So, you’re thinking about leasing commercial property? Maybe you’re a landlord looking to attract quality tenants, or perhaps you’re a business owner wanting to set up shop. Either way, you’ve probably stumbled upon the term “triple net lease,” or “NNN lease,” and are now wondering what exactly it entails. It sounds complicated, right? Don’t worry, we’re here to break it down in plain English. A big part of understanding a triple net lease involves having a solid template on hand, so let’s dive into what that looks like.

Think of a triple net lease as a commercial lease agreement where the tenant takes on significantly more responsibility than in a traditional lease. It’s not just about paying rent each month; it’s about contributing to, or directly covering, the property’s operating expenses. We’re talking property taxes, building insurance, and common area maintenance – hence the “triple” in triple net. This arrangement can be beneficial for both landlords and tenants, offering certain advantages and creating a clear distribution of responsibilities.

This article will explore the ins and outs of triple net leases, focusing on what makes them unique, who benefits most from them, and what key elements you should look for in a solid triple net lease agreement template. We’ll also touch on how to find a suitable template and what considerations you need to keep in mind before signing on the dotted line. Let’s demystify the world of NNN leases and help you navigate this important aspect of commercial real estate.

Understanding the Nuances of a Triple Net Lease

The triple net lease, as mentioned earlier, essentially shifts the burden of property-related expenses from the landlord to the tenant. It’s a common arrangement for commercial properties like retail spaces, office buildings, and industrial warehouses. But why would a landlord choose this type of lease? And why would a tenant agree to it? The answers lie in the distribution of risk and potential reward.

From a landlord’s perspective, a triple net lease offers a more predictable income stream. Since the tenant is responsible for the operating expenses, the landlord’s net income remains relatively stable, regardless of fluctuations in property taxes, insurance premiums, or maintenance costs. This makes it easier to budget and plan for the future. It’s a more hands-off approach, freeing them from day-to-day property management duties.

Tenants, on the other hand, might be drawn to a triple net lease if they value control and long-term cost savings. While they bear the responsibility for operating expenses, they also have a say in how those expenses are managed. For example, a tenant might be able to negotiate better insurance rates or implement cost-effective maintenance strategies. Furthermore, in some cases, the base rent under a triple net lease is lower than in other types of leases, making it an attractive option for businesses seeking to minimize their initial costs.

However, it’s crucial to remember that a triple net lease is a significant commitment. Before entering into such an agreement, both landlords and tenants should carefully assess their financial situations and risk tolerance. It’s also essential to have a clear understanding of the specific terms of the lease, including the exact expenses the tenant is responsible for and the procedures for handling disputes.

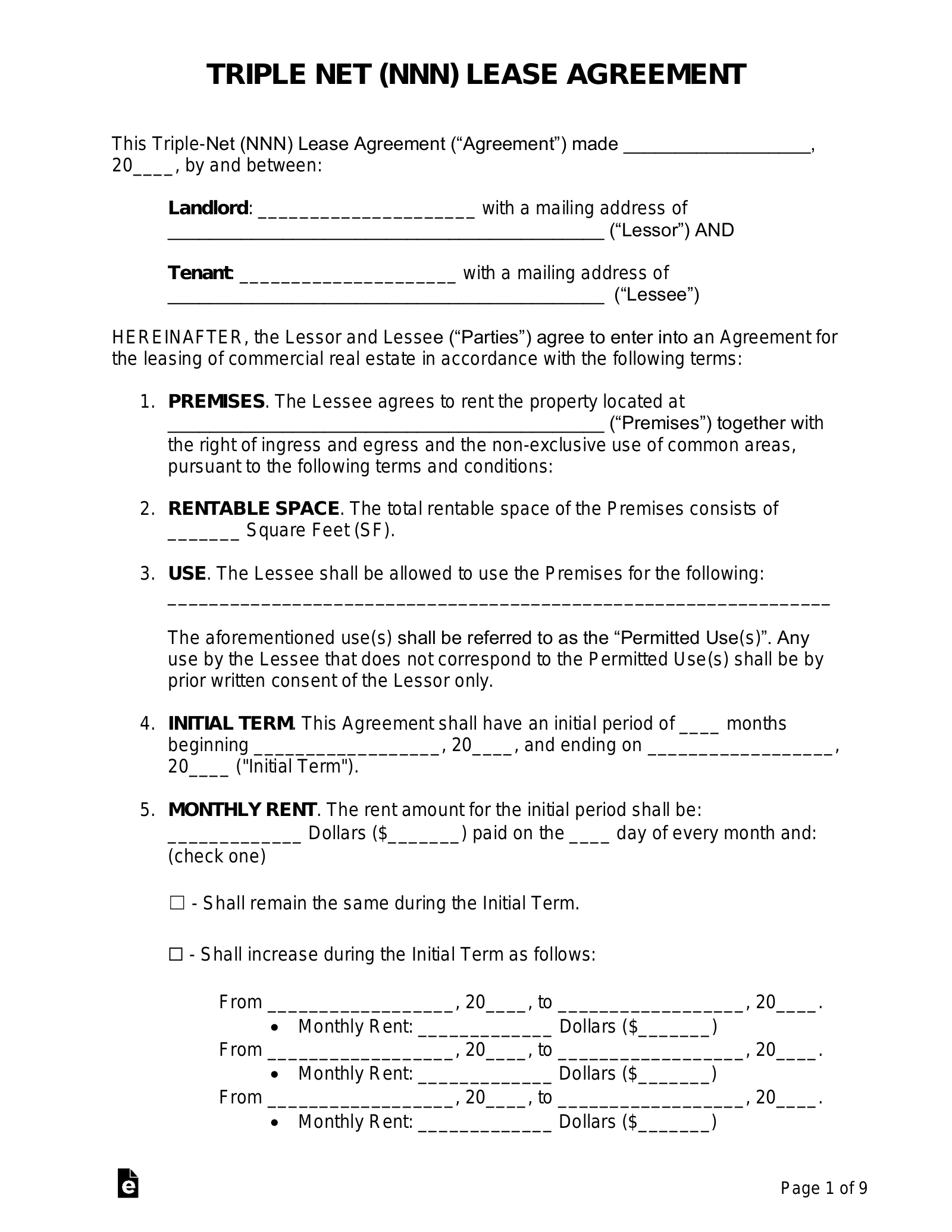

A good triple net lease agreement template will clearly outline all of these aspects, leaving no room for ambiguity. It should specify what constitutes “common area maintenance,” how property taxes will be calculated and paid, and what types of insurance coverage are required. It is advised to have qualified legal counsel review the lease agreement before its execution.

Key Elements to Look for in a Triple Net Lease Agreement Template

When searching for a triple net lease agreement template, you need to ensure it’s comprehensive and legally sound. Not all templates are created equal; some might be too generic, leaving critical details unaddressed. A well-structured template will protect the interests of both parties involved.

Firstly, the template should clearly define the property being leased, including its address and a detailed description of the premises. This avoids any confusion about which areas are covered by the lease. Secondly, the lease term should be explicitly stated, along with any renewal options and the procedures for exercising those options. A lot of issues tend to happen here. It is best to be specific.

Next, the template must outline the rent payment schedule, including the amount of base rent and the frequency of payments. It should also specify how the tenant will reimburse the landlord for operating expenses, whether through direct payment or an estimated annual payment adjusted periodically. Furthermore, the template needs to detail the specific expenses the tenant is responsible for, such as property taxes, building insurance, and common area maintenance. This section should be as clear and specific as possible, avoiding vague or ambiguous language.

Another essential element is a clear description of the tenant’s responsibilities for repairs and maintenance. The template should specify what types of repairs the tenant is responsible for, as well as the standards to which those repairs must be performed. It should also address issues such as alterations, improvements, and signage, outlining the tenant’s rights and obligations in these areas. A solid template will include clauses covering issues like subletting, assignment, and default, as well as dispute resolution mechanisms.

Finally, before using any triple net lease agreement template, it is strongly recommended that you consult with an attorney or real estate professional. They can review the template to ensure it complies with local laws and regulations and that it adequately protects your interests. They can also help you negotiate any necessary modifications to the template to better suit your specific needs.

Commercial leasing can appear complicated at first glance, but a solid understanding of how the triple net lease works, coupled with a robust triple net lease agreement template, can set you up for success. Just remember to do your due diligence and seek professional advice when needed.

Ultimately, a well-crafted triple net lease benefits both the landlord and the tenant. The landlord gains a predictable income stream and reduced management responsibilities, while the tenant gains more control over their operating expenses and potentially lower base rent. It’s all about finding the right balance and having a comprehensive agreement in place.