Life happens, doesn’t it? Sometimes unexpected expenses pop up, or maybe you’re just trying to manage your finances a little better. Whatever the reason, finding yourself needing a payment plan is more common than you think. And when you’re on the other side, perhaps a business owner or service provider, offering a payment plan can be a great way to retain clients and ensure you still get paid. But navigating the world of payment plans can feel a bit daunting, especially when it comes to the paperwork.

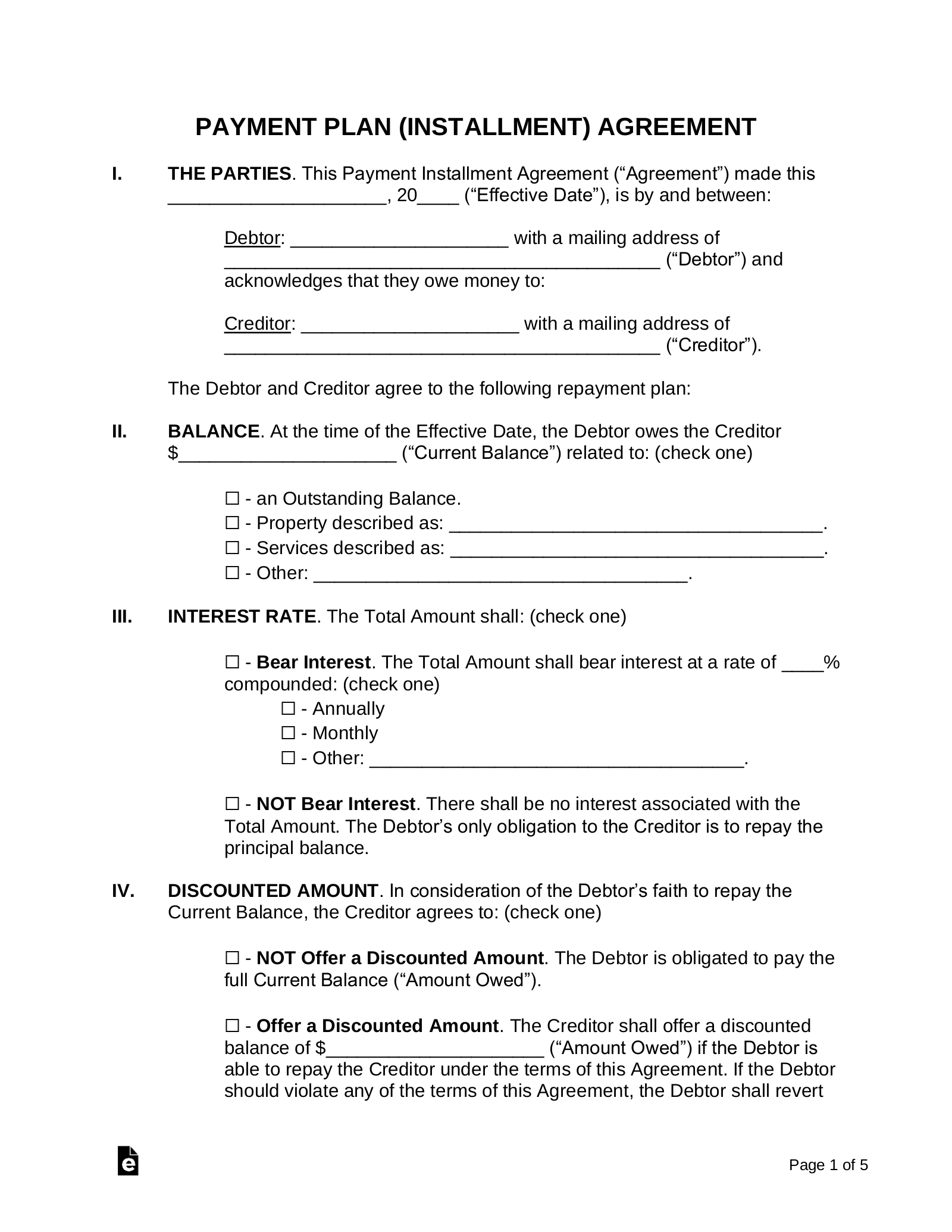

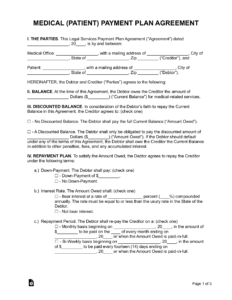

That’s where a simple payment plan agreement template comes in handy. It’s a straightforward document outlining the terms of the repayment, including the amount owed, the payment schedule, and any applicable interest or fees. Think of it as a roadmap for getting back on track, or for helping your customer navigate the payment in a smoother way.

Instead of stressing over legal jargon and complicated contracts, a well-designed template allows you to quickly and easily create a payment plan that works for both parties. It provides clarity, establishes expectations, and helps prevent misunderstandings down the road. This article will walk you through the ins and outs of using a simple payment plan agreement template and give you the confidence to create one that meets your specific needs.

Why You Need a Payment Plan Agreement Template

Think of a payment plan agreement template as a safety net for your financial arrangements. Whether you’re a freelancer, a small business owner, or even lending money to a friend, having a written agreement protects everyone involved. Without a clear agreement, things can get messy fast. Memories fade, assumptions are made, and before you know it, you’re dealing with disagreements and potentially damaged relationships.

A payment plan agreement template eliminates ambiguity by clearly defining the terms of the repayment. It specifies the total amount owed, the amount of each installment, the due dates for each payment, and any late fees or interest charges. Having all of this information in writing ensures that everyone is on the same page and understands their responsibilities. This reduces the risk of misunderstandings and disputes later on.

Furthermore, a simple payment plan agreement template can be a valuable tool for managing your finances. By tracking the payments and keeping a record of the agreement, you can stay organized and avoid missed payments. This can help you maintain a good credit score and avoid unnecessary fees. For businesses, it offers an easy to track solution for accounts receivables.

From a legal standpoint, a written agreement provides evidence of the debt and the terms of repayment. In the unfortunate event that a borrower defaults on their payments, the agreement can be used as evidence in court to support your claim. While hopefully you’ll never need it, having a legally sound document can provide peace of mind and protect your financial interests.

In short, a simple payment plan agreement template is an essential tool for anyone who is lending or borrowing money. It provides clarity, protects your financial interests, and helps you manage your finances effectively. Don’t underestimate the power of a well-drafted agreement. It can save you time, money, and a whole lot of headaches in the long run.

Key Elements of a Simple Payment Plan Agreement

Creating a useful payment plan agreement doesn’t have to be complex. There are some key elements you’ll want to include to make sure the agreement is comprehensive and clear for everyone involved. Neglecting these elements can result in misunderstandings and potential legal issues down the line.

First and foremost, you need to clearly identify the parties involved. This includes the full legal names and addresses of both the creditor (the person or entity owed the money) and the debtor (the person or entity owing the money). This seemingly simple step is crucial for establishing who is legally bound by the agreement.

Next, you need to specify the total amount owed. This is the principal amount that the debtor is obligated to repay. It’s important to be precise and avoid any ambiguity about the total debt. Also, include a breakdown of the payment schedule. Clearly state the amount of each installment, the due dates for each payment, and the method of payment (e.g., check, cash, online transfer). The more detail you provide, the less room there is for confusion.

Don’t forget to address interest and late fees. If you’re charging interest on the outstanding balance, clearly state the interest rate and how it will be calculated. Similarly, if you’re charging late fees for missed payments, specify the amount of the fee and when it will be applied. Transparency about these charges is essential for maintaining a fair and ethical agreement. Finally, it’s always a good idea to include a clause addressing what happens in the event of default. This should outline the steps the creditor can take if the debtor fails to make payments as agreed. This might include sending a demand letter, initiating legal action, or seeking mediation.

By including these key elements in your simple payment plan agreement template, you can create a document that is clear, comprehensive, and legally sound. This will protect your financial interests and help ensure a smooth and successful repayment process. A simple payment plan agreement template helps to formalize the payment arrangement, ensuring that both parties understand their obligations and rights. The more clear and well-defined the agreement is, the better protected you are against potential disagreements.

Having a payment plan in place is beneficial for both parties involved. It enables individuals facing financial difficulties to manage their debts in a structured way while providing creditors with a reasonable expectation of repayment. This kind of arrangement promotes a healthier financial ecosystem.