So, you’re starting or already running an LLC? That’s fantastic! You’ve probably already navigated the complexities of formation, operating agreements, and the day-to-day grind. But have you thought about what happens when a member wants to leave, retires, or, unfortunately, passes away? That’s where an LLC buy-sell agreement template comes into play. It’s like a prenuptial agreement for your business partnership, outlining exactly what happens to a member’s share in various scenarios. Think of it as protecting your investment and the future of your company.

Without a solid buy-sell agreement, you could find yourself in a messy legal battle, struggling to determine the value of a member’s interest, or even stuck with an unwanted new member. No one wants that kind of headache. A well-drafted agreement provides clarity, ensures a smooth transition, and protects the remaining members from unforeseen circumstances. It allows you to plan for the future with confidence, knowing that the departure of a member won’t derail your business.

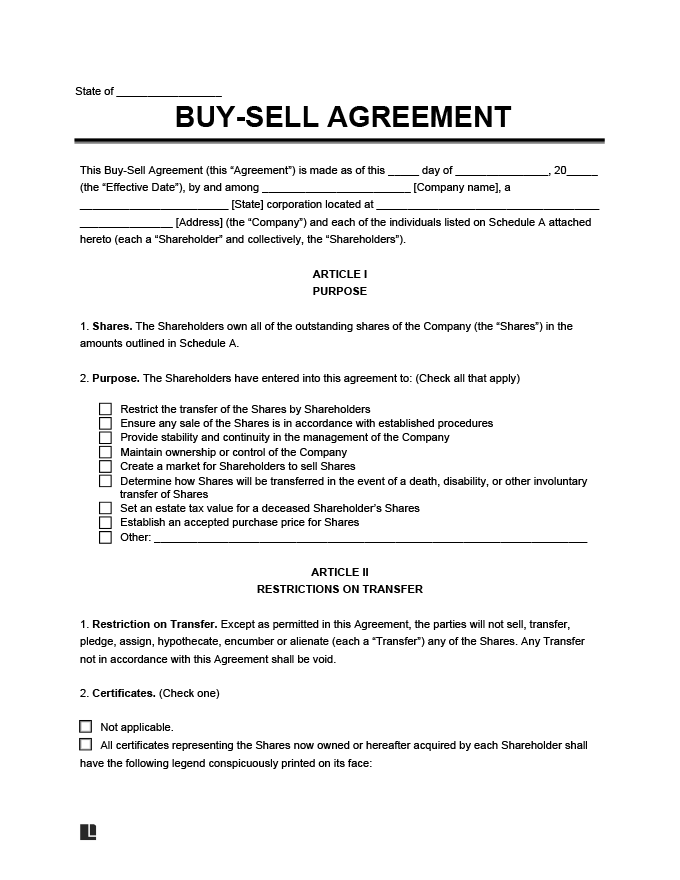

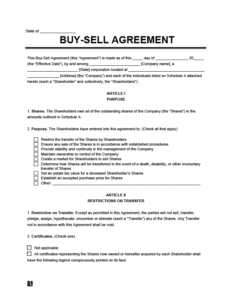

In essence, an LLC buy sell agreement template is a legally binding contract that dictates the terms and conditions under which a member’s interest in a limited liability company can be bought and sold. This helps to maintain control over who your business partners are, sets a fair price for shares, and keeps the business running smoothly even during difficult times. Let’s dive deeper into what it is and why it’s so essential for your LLC.

Why You Absolutely Need an LLC Buy Sell Agreement

Let’s be honest, nobody likes thinking about worst-case scenarios, but in business, foresight is key. An LLC buy-sell agreement isn’t just a nice-to-have document; it’s a critical component of sound business planning. Think of it as an insurance policy for your LLC, safeguarding it against potential disruptions and ensuring its long-term stability. Without it, you’re leaving your company vulnerable to a host of issues that could ultimately lead to its downfall. Imagine a scenario where a member suddenly passes away and their share is inherited by someone who doesn’t share your vision or lacks the necessary expertise. This can create significant friction and hinder your company’s growth.

One of the primary reasons to have a buy-sell agreement is to control who becomes a member of your LLC. It prevents unwanted outsiders from gaining ownership and potentially disrupting your business operations. It provides a mechanism for the remaining members to purchase the departing member’s interest, ensuring that control remains within the existing group. This is particularly important in closely held LLCs where the personal relationships and shared vision of the members are crucial to the company’s success. Imagine a new member joining who constantly disagrees with the company’s direction. A buy-sell agreement prevents this from happening.

Another crucial benefit is that it establishes a predetermined process for valuing a member’s interest. This eliminates the potential for disputes and expensive litigation when a member leaves or passes away. The agreement will outline the method for determining the fair market value of the shares, whether it’s based on a formula, appraisal, or some other mutually agreed-upon method. This clarity provides peace of mind and ensures that all parties are treated fairly. Imagine the chaos if each member has a different idea of how much shares are worth when someone departs. This document prevents this from happening.

Furthermore, a buy-sell agreement can address issues related to funding the purchase of a departing member’s interest. It can specify whether the remaining members will purchase the interest individually, or whether the LLC will redeem the shares. It can also outline the payment terms, such as whether the purchase price will be paid in a lump sum or in installments. This clarity is essential for ensuring that the transaction is financially feasible and that the remaining members have the resources to acquire the departing member’s interest. It helps you manage the financial burden of the transition.

In short, an LLC buy-sell agreement is a safety net, a blueprint, and a protection plan all rolled into one. It provides a clear framework for handling member departures, ensures fair valuation of interests, and safeguards the future of your LLC. Don’t wait until a crisis hits to realize the importance of having this critical document in place. Taking the time to create a comprehensive agreement now can save you a world of trouble down the road. Let’s not forget how it dictates the payment terms to be followed, therefore preventing future lawsuits and stress among members.

Types of Buy-Sell Agreements

There are several different types of buy-sell agreements, each with its own advantages and disadvantages. The most common types include:

- Entity Purchase (Redemption) Agreement: The LLC itself purchases the departing member’s interest.

- Cross-Purchase Agreement: The remaining members individually purchase the departing member’s interest.

- Hybrid Agreement: A combination of the entity purchase and cross-purchase approaches.

Key Components of an LLC Buy Sell Agreement Template

So, what exactly goes into creating a solid LLC buy sell agreement template? While the specific terms will vary depending on the unique circumstances of your business, there are several key components that should be included in every agreement. These elements work together to provide a comprehensive framework for handling member departures and ensuring a smooth transition. Think of these as the building blocks of your agreement, each playing a crucial role in its overall effectiveness.

First and foremost, the agreement should clearly define the triggering events that will activate the buy-sell provisions. These events typically include death, disability, retirement, resignation, bankruptcy, or divorce of a member. Specifying these events ensures that the agreement is triggered only in appropriate circumstances and prevents disputes over whether or not a buyout is required. This avoids problems of shares passing hands unwillingly. It’s like setting the parameters for when the safety net should deploy.

Next, the agreement must outline the method for valuing a member’s interest. As mentioned earlier, this is a critical component that can prevent costly disputes. Common valuation methods include fixed price, formula-based valuation (e.g., based on revenue or earnings), appraisal by a qualified third-party, or a mutually agreed-upon valuation. The agreement should also specify the date on which the valuation will be determined. A neutral third-party is usually a good option to avoid conflict of interest.

The agreement should also detail the purchase price and payment terms. This includes specifying the amount to be paid for the departing member’s interest, as well as the method of payment (e.g., lump sum, installment payments). It should also address issues such as interest rates, security for the payment, and remedies for default. The goal is to create a payment plan that is fair to both the departing member and the remaining members. This can be paid in a lump sum or in installments.

Another important aspect to consider is the right of first refusal. This provision gives the remaining members the right to purchase the departing member’s interest before it can be offered to an outside party. This helps to maintain control over who becomes a member of the LLC and prevents unwanted outsiders from gaining ownership. It’s like having the first dibs on buying back the shares.

Finally, the agreement should include provisions for dispute resolution, such as mediation or arbitration. This can help to resolve any disagreements that may arise in a more efficient and cost-effective manner than traditional litigation. A well-drafted dispute resolution clause can save you time, money, and stress in the long run. The buy-sell agreement also outlines that if all efforts to resolve disagreements fail, the case will proceed to litigation.

Crafting a buy-sell agreement isn’t a task to take lightly. Consider consulting with an attorney to ensure that your agreement is legally sound and tailored to your specific business needs.

An ounce of prevention is worth a pound of cure, and in the case of LLC buy-sell agreements, that’s definitely the truth. It’s an investment in the future stability and success of your business.