Ever been in a situation where you need cash fast, but your clients are taking their sweet time paying their invoices? It’s a common problem for businesses, especially startups and small companies. An assignment of receivables agreement might be just the solution you’re looking for. It’s a legal tool that allows you to sell or transfer your accounts receivable to a third party, usually a financing company, in exchange for immediate funds. Think of it as turning future income into present cash, giving you the financial breathing room you need to operate and grow.

This agreement essentially involves three parties: the assignor (that’s you, the business owner selling the receivables), the assignee (the financing company or lender buying the receivables), and the account debtor (your client who owes the money). The assignee then collects the payments directly from your clients, and you get a percentage of the invoice value upfront, minus any fees or discounts agreed upon. While it may sound complex, understanding the basics can empower you to manage your cash flow effectively and make informed financial decisions.

This article dives deep into the world of assignment of receivables agreements. We’ll explore what they are, why businesses use them, and what key elements to look for in an assignment of receivables agreement template. By the end, you’ll have a solid understanding of how this financial instrument can help your business thrive and how an assignment of receivables agreement template can make this process smoother.

Understanding the Ins and Outs of an Assignment of Receivables Agreement

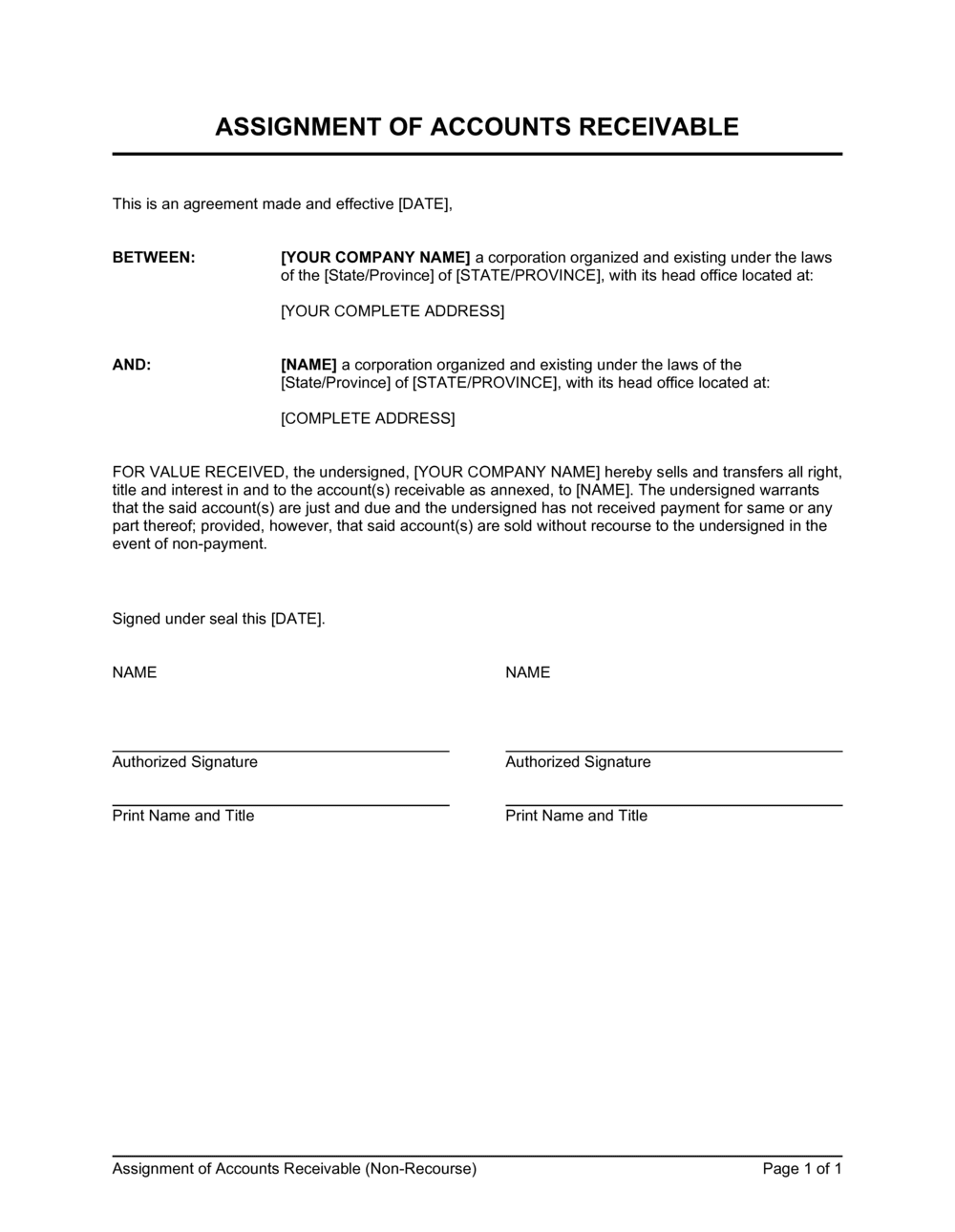

An assignment of receivables agreement is more than just a simple transaction; it’s a legally binding contract that outlines the rights and responsibilities of all parties involved. It’s crucial to understand the nuances of this agreement to ensure a smooth and beneficial arrangement. Essentially, you’re transferring the right to collect payments from your customers to another party. This transfer needs to be clearly defined in the agreement to avoid any future disputes or misunderstandings. The agreement should specify which invoices are being assigned, the total amount owed, and the terms of payment.

The main purpose of an assignment of receivables agreement is to provide the assignor (the business selling the receivables) with immediate access to funds. Instead of waiting 30, 60, or even 90 days for customer payments, the business receives a lump sum from the assignee (the financing company). This can be particularly useful for businesses that need to cover operating expenses, invest in new equipment, or take advantage of growth opportunities. It’s a way to bridge the gap between providing goods or services and receiving payment, allowing for more efficient cash flow management.

However, it’s important to note that an assignment of receivables agreement typically involves a discount. The assignee will not pay the full face value of the invoices. This is because they are taking on the risk of non-payment. The discount rate will depend on various factors, such as the creditworthiness of your customers, the industry you’re in, and the overall economic climate. It’s essential to carefully evaluate the discount rate to ensure that the agreement is financially viable for your business. Think of it as a trade-off – you’re sacrificing a portion of the invoice value for the convenience of immediate cash.

Furthermore, the agreement should clearly define the recourse available to the assignee in case of non-payment. Will the assignor be responsible for repurchasing the uncollected receivables? Or will the assignee bear the loss? The terms of recourse can significantly impact the overall risk and cost of the agreement. Non-recourse agreements, where the assignee assumes the risk of non-payment, are generally more expensive but offer greater protection for the assignor. Recourse agreements, on the other hand, place the burden of non-payment back on the assignor.

Before entering into an assignment of receivables agreement, it’s always advisable to seek legal counsel. An attorney can review the agreement, explain the terms in plain language, and advise you on any potential risks or pitfalls. They can also help you negotiate more favorable terms with the assignee. While using an assignment of receivables agreement template can save time and money, it’s essential to ensure that the template is appropriate for your specific circumstances and that you fully understand all the legal implications.

Key Elements to Look for in an Assignment of Receivables Agreement Template

When you’re on the hunt for an assignment of receivables agreement template, not all templates are created equal. A good template should be comprehensive, clear, and customizable to fit your specific business needs. Look for templates that cover all the essential elements and provide flexibility for adjustments. A poorly drafted template can lead to misunderstandings, disputes, and even legal challenges down the road.

One of the first things to look for is a clear definition of the parties involved. The template should accurately identify the assignor, the assignee, and the account debtor. It should also specify the addresses and contact information for each party. This information is crucial for legal and communication purposes. Without clear identification, it can be difficult to enforce the agreement or resolve any issues that may arise.

The template should also include a detailed description of the receivables being assigned. This should include the invoice numbers, dates, amounts, and due dates. It’s important to be as specific as possible to avoid any ambiguity. You might even consider attaching copies of the invoices to the agreement as exhibits. The more detail you provide, the less room there is for misinterpretation or dispute.

Another crucial element is the payment terms. The template should clearly state the percentage of the invoice value that the assignor will receive upfront, the discount rate, and any fees or charges associated with the assignment. It should also specify the payment schedule and the method of payment. Transparency in payment terms is essential for building trust and maintaining a positive relationship with the assignee. You should know exactly how much you’re going to receive and when you’re going to receive it.

Finally, the template should include provisions for dispute resolution, governing law, and termination. These clauses outline how any disagreements will be resolved, which jurisdiction’s laws will govern the agreement, and under what circumstances the agreement can be terminated. These provisions are important for protecting your rights and ensuring a fair and efficient resolution of any potential conflicts. Don’t overlook these seemingly minor details; they can be crucial in the event of a dispute. Using the right assignment of receivables agreement template is key to navigating this process effectively.

Ultimately, an assignment of receivables agreement can be a powerful tool for managing cash flow and funding business growth. Understanding the agreement’s terms and carefully selecting a suitable template will empower you to secure your financial future.

By choosing the right path forward with a well-crafted agreement, your business can turn outstanding invoices into readily available capital, opening doors to new opportunities and strengthening your overall financial position.