So, you’re diving into the world of entrepreneurship in the Lone Star State and forming a single member LLC? Congratulations! That’s a fantastic step towards protecting your personal assets and establishing a legitimate business. One of the most crucial documents you’ll need is a Texas single member LLC operating agreement template. Think of it as the rulebook for your business, even though you’re the only member. It might seem unnecessary since you’re calling all the shots, but trust me, having a well-drafted operating agreement can save you a lot of headaches down the road. It formalizes your business structure and demonstrates its separation from your personal affairs.

Why is this operating agreement so important? Well, imagine a scenario where your business gets sued. Without a solid operating agreement, a court might view your LLC as merely an extension of yourself, potentially putting your personal assets at risk. The operating agreement helps to solidify the limited liability protection that the LLC structure offers. It clearly outlines how the business is managed, how profits and losses are allocated, and what happens if you decide to dissolve the LLC. Essentially, it provides clarity and legal defensibility to your business operations.

Creating a Texas single member LLC operating agreement template doesn’t have to be intimidating. There are plenty of resources available to help you get started. You can find templates online, consult with an attorney, or use legal software to guide you through the process. The key is to ensure that the agreement accurately reflects your business operations and complies with Texas state law. A little effort upfront can save you significant time, money, and stress in the future. So, let’s delve into what this document entails and how to create one that works for you.

Why You Absolutely Need a Texas Single Member LLC Operating Agreement

Even if you’re the only member of your LLC, an operating agreement is far from optional. It’s a foundational document that establishes the legitimacy of your business and protects your personal assets. Think of it as an insurance policy against potential legal issues and misunderstandings. While not legally required in Texas for single-member LLCs, its benefits far outweigh the effort required to create one.

First and foremost, an operating agreement reinforces the separation between you and your business. This separation is what gives you limited liability protection – the core advantage of forming an LLC. By clearly outlining the structure, ownership, and operational procedures of your business, you demonstrate that your LLC is a distinct legal entity, not just an extension of yourself. This separation is crucial in case your business incurs debts or faces lawsuits. Without an operating agreement, it’s easier for creditors or plaintiffs to argue that your personal assets should be at risk.

Furthermore, a Texas single member LLC operating agreement template clarifies how the business will be managed. While you, as the sole member, will be making all the decisions, the operating agreement documents this fact. It specifies your roles, responsibilities, and decision-making authority. It can also outline how profits and losses will be allocated (typically 100% to you, the sole member), and how distributions will be made. Documenting these aspects prevents any ambiguity and strengthens the legal standing of your LLC.

Another critical function of the operating agreement is to address what happens in unforeseen circumstances. What if you become incapacitated? What if you want to sell the LLC? What if you decide to dissolve the business? The operating agreement can outline procedures for these events, ensuring a smooth transition and avoiding potential disputes. It provides a roadmap for the future of your business, even if that future involves changes or closure.

Finally, having an operating agreement can simplify certain business transactions. For example, banks often require to see an operating agreement when you apply for a business loan. The existence of a comprehensive agreement signals to lenders that you are serious about your business and have taken the necessary steps to formalize its operations. It can also be helpful when dealing with vendors, suppliers, and other business partners. It demonstrates professionalism and provides assurance that your business is properly structured and managed.

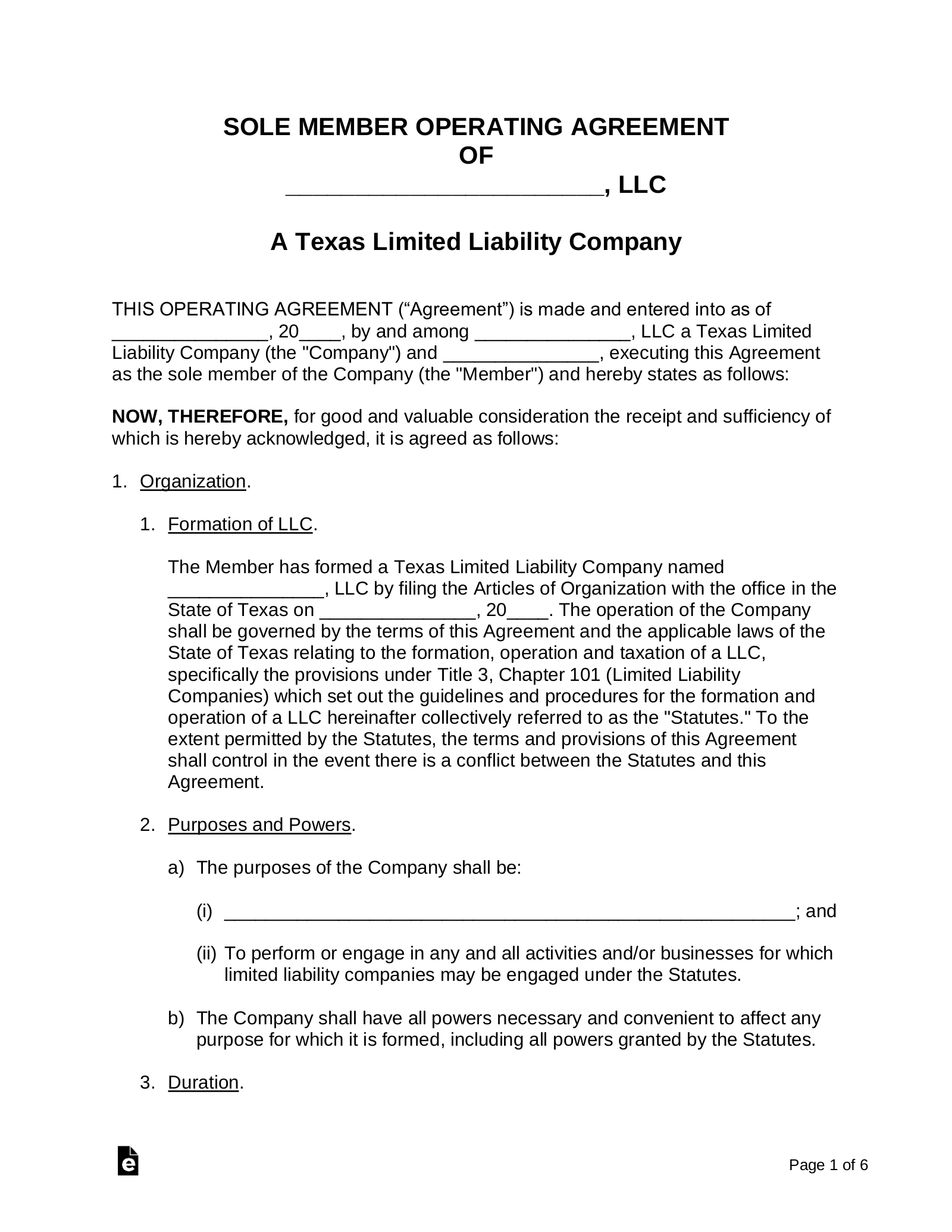

Key Elements of a Texas Single Member LLC Operating Agreement Template

Crafting a comprehensive Texas single member LLC operating agreement template requires careful consideration of several key elements. Each section plays a vital role in defining the structure, operations, and future of your business. Here’s a breakdown of the essential components:

The first section typically covers basic information about your LLC, including its name, principal place of business, and registered agent. This information is essential for identifying your business and ensuring that official notices and legal documents are properly delivered. The agreement should also state the purpose of your business – a brief description of what your LLC will do. While this can be broad, it’s important to have a clear statement of your business activities.

Next, the operating agreement should clearly define the ownership structure of your LLC. As a single member LLC, this section will specify that you are the sole member and owner of the business. It should also outline your rights and responsibilities as the sole member, including your authority to manage the business and make all decisions. The agreement should also address capital contributions, specifying any initial contributions you made to start the business.

Another crucial section deals with management and operations. This section outlines how the business will be managed and operated on a day-to-day basis. It will specify your role as the manager of the LLC, giving you the authority to make decisions on behalf of the business. It should also address issues such as banking, accounting, and record-keeping. How will financial records be maintained? Who will have access to the company’s bank accounts? These details should be clearly outlined.

The operating agreement should also include provisions for distributions of profits and losses. As the sole member, you’re typically entitled to all profits and responsible for all losses. However, the agreement should explicitly state how profits and losses will be allocated. It should also address how distributions will be made to you as the member. Will distributions be made on a regular basis, or only when the business has sufficient profits? These details should be clearly defined to avoid any misunderstandings.

Finally, the operating agreement should address dissolution procedures. What happens if you decide to dissolve the LLC? The agreement should outline the steps that will be taken to wind down the business, including paying off debts, distributing assets, and filing the necessary paperwork with the state. It should also address what happens if you become incapacitated or pass away. While it’s not pleasant to think about these scenarios, addressing them in the operating agreement can prevent confusion and ensure a smooth transition.

Creating a Texas single member LLC operating agreement template might seem like a daunting task, but it’s an essential step in establishing and protecting your business. By taking the time to craft a comprehensive and well-written agreement, you can solidify the legal foundation of your LLC and avoid potential problems down the road.

Ultimately, this document serves as a testament to your commitment to your business. Investing the time to create a solid operating agreement is a worthwhile endeavor that offers both legal protection and peace of mind, allowing you to focus on what you do best: running and growing your Texas business.