Need to borrow some money from a friend or family member, or maybe lend some to someone you trust? Awesome! That’s where a basic personal loan agreement template comes in super handy. It’s basically a written promise, making sure everyone’s on the same page about who’s borrowing, how much, when it needs to be paid back, and what happens if things get a little tricky along the way. Think of it as a relationship-saver, not just a piece of paper.

Creating a simple loan agreement, even for friends and family, is a smart move. It avoids misunderstandings and ensures everyone understands the terms. No one wants a financial favor turning into a family feud, right? Using a basic personal loan agreement template helps to clearly outline expectations and prevents hurt feelings down the line.

In this article, we’ll explore what makes up a solid personal loan agreement, what key details to include, and why having a written agreement is way better than relying on a handshake deal, especially when money is involved. We’ll also touch on where you can find reliable templates to make the process even easier. So, let’s dive in and get you sorted with your own lending or borrowing agreement!

Why You Absolutely Need a Personal Loan Agreement

Okay, so maybe you’re thinking, “A loan agreement for my sister? Or my best friend? Isn’t that a bit much?” Well, hear me out. Even the strongest relationships can be strained by misunderstandings about money. A personal loan agreement isn’t about distrust; it’s about clear communication and setting clear expectations from the get-go. Think of it as relationship insurance – it protects everyone involved.

One of the biggest benefits of using a personal loan agreement template is that it eliminates ambiguity. It forces you to consider all the important details upfront: the exact amount of the loan, the interest rate (if any), the repayment schedule (weekly, monthly, etc.), and the consequences of late or missed payments. By putting everything in writing, you minimize the risk of disputes arising later on.

Imagine lending a friend some money, verbally agreeing they’ll pay you back in six months. But what if they forget? Or they interpret “six months” differently than you do? Suddenly, you’re in an awkward situation, potentially damaging your friendship. A written agreement acts as a reminder and a reference point for both parties, ensuring everyone stays on track.

Furthermore, a well-drafted personal loan agreement can be useful for tax purposes, especially if you’re charging interest. It provides a record of the transaction, which you may need to report to the IRS. While it might seem like overkill for a small loan between friends, it’s always better to be prepared and compliant.

Finally, consider the legal implications. While you might not envision taking legal action against a loved one, having a written agreement strengthens your position if things really go south. It provides evidence of the loan’s terms and conditions, making it easier to pursue legal remedies if necessary. Hopefully, it will never come to that, but it’s always best to have a safety net.

Key Elements of a Basic Personal Loan Agreement Template

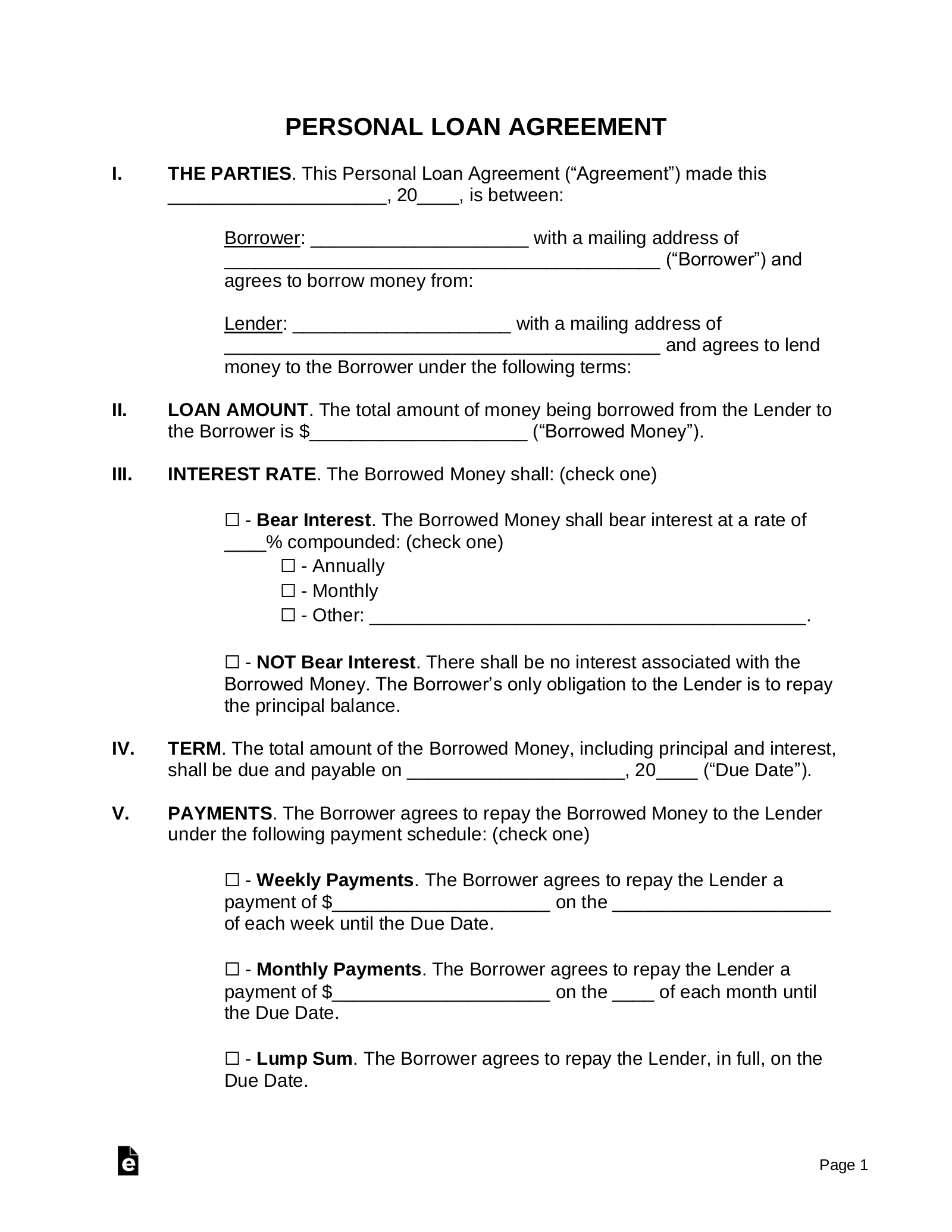

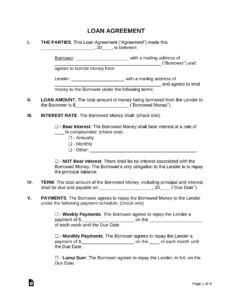

So, you’re convinced that a personal loan agreement is a good idea. Great! Now, let’s break down the key components you should include in your document. Don’t worry, it’s not as complicated as it sounds. A basic personal loan agreement template usually includes these elements:

First, you need to clearly identify the parties involved. This means including the full legal names and addresses of both the lender and the borrower. This may seem obvious, but it’s crucial for legal clarity. Make sure you double-check the spelling and accuracy of all the information.

Next, specify the loan amount. This is the exact amount of money being lent. Be specific – don’t just say “a few thousand dollars.” Write out the amount in both numerical form (e.g., $5,000) and in words (e.g., Five Thousand Dollars). This helps prevent any confusion or ambiguity.

The agreement should also outline the interest rate, if any. If you’re charging interest, state the annual percentage rate (APR) clearly. Also, specify how the interest will be calculated (e.g., simple interest, compound interest). If you’re not charging interest, explicitly state that the loan is interest-free.

Another essential element is the repayment schedule. This details how and when the borrower will repay the loan. Specify the frequency of payments (e.g., monthly, bi-weekly), the amount of each payment, and the due date for each payment. You should also include information on how the payments should be made (e.g., check, electronic transfer, cash).

Finally, your agreement should address what happens in case of default. What actions can the lender take if the borrower fails to make timely payments? Can the lender demand immediate repayment of the entire loan amount? Including a default clause protects the lender’s interests and clarifies the consequences of non-payment. When searching for a basic personal loan agreement template, ensure it has all the features to protect both parties.

Creating this document serves as a mutual understanding of responsibilities, expectations, and repercussions if obligations aren’t met. It establishes an official record of the agreement and allows both parties to refer back to the document whenever uncertainty arises.

In conclusion, a basic personal loan agreement template is a powerful tool for managing financial relationships with loved ones. It helps prevent misunderstandings, clarifies expectations, and provides a framework for resolving disputes. By taking the time to create a written agreement, you can protect both your financial interests and your relationships.