Ever found yourself in a situation where you and another party have a disagreement about a debt? Maybe you owe someone money, but you believe the amount is incorrect, or you simply can’t afford to pay the full sum right now. Or perhaps you are the one to whom money is owed, and you’re willing to accept a lesser amount to avoid a costly and time-consuming legal battle. That’s where an accord and satisfaction agreement comes into play. It’s essentially a legally binding contract that settles a disputed claim for a lesser amount than originally owed.

Think of it as a compromise. It’s a way for both parties to walk away with some level of satisfaction, even if it’s not exactly what they initially wanted. The “accord” is the agreement to settle for less, and the “satisfaction” is the actual payment of the agreed-upon amount. Once the satisfaction is complete, the original debt is considered fully paid, and the matter is closed. This can save everyone involved a significant amount of stress, time, and legal fees.

But how do you create such an agreement? Well, you could hire a lawyer, and in some complex cases, that’s definitely the best approach. However, for simpler situations, using an accord and satisfaction agreement template can be a cost-effective and efficient solution. These templates provide a framework for drafting your own agreement, ensuring you include all the necessary elements to make it legally sound. Let’s explore the ins and outs of these templates and how they can help you navigate debt disputes.

Understanding the Components of an Accord and Satisfaction Agreement Template

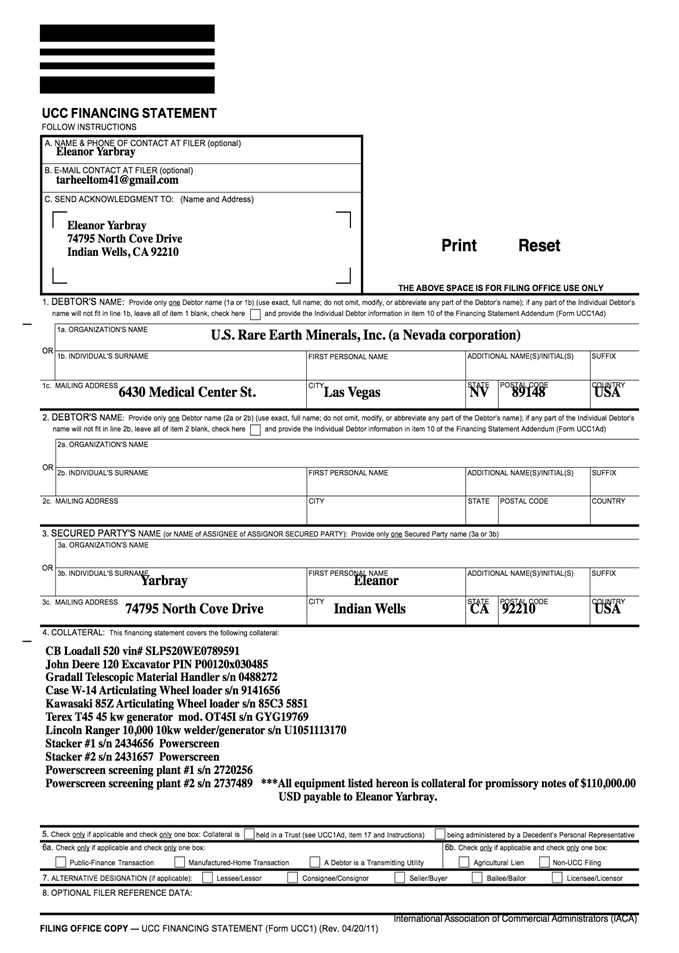

An accord and satisfaction agreement template isn’t just a fill-in-the-blank form; it’s a structured document designed to address specific legal requirements. Understanding the different components is crucial to creating an agreement that will hold up in court, should the need arise. Typically, a good template will include several key sections, each serving a distinct purpose. The first section usually identifies the parties involved – the debtor (the person owing the money) and the creditor (the person to whom the money is owed). It will clearly state their names, addresses, and contact information. Accuracy here is paramount to avoid any ambiguity later on.

Next, the template will detail the original debt. This section should clearly describe the nature of the debt, the date it was incurred, and the original amount owed. Attaching supporting documentation, such as invoices or contracts, is always a good idea. This establishes a clear baseline for the dispute. Then comes the crux of the agreement: the terms of the accord. This is where you specify the new amount that the creditor is willing to accept in full satisfaction of the original debt. The payment method (e.g., check, wire transfer) and the payment due date are also clearly stated here.

The template will also include a release of claims clause. This is a crucial element that states that once the debtor pays the agreed-upon amount, the creditor releases all claims against the debtor related to the original debt. This provides the debtor with peace of mind, knowing that they won’t be pursued for the remaining balance. Furthermore, a well-drafted template will contain a statement confirming that both parties are entering into the agreement voluntarily and with a full understanding of its terms. This helps prevent either party from later claiming they were coerced or misled.

Finally, the accord and satisfaction agreement template will have a section for signatures. Both the debtor and the creditor must sign and date the agreement in the presence of a witness, if required by your local jurisdiction. Having the signatures notarized can further strengthen the agreement’s legal validity. Remember, a template is just a starting point. You may need to modify it to fit your specific situation and to comply with the laws of your state or jurisdiction. Consulting with an attorney is always recommended, especially if the amount of the debt is significant or the situation is complex.

Using an accord and satisfaction agreement template can be a great way to resolve a debt dispute. However, it’s important to remember that such agreement is not a get-out-of-jail-free card. It is designed to address good-faith disputes where there is a genuine disagreement about the amount owed or the ability to pay. It is not intended to allow debtors to simply avoid paying legitimate debts.

Benefits and Considerations When Using an Accord and Satisfaction Agreement Template

The primary benefit of using an accord and satisfaction agreement template lies in its convenience and cost-effectiveness. Rather than paying hefty legal fees to draft an agreement from scratch, you can utilize a template to create a legally sound document that addresses the key elements of the settlement. This is particularly helpful for individuals and small businesses operating on a tight budget. A good template provides a structured framework, ensuring you don’t overlook any critical clauses or provisions. It acts as a checklist, guiding you through the essential steps of documenting the agreement.

Another advantage is clarity. A well-drafted template uses clear and concise language, minimizing the risk of misinterpretation or ambiguity. This is crucial for preventing future disputes. The template outlines the terms of the settlement in a straightforward manner, leaving no room for doubt about the obligations of each party. This promotes a sense of fairness and transparency, fostering a more amicable resolution to the debt dispute. Furthermore, templates can be easily customized to suit the specific circumstances of your situation. You can add or modify clauses to address any unique aspects of the debt or the agreement.

However, it’s important to be aware of the limitations. While templates offer a convenient starting point, they are not a substitute for legal advice. Every situation is unique, and a template may not adequately address all the nuances of your particular case. You should always review the template carefully and consider whether it fully reflects your intentions and protects your interests. If you’re unsure about any aspect of the template or its suitability for your situation, consulting with an attorney is highly recommended. They can provide tailored advice and ensure the agreement is legally sound and enforceable.

Another consideration is the other party’s willingness to negotiate. An accord and satisfaction agreement requires both parties to agree on the terms. If the creditor is unwilling to accept a lesser amount or the debtor is unable to pay the agreed-upon sum, the agreement will be ineffective. In such cases, you may need to explore alternative dispute resolution methods, such as mediation or arbitration. Also, while it is easier to use an accord and satisfaction agreement template, it is important to know that it might not be suitable in cases where debt is high. Legal help would be crucial.

In conclusion, an accord and satisfaction agreement template can be a valuable tool for resolving debt disputes efficiently and cost-effectively. By understanding the components of the template, carefully reviewing its provisions, and seeking legal advice when necessary, you can create a legally sound agreement that protects your interests and helps you move forward.

It offers a practical approach to settling disagreements and can potentially save time, money and stress for everyone involved. Just remember to use it wisely and consult with an attorney if you have any doubts or concerns about your specific situation.