Ever find yourself needing to tweak the terms of a loan after the ink has already dried on the original agreement? Life happens, right? Businesses evolve, personal circumstances change, and sometimes the initial loan terms just don’t quite fit anymore. That’s where an addendum to a loan agreement comes in handy. Think of it as a friendly amendment, a way to update and adjust the original document to reflect the new reality.

Essentially, an addendum allows both the lender and the borrower to formally agree on changes without having to scrap the entire loan agreement and start from scratch. It’s a more efficient and less cumbersome process. It’s a separate document that, when properly executed, becomes a legally binding part of the original loan agreement. No one wants a headache trying to deal with modifying contracts, so understanding how to correctly use an addendum can be a lifesaver.

Whether you’re adjusting the interest rate, extending the repayment schedule, adding collateral, or modifying any other aspect of the loan, an addendum is the tool to use. It ensures everyone is on the same page and protects the interests of both parties involved. Let’s dive deeper into what makes a good addendum and how you can use an addendum to loan agreement template to create one that works for you.

Understanding the Purpose and Components of an Addendum

An addendum isn’t just a scribbled note on the original loan agreement. It’s a formal document that carries legal weight. Its primary purpose is to modify or clarify certain aspects of the original agreement without invalidating the entire contract. This is crucial because loan agreements are often complex and meticulously drafted to cover a wide range of scenarios. An addendum allows for flexibility when unforeseen circumstances arise or when both parties mutually agree to a change.

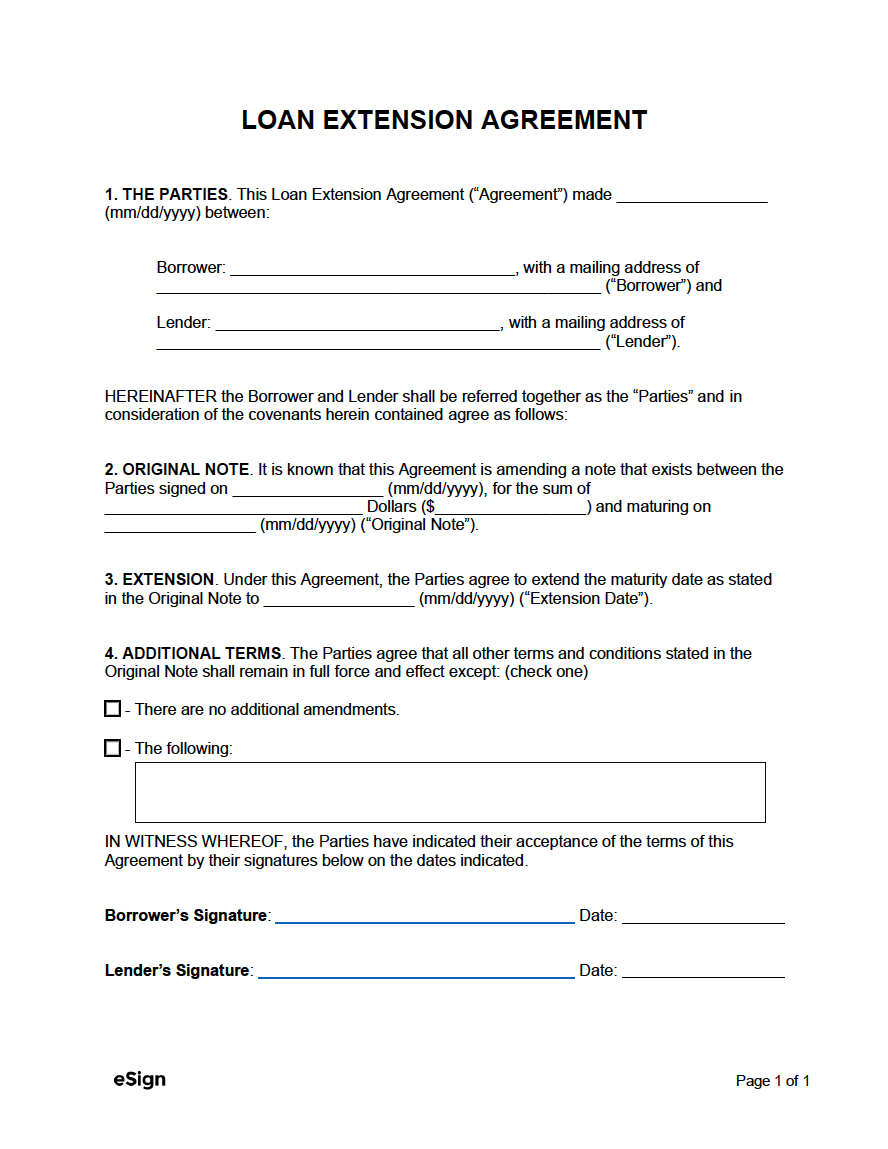

A well-drafted addendum should clearly identify the original loan agreement it’s amending. This includes the date of the original agreement, the parties involved (lender and borrower), and any specific identifying information, such as a loan number. It should then clearly state which sections of the original agreement are being modified, added to, or deleted. The language used must be unambiguous and precise to avoid any future misunderstandings or disputes. Remember clarity is key when you are dealing with legally binding documents.

Each modification should be described in detail. For example, if you’re changing the repayment schedule, the addendum should specify the new payment amount, the new due date, and any changes to the overall repayment term. If you’re adding collateral, the addendum should describe the collateral in detail, including its value and location. If you’re adjusting the interest rate, the addendum should clearly state the new interest rate and when it takes effect. The more specific and detailed you are, the better protected both parties will be.

Furthermore, the addendum should include a statement confirming that all other terms and conditions of the original loan agreement remain in full force and effect, except as specifically modified by the addendum. This ensures that the original agreement is still valid and enforceable. Both the lender and the borrower must sign and date the addendum, signifying their agreement to the changes. It’s also a good practice to have the signatures notarized, especially for significant modifications, to further strengthen the addendum’s legal standing.

Using an addendum to loan agreement template can be a great starting point, but remember to tailor it to your specific situation. Don’t just blindly fill in the blanks. Read each clause carefully and ensure it accurately reflects the agreed-upon changes. Consider seeking legal advice to ensure the addendum is properly drafted and protects your interests. Doing so can save you time, money, and potential headaches down the road.

Key Elements to Include in Your Addendum

Crafting an effective addendum involves more than just stating the changes you want to make. You need to include essential components that clearly define the modifications and ensure the addendum is legally sound. Here’s a breakdown of the key elements to incorporate:

First, always start with a clear and concise introduction. This section should explicitly state that the document is an addendum to a specific loan agreement. Include the title of the original agreement, the date it was signed, and the names of all parties involved (both lender and borrower). This introduction acts as a reference point, ensuring there’s no confusion about which agreement the addendum pertains to. This is important for everyone’s understanding.

Next, clearly identify the sections of the original loan agreement that you are amending. Be specific. Instead of saying “change the repayment terms,” state “Section 3.2 of the Loan Agreement is hereby amended to read as follows: [insert new repayment terms].” Providing exact section numbers and titles helps avoid ambiguity and makes it easy for all parties to understand exactly what’s being modified. Furthermore, when you state the amended section, make sure to write it exactly how you want it to be written. This will cause fewer headaches and the parties will understand.

Detail the specific changes you’re making. If you’re adjusting the interest rate, state the old interest rate and the new interest rate, as well as the effective date of the change. If you’re adding collateral, describe the collateral in detail, including its make, model, serial number, and appraised value. The more detailed and comprehensive you are, the less room there is for misinterpretation or disagreement. This includes but is not limited to adding extra clauses.

Include a clause confirming that all other terms and conditions of the original loan agreement remain in full force and effect, except as specifically modified by the addendum. This reinforces the fact that the addendum only changes the specified sections, and the rest of the agreement remains unchanged. Finally, be sure to include signature blocks for all parties involved (lender and borrower), as well as a date line. Both parties must sign and date the addendum for it to be legally binding.

Ultimately, a well-crafted addendum is clear, concise, and comprehensive. It leaves no room for ambiguity or misinterpretation. It protects the interests of both the lender and the borrower by ensuring that all changes are documented and agreed upon. An addendum to loan agreement template can offer a helpful framework, but remember to customize it to your specific situation and, if necessary, seek legal advice to ensure it meets your needs.

Modifying an existing agreement can seem intimidating at first. However, understanding the purpose and components of an addendum to loan agreement can make the process much smoother.

By carefully drafting an addendum that clearly outlines the changes and ensures the original agreement remains largely intact, you can effectively address evolving circumstances while maintaining a solid legal foundation.