So, you’re thinking of starting an LLC in Virginia? Awesome! You’re taking a smart step towards protecting your personal assets and establishing a legitimate business. But before you dive headfirst into the world of entrepreneurship, there’s a crucial document you’ll need to get your hands on: an LLC operating agreement template Virginia. This isn’t just some formality; it’s the backbone of your LLC, outlining how it’s run, who’s responsible for what, and how profits and losses are divided.

Think of it like a roadmap for your business. Without it, you’re driving without directions, and things can get messy fast. What happens if a member wants to leave the LLC? How are decisions made when members disagree? An operating agreement anticipates these scenarios and provides a clear path forward, preventing potential disputes and ensuring everyone’s on the same page.

Finding a solid LLC operating agreement template Virginia is easier than you might think. There are plenty of resources available online, but it’s important to choose one that’s tailored to Virginia law and suits the specific needs of your business. This article will help guide you through the process, highlighting key considerations and pointing you in the right direction to get started. Let’s jump in!

Why You Absolutely Need an LLC Operating Agreement in Virginia

Okay, let’s be real for a second. The Commonwealth of Virginia doesn’t technically require you to have an operating agreement for your LLC. So, why bother? Well, think of it this way: just because you *can* drive without insurance doesn’t mean you *should*. An operating agreement is your insurance policy for your business relationships and internal operations. It’s a proactive step that protects you and your fellow members from future headaches. Without it, you’re essentially leaving your LLC’s fate to Virginia’s default rules, which might not align with your specific goals or intentions. These default rules may not be ideal for your specific business structure or the way you want to operate.

Imagine you and a friend decide to start a dog-walking business. You both put in equal amounts of time and effort. But what if one of you decides to take on more responsibilities later on? Without an operating agreement specifying how profits are distributed based on workload, disagreements are almost guaranteed. An operating agreement can clearly define each member’s roles, responsibilities, and how profits and losses are allocated, preventing resentment and misunderstandings down the line.

Furthermore, an operating agreement reinforces the separation between your personal assets and your business assets, which is one of the primary reasons for forming an LLC in the first place. By clearly defining the structure and operational procedures of your LLC, you strengthen the legal distinction between you and your business. This helps protect your personal savings, house, and other belongings from business debts and lawsuits.

Beyond internal operations and asset protection, an operating agreement also provides clarity for external parties, such as banks and investors. When seeking funding or opening a business bank account, these institutions will often request to see your operating agreement to understand the structure and management of your LLC. A well-drafted operating agreement demonstrates professionalism and provides confidence to those you are doing business with.

In short, while Virginia doesn’t mandate an operating agreement, it’s an invaluable tool for any LLC. It provides clarity, protects your assets, and sets the stage for a smooth and successful business venture. Think of it as an investment in the long-term health and stability of your LLC.

What Should Be Included in Your LLC Operating Agreement Template Virginia?

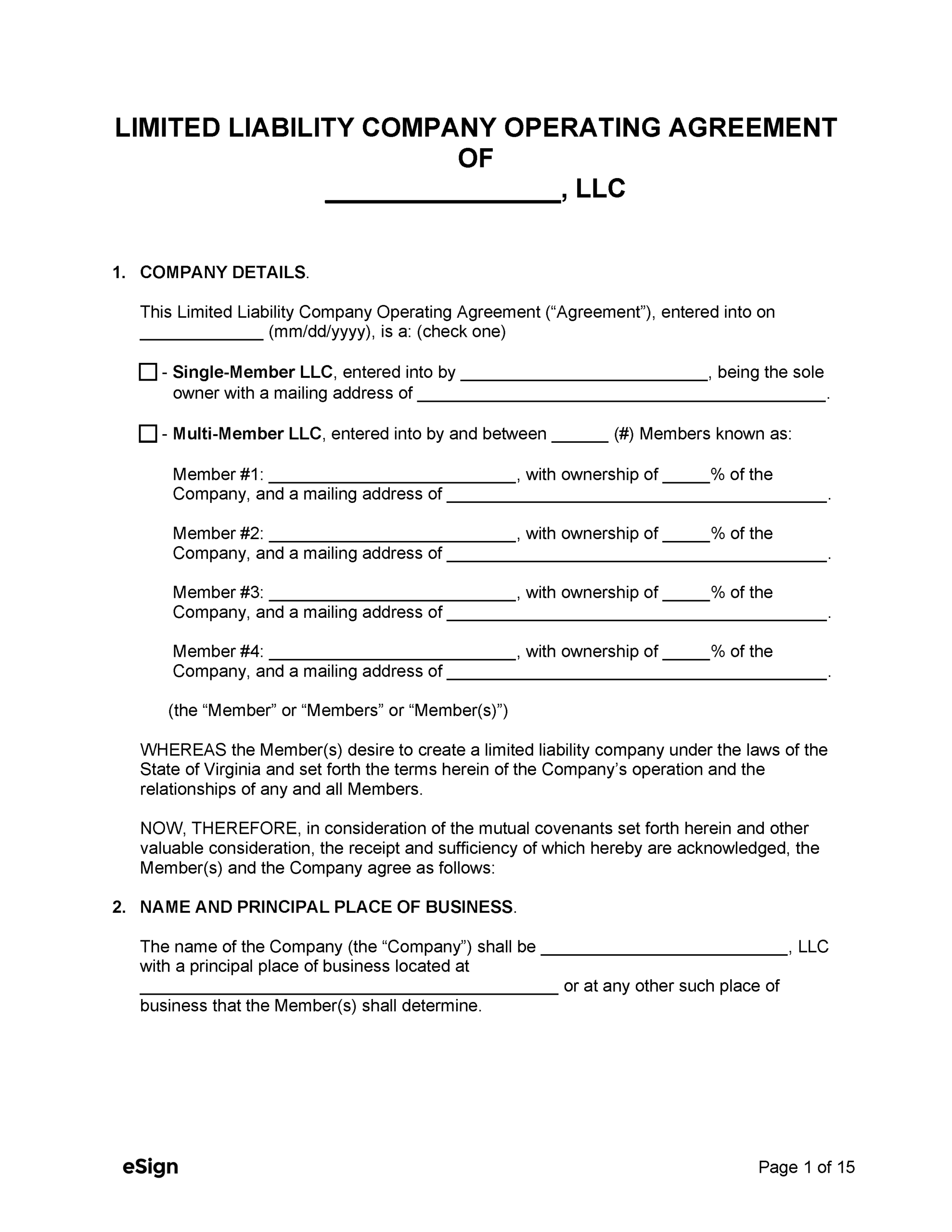

Alright, so you’re convinced you need an operating agreement. Great! Now, what exactly should it include? The specifics will vary depending on your business, but here are some essential elements to consider incorporating into your LLC operating agreement template Virginia:

Basic Information: This section covers the fundamentals of your LLC, including its name, registered agent, principal place of business, and purpose. Be sure to use the exact legal name registered with the Virginia State Corporation Commission. The registered agent is the person or entity designated to receive official legal and tax documents on behalf of the LLC.

Membership Details: This section outlines the members of the LLC, their contributions (both financial and in-kind), and their ownership percentages. It should also specify how new members can be admitted to the LLC and how existing members can transfer their ownership interests. If members will contribute different amounts of capital, the agreement should detail how this impacts ownership percentages and profit/loss allocation.

Management Structure: How will your LLC be managed? Will it be member-managed, where all members actively participate in decision-making, or manager-managed, where one or more designated managers are responsible for the day-to-day operations? Clearly define the roles and responsibilities of the members or managers, including their authority to make decisions on behalf of the LLC.

Profit and Loss Allocation: This section details how profits and losses will be divided among the members. Will it be based on ownership percentages, contributions, or some other formula? This is a crucial section to prevent disagreements and ensure fairness among the members. You may also need to address guaranteed payments to members for services provided to the LLC.

Meetings and Voting: How often will member meetings be held? What constitutes a quorum for voting purposes? What percentage of votes is required to approve major decisions, such as selling the business or taking on new debt? Establishing clear rules for meetings and voting ensures that decisions are made in a fair and transparent manner.

Dissolution: This section outlines the process for dissolving the LLC. What events will trigger dissolution? How will the assets of the LLC be distributed upon dissolution? Having a clear plan for dissolution can prevent disputes and ensure that the process is handled efficiently and legally.

Amendment Procedures: How can the operating agreement be amended in the future? Requiring unanimous consent or a supermajority vote to amend the agreement can protect the interests of all members and prevent one member from unilaterally changing the rules.

Remember, this is not an exhaustive list, and you may need to include additional provisions based on the specific needs of your business. Consulting with an attorney is always a good idea to ensure that your operating agreement is comprehensive and legally sound. Creating the operating agreement is an important step when creating your LCC operating agreement template Virginia.

Starting an LLC is an exciting venture, and creating a solid operating agreement is a key step towards building a successful and sustainable business. Take the time to carefully consider the needs of your business and consult with legal professionals as needed.

With a well-drafted LLC operating agreement template Virginia in place, you’ll be well-positioned to navigate the challenges of entrepreneurship with confidence and clarity.