So, you’re diving into the world of Illinois Series LLCs, huh? Smart move! Setting up a Series LLC in Illinois can be a fantastic way to protect your assets and streamline your business operations, especially if you’re involved in multiple ventures. One of the most crucial steps in this process is creating a solid operating agreement. Think of it as the constitution for your Series LLC, outlining how it will function and how its members will interact.

An Illinois Series LLC allows you to create separate “series” or cells within the main LLC, each with its own assets, liabilities, and members. This means that if one series incurs debt or faces a lawsuit, the assets of the other series are typically shielded. But here’s the kicker: this protection is only as strong as your operating agreement. A well-drafted operating agreement clearly defines the rights, responsibilities, and operating procedures for both the main LLC and each individual series.

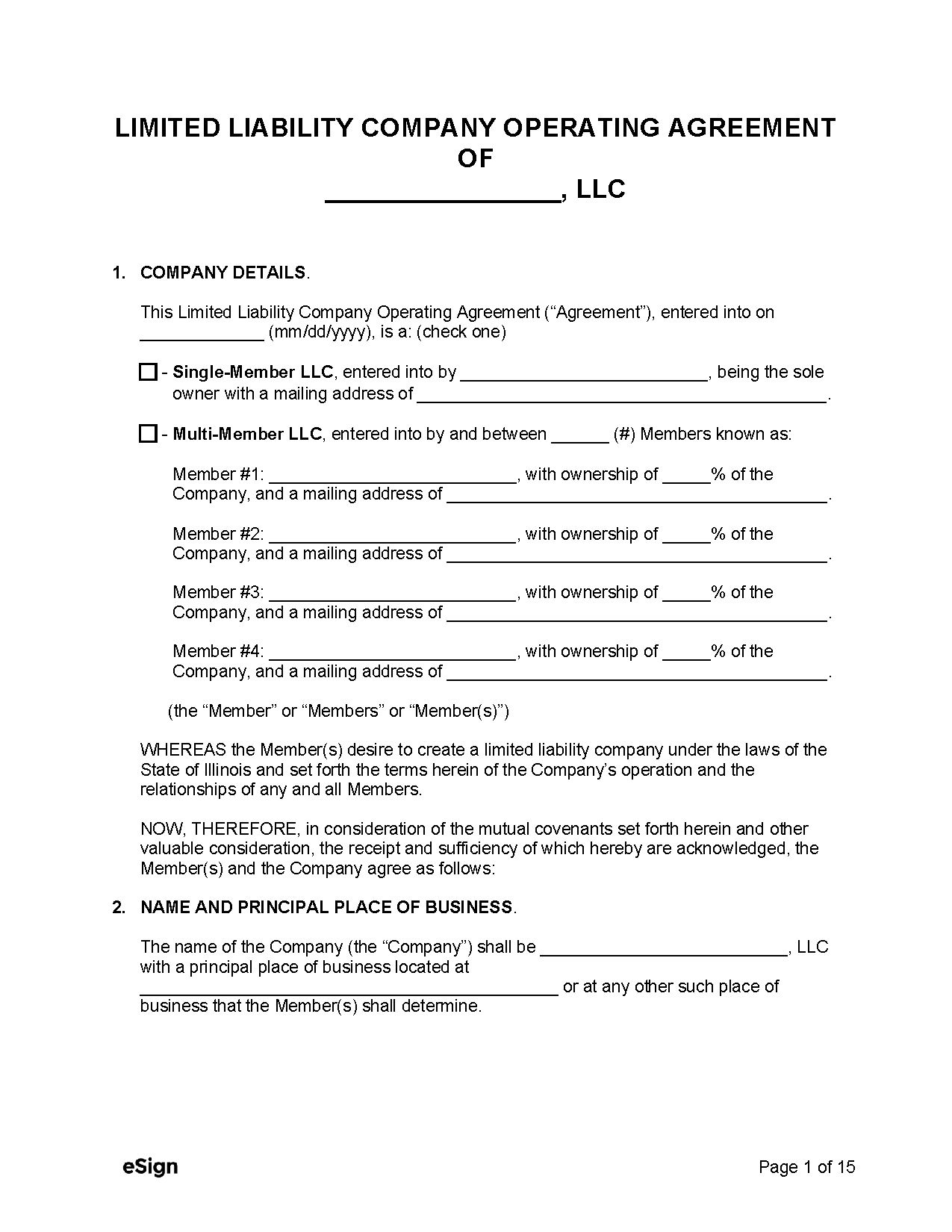

That’s where the Illinois series llc operating agreement template comes in handy. Instead of starting from scratch, you can use a template as a foundation and then customize it to fit your specific business needs. This saves you time and ensures that you cover all the essential aspects of operating your Series LLC. It’s like having a roadmap that guides you through the complexities of managing your business structure.

Why You Absolutely Need a Robust Operating Agreement for Your Illinois Series LLC

Let’s face it, legal documents can be intimidating. But trust me, putting in the effort to create a comprehensive operating agreement for your Illinois Series LLC is an investment that pays off in the long run. Think of it as building a strong foundation for your business – it provides clarity, protects your assets, and minimizes the risk of future disputes. Without a solid agreement, you’re essentially leaving your business open to potential problems down the line.

So, what exactly makes an operating agreement so important? First and foremost, it clarifies the ownership structure of your LLC. It spells out who the members are, their percentage of ownership, and their rights and responsibilities within the company. This is crucial for preventing misunderstandings and disagreements among members, especially as your business grows and evolves. Imagine trying to resolve a conflict without a clear understanding of each member’s role and authority – it could quickly become a messy situation.

Secondly, the operating agreement outlines how the LLC will be managed. Will it be member-managed, where the members directly run the business? Or will it be manager-managed, where a designated manager is responsible for day-to-day operations? The operating agreement clearly defines the management structure and specifies the powers and duties of the managers or members involved in the business’ operations.

Furthermore, a well-crafted operating agreement details the financial aspects of the LLC. This includes how profits and losses will be allocated among the members, how capital contributions will be handled, and how distributions will be made. It also covers important matters like accounting methods, bank accounts, and financial reporting. Having these financial matters clearly defined helps to ensure transparency and accountability, which is essential for maintaining trust among the members.

Finally, and perhaps most importantly for a Series LLC, the operating agreement establishes the specific procedures for creating and managing each individual series. It defines the series’ purpose, identifies its members, and outlines the process for allocating assets and liabilities to each series. This is critical for maintaining the legal separation between the series and ensuring that the assets of one series are protected from the liabilities of another. Without clear procedures in place, the “series” structure could be challenged in court, potentially jeopardizing your asset protection strategy. This is where an Illinois series llc operating agreement template can be extremely helpful, providing a solid starting point that you can customize for each series. You can see how important it is to have your Illinois series llc operating agreement template in order.

Key Components of an Illinois Series LLC Operating Agreement Template

Alright, so you’re convinced you need a strong operating agreement. But what exactly should it include? While every business is unique, there are some essential elements that should be included in every Illinois Series LLC operating agreement template. These elements provide a framework for your business operations and help to ensure that your LLC is compliant with Illinois state law.

First, you’ll need to clearly identify the name of the main LLC and its registered agent. The registered agent is the individual or entity designated to receive legal notices and other official correspondence on behalf of the LLC. You’ll also need to state the purpose of the LLC, which should be broad enough to encompass all of your business activities. This section also typically includes the principal place of business and the duration of the LLC (which is usually perpetual).

Next, the operating agreement should detail the members of the LLC, including their names, addresses, and percentage of ownership. As mentioned earlier, this section also specifies the rights, responsibilities, and voting power of each member. It’s important to clearly define the roles of each member and how decisions will be made within the LLC. This section should also address procedures for admitting new members, transferring ownership interests, and the withdrawal or expulsion of members.

The operating agreement should also outline the capital contributions of each member, including the amount and type of contribution (e.g., cash, property, services). It should also specify how additional capital contributions will be handled in the future. This is important for ensuring that the LLC has sufficient funding to operate and grow, and that the members are treated fairly in terms of their contributions.

Finally, and crucially for a Series LLC, the operating agreement needs to clearly define the process for creating and managing each individual series. This includes the name of each series, its purpose, its members (which may be the same as the main LLC or different), and the process for allocating assets and liabilities to the series. It should also specify how each series will be managed and operated. Remember, the key to a successful Series LLC is maintaining the legal separation between the series, so this section is absolutely critical. Ensure the agreement includes specific language that limits the recourse of creditors to the assets of the specific series involved in the debt or liability. This is the core protection offered by the Series LLC structure.

Keep in mind that while an Illinois series llc operating agreement template can be a great starting point, it’s always a good idea to consult with an attorney to ensure that your operating agreement is tailored to your specific business needs and complies with all applicable laws.

Navigating the intricacies of forming a Series LLC and crafting the perfect operating agreement can feel overwhelming. Remember, this document is the backbone of your business structure, so investing the time and resources to get it right is essential.

Ultimately, a well-defined operating agreement is more than just a legal document; it’s a tool that empowers you to manage your business effectively, protect your assets, and achieve your business goals with confidence.