So, you’re thinking of starting a Limited Liability Partnership, or LLP, huh? That’s fantastic! It’s a great way to combine the flexibility of a partnership with the liability protection of a corporation. But before you jump in headfirst, you’re going to need something crucial: a solid Limited Liability Partnership Agreement. Think of it as the constitution for your business – it lays out the rules, responsibilities, and everything else that will keep your partnership running smoothly. Without one, you’re essentially navigating a ship without a rudder, and that’s a recipe for potential disagreements and even legal troubles down the road.

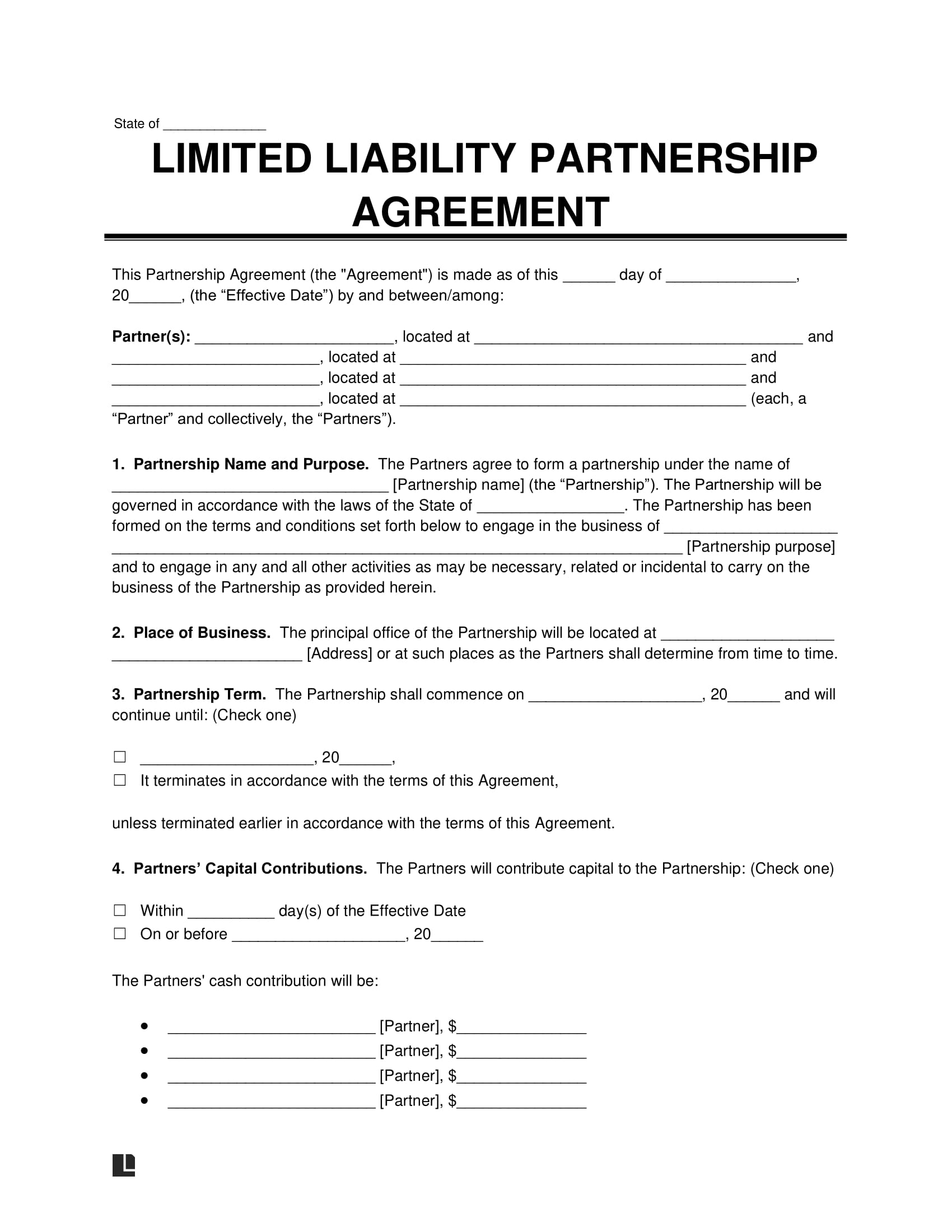

Creating a Limited Liability Partnership Agreement might sound intimidating, but it doesn’t have to be. You have options! You could hire a lawyer to draft a custom agreement tailored to your specific needs. While that’s definitely a smart move, it can also be quite expensive. That’s where a Limited Liability Partnership Agreement Template comes in handy. It provides a solid framework that you can customize to fit your particular business and partnership dynamics. It’s a cost-effective way to get started and ensure that you’re covering all the essential bases.

Finding the right Limited Liability Partnership Agreement Template is key. You want to make sure it’s comprehensive, easy to understand, and compliant with the laws of your state. After all, a poorly written or incomplete agreement can be just as bad as having no agreement at all. This article will guide you through everything you need to know about using an LLP agreement template and highlight some of the critical sections you should pay close attention to.

Why You Absolutely Need a Limited Liability Partnership Agreement

Imagine starting a business with your best friend. You’re both excited, full of ideas, and ready to take on the world. You each contribute capital, expertise, and a whole lot of sweat equity. But what happens when disagreements arise? What if one partner wants to take the business in a different direction? What if one partner decides to leave? This is where a well-drafted Limited Liability Partnership Agreement becomes invaluable. It’s the roadmap that guides your partnership through the inevitable bumps in the road and ensures that everyone is on the same page.

At its core, a Limited Liability Partnership Agreement outlines the rights, responsibilities, and obligations of each partner. It details how profits and losses will be distributed, how decisions will be made, and what happens if a partner wants to withdraw from the partnership. It also covers important issues like capital contributions, management structure, and dispute resolution. Think of it as a prenuptial agreement for your business – it may not be the most romantic document, but it can save you a lot of heartache and legal fees in the long run.

Using a Limited Liability Partnership Agreement Template can significantly simplify the process of creating this essential document. A good template will provide you with a framework that you can customize to fit your specific needs. It will also prompt you to consider important issues that you might not have thought of otherwise. However, it’s crucial to remember that a template is just a starting point. You’ll need to carefully review and modify it to ensure that it accurately reflects the terms of your partnership.

Key Components of a Solid LLP Agreement

So, what exactly should be included in your Limited Liability Partnership Agreement? Here are some of the key components to consider:

- **Name and Purpose:** Clearly state the name of the LLP and its intended business purpose.

- **Partnership Term:** Specify the duration of the partnership. Is it for a fixed term, or will it continue indefinitely?

- **Capital Contributions:** Outline the amount of capital each partner will contribute to the partnership.

- **Profit and Loss Allocation:** Detail how profits and losses will be distributed among the partners. This is often based on capital contributions or a predetermined percentage.

- **Management and Decision-Making:** Describe the management structure of the LLP and how decisions will be made. Will all partners have equal voting rights, or will some partners have more authority?

- **Withdrawal and Dissolution:** Explain the process for a partner to withdraw from the partnership and the procedures for dissolving the LLP.

- **Dispute Resolution:** Establish a method for resolving disputes among the partners, such as mediation or arbitration.

Don’t underestimate the power of a well-defined Limited Liability Partnership Agreement. It’s an investment in the future success and stability of your business.

Finding the Right Limited Liability Partnership Agreement Template

Okay, you’re convinced you need a Limited Liability Partnership Agreement. Great! Now, the next step is finding the right template. With so many options available online, it can be overwhelming to choose one that meets your specific needs. Not all templates are created equal. Some are poorly written, incomplete, or simply don’t comply with the laws of your state. Therefore, you need to do some research before settling on a particular template. Here are some tips to help you find the perfect fit.

First and foremost, consider the source of the template. Is it from a reputable legal website or a trusted business resource? Look for templates that have been reviewed by attorneys and are regularly updated to reflect changes in the law. Avoid free templates from unknown sources, as they may be outdated or contain inaccurate information. It’s also a good idea to read reviews and testimonials from other users to get an idea of the template’s quality and effectiveness.

Secondly, make sure the template covers all the essential elements of an LLP agreement. As we discussed earlier, this includes details about capital contributions, profit and loss allocation, management structure, withdrawal procedures, and dispute resolution. The template should also include provisions for amending the agreement and governing law. A comprehensive template will provide you with a solid foundation to build upon and minimize the risk of overlooking important issues.

Thirdly, consider the ease of use and customization of the template. Is it easy to understand and modify to fit your specific business needs? Does it come with clear instructions and examples? A user-friendly template will save you time and effort and help you avoid making costly mistakes. Look for templates that are available in a format that you can easily edit, such as Microsoft Word or Google Docs.

Finally, don’t be afraid to seek professional advice. Even if you’re using a template, it’s always a good idea to have an attorney review your completed agreement to ensure that it’s legally sound and protects your interests. An attorney can also help you identify any potential issues or gaps in the template and suggest modifications to better suit your unique circumstances. Investing in legal advice upfront can save you a lot of headaches and legal fees down the road.

Drafting an agreement from scratch can be a daunting and expensive task. By using a well-vetted Limited Liability Partnership Agreement Template as a starting point, you can save time, money, and energy, all while ensuring your business is built on a solid legal foundation.

Starting an LLP comes with its fair share of challenges, but it can be incredibly rewarding to work with partners towards a common goal. The right agreement can make this path much smoother.

By taking the time to customize a template, you’re essentially building a strong legal foundation for your business and creating a clear roadmap for success. It’s an investment that will pay off dividends in the long run.