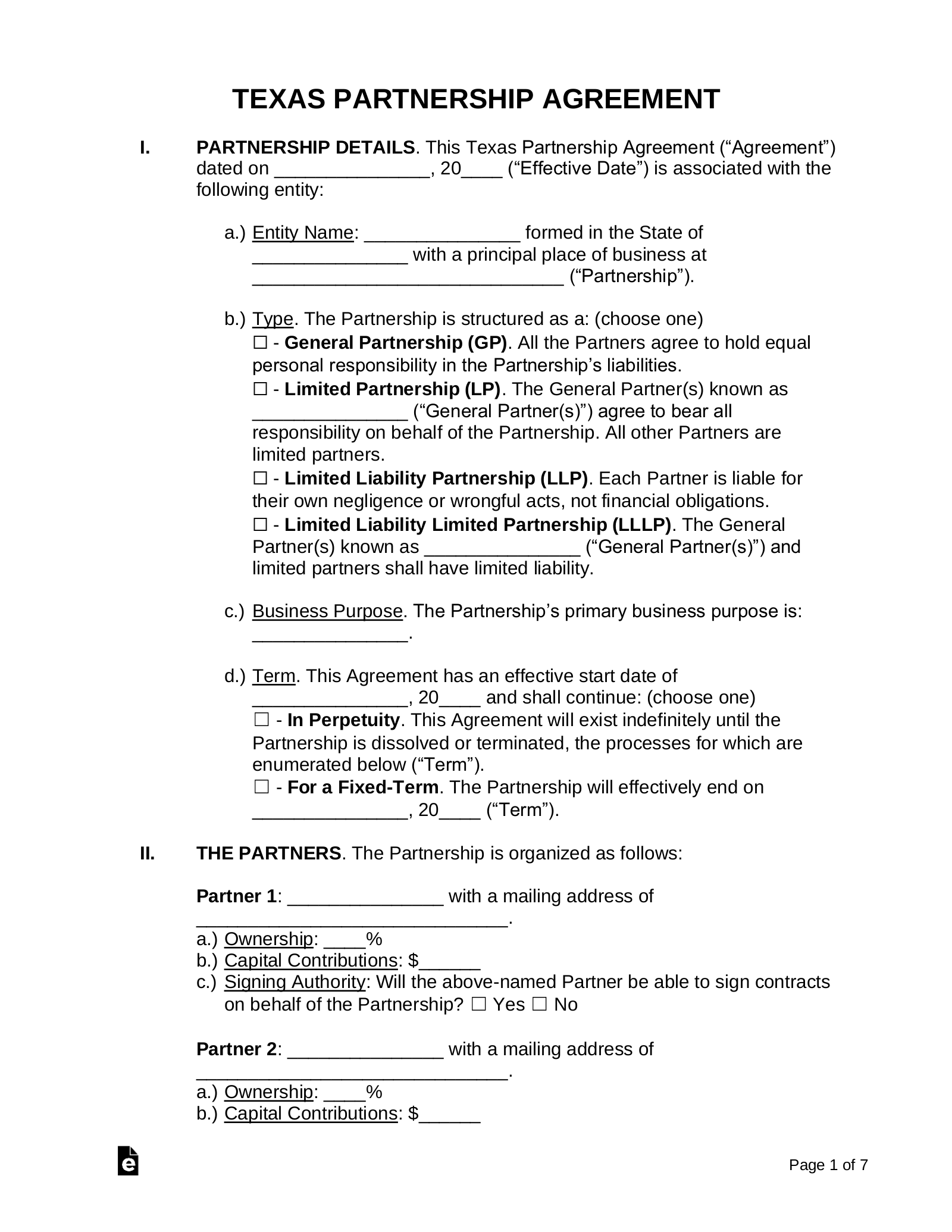

So, you’re thinking about starting a limited partnership in the Lone Star State? That’s fantastic! Navigating the business world can be tricky, especially when it comes to legal documents. But fear not, because having a solid Texas limited partnership agreement template can be your secret weapon. This agreement is essentially the rulebook for your partnership, outlining everything from who does what to how profits (and losses!) are divided. Think of it as a roadmap that keeps everyone on the same page and helps avoid disagreements down the road.

Why is a template so important? Well, attempting to draft an agreement from scratch can be a daunting task, especially if you’re not a legal expert. A well-crafted template provides a framework that you can customize to fit your specific needs. It covers essential clauses and legal requirements, ensuring that your partnership is properly structured and compliant with Texas law. Plus, it saves you valuable time and potentially costly legal fees.

Choosing the right template is crucial. You need one that is specifically designed for Texas limited partnerships and reflects the unique legal landscape of the state. Look for templates that are clear, concise, and comprehensive, covering all the key aspects of your partnership agreement. With the right template in hand, you’ll be well on your way to establishing a successful and well-governed partnership in Texas.

Key Components of a Texas Limited Partnership Agreement

A comprehensive Texas limited partnership agreement covers a wide array of essential details. It acts as a constitution for your partnership, defining its structure, operations, and the rights and responsibilities of each partner. Let’s break down some of the most important elements that should be included in your agreement.

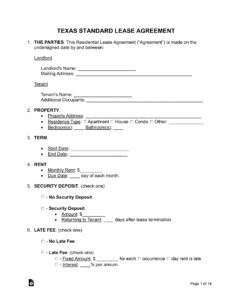

First and foremost, the agreement should clearly identify the name and address of the partnership, as well as the names and addresses of all general and limited partners. This might seem obvious, but clarity is key. The agreement should also specify the purpose of the partnership. What business will the partnership engage in? Being specific here helps to define the scope of the partnership’s activities and prevents future disputes about whether a particular activity falls within the partnership’s purview. Furthermore, clearly define the term or duration of the partnership. Will it last for a specific period, or will it continue indefinitely until dissolved? This section of the agreement provides clarity about the partnership’s lifespan.

Another critical aspect is the capital contributions of each partner. How much money (or other assets) is each partner contributing to the partnership? The agreement should specify the amount of each partner’s initial contribution and outline any provisions for future contributions. Equally important is the allocation of profits and losses. How will the partnership’s profits and losses be divided among the partners? Will it be based on their capital contributions, their level of involvement, or some other formula? The agreement should clearly spell out the allocation method to avoid misunderstandings and conflicts.

The agreement must clearly define the roles, rights, and responsibilities of general and limited partners. General partners typically have management responsibilities and are personally liable for the partnership’s debts, while limited partners have limited liability and typically do not participate in management. The agreement should specify the extent of each partner’s authority and responsibilities. It’s also important to outline the procedures for admitting new partners and for partners to withdraw or transfer their interests. What are the requirements for adding a new partner to the partnership? What happens if a partner wants to leave or sell their stake? The agreement should address these scenarios to ensure a smooth transition.

Finally, the agreement should include provisions for dissolution of the partnership. Under what circumstances will the partnership be dissolved? What process will be followed to wind up the partnership’s affairs and distribute its assets? Having a clear dissolution clause can help to avoid costly and time-consuming legal battles if the partnership eventually comes to an end. A well-defined agreement also specifies how disputes will be resolved. Will the partnership use mediation, arbitration, or litigation to resolve conflicts among the partners? Choosing a dispute resolution method in advance can save time and money if disagreements arise.

Having a comprehensive Texas limited partnership agreement template ensures that your partnership starts off on the right foot, with clear rules and guidelines in place to govern its operations.

Why Use a Texas Limited Partnership Agreement Template?

Crafting a partnership agreement from scratch can feel like navigating a legal minefield. The sheer volume of legal jargon and the intricate nuances of Texas partnership law can be overwhelming. This is precisely where a Texas limited partnership agreement template becomes invaluable. It provides a pre-structured framework, saving you time and effort by offering a ready-made foundation upon which to build your specific partnership agreement.

A good template covers all the essential clauses required under Texas law, ensuring that your agreement is legally sound and enforceable. This is crucial because a poorly drafted agreement can lead to disputes, legal challenges, and even the unintentional creation of unintended liabilities. The right template acts as a safety net, minimizing the risk of errors and omissions that could compromise your partnership’s legal standing. Additionally, it helps to standardize the document. Using a template ensures consistency and structure, making it easier for all parties involved to understand their rights and obligations. This can be particularly beneficial when dealing with complex financial arrangements or multiple partners.

Furthermore, a template can be a significant cost-saving measure. Hiring an attorney to draft a partnership agreement from scratch can be expensive. While legal advice is always recommended, a template allows you to handle the initial drafting process yourself, saving on attorney fees. You can then consult with an attorney to review and customize the template, ensuring it meets your specific needs. Remember to tailor the template to your specific partnership circumstances. Don’t just blindly fill in the blanks. Take the time to carefully consider each clause and how it applies to your unique situation. For example, the profit and loss allocation provisions should reflect the specific contributions and roles of each partner.

Ultimately, using a Texas limited partnership agreement template streamlines the process of creating a legally sound and comprehensive agreement. It reduces the risk of errors, saves time and money, and ensures that your partnership is properly structured from the outset. The availability of a reliable texas limited partnership agreement template empowers you to take control of your partnership’s legal foundation. Having one ready makes a big difference.

Choosing the right template is also key, select a template that is specifically designed for Texas limited partnerships and reflects the current state of Texas law. Look for templates that are clear, concise, and comprehensive, covering all the key aspects of your partnership agreement. A well-vetted template will provide a solid foundation, allowing you to focus on the specific details of your partnership and build a successful business.

Having a solid agreement is a critical step, it’s a collaborative endeavor. Every partner should actively participate in the process of reviewing and customizing the agreement. This ensures that everyone understands their rights and responsibilities and helps to foster a spirit of collaboration and trust.

Embarking on a business venture requires a solid foundation, and a well-structured partnership agreement is the cornerstone of that foundation. By carefully considering your unique circumstances and customizing a reliable template, you can create an agreement that protects your interests, promotes collaboration, and sets your partnership up for success.

Setting up a Texas limited partnership can be a smart move, but make sure you dot your i’s and cross your t’s. A comprehensive partnership agreement is more than just a formality; it’s a critical tool for managing your business and protecting your investment.