Ever stumbled upon a situation where someone’s eagerly looking to step into your shoes and take over your existing payment obligations? Maybe you’re selling a business with ongoing contracts, or perhaps you’re transferring a lease. Whatever the reason, a well-crafted take over payments agreement is your best friend. It’s a legal safety net ensuring a smooth transition, protecting everyone involved and clearly defining who’s responsible for what. Think of it as a clear roadmap, guiding you through the process and minimizing potential headaches down the line.

Without a proper agreement, you risk leaving yourself open to potential liabilities. Imagine the person taking over the payments fails to honor them. Who’s going to be held responsible? You, most likely. That’s why having a legally sound document outlining the terms and conditions of the payment transfer is absolutely crucial. It provides a clear record of the agreement and can be used as evidence in case of disputes.

This article dives deep into the world of take over payments agreements, giving you a clear understanding of what they are, why they’re important, and how to create one that works for you. We’ll explore key clauses, things to consider, and resources to help you on your way. By the end, you’ll be well-equipped to navigate this process with confidence and ensure a seamless transfer of payment obligations.

Understanding the Importance of a Take Over Payments Agreement

A take over payments agreement acts as a legally binding contract that outlines the responsibilities and obligations of both the original party (the one transferring the payment responsibility) and the new party (the one assuming the payment responsibility). Its primary function is to clearly define who is responsible for making future payments, thereby shielding the original party from potential financial liabilities should the new party default. This is especially vital in situations involving loans, leases, contracts, or any other financial obligation that extends over a period of time.

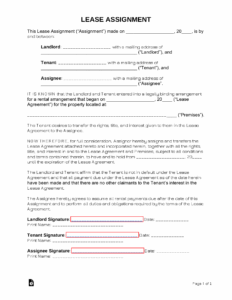

Consider this: you’re selling your business, which has a remaining lease on its premises. A potential buyer is interested and agrees to take over the lease payments. Without a take over payments agreement, you could still be liable for those lease payments if the buyer fails to pay. However, with a well-drafted agreement, you transfer that responsibility entirely to the buyer, providing you with peace of mind and protection.

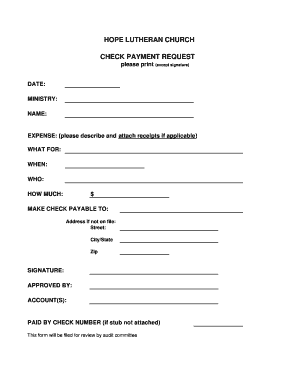

The agreement needs to be incredibly specific. It must clearly identify the original agreement (lease, loan, etc.), the parties involved (both the original and new party), the exact amount of the payments, the payment schedule, and any other relevant terms and conditions. Ambiguity can lead to disputes and legal battles, so precision is key. Also include the effective date on which the new party assumes responsibility for the payments. This is critical for establishing a clear timeline.

Moreover, a take over payments agreement typically includes clauses addressing potential breaches of contract. What happens if the new party fails to make payments on time? The agreement should outline the consequences, such as late fees, penalties, or even the termination of the agreement. Having these contingencies clearly defined helps to prevent misunderstandings and provides a roadmap for resolving any issues that may arise.

Beyond legal protection, a take over payments agreement offers clarity and transparency. It ensures that all parties are on the same page regarding the payment transfer, minimizing the potential for confusion or disagreements. This fosters a positive business relationship and contributes to a smooth and efficient transition. In essence, it is about setting expectations clearly and avoiding potential problems before they arise.

Key Clauses to Include

Essential clauses include a detailed description of the underlying debt or obligation, a clear statement of assumption by the new party, indemnification language protecting the original party, and remedies for breach of contract. Seek legal advice to tailor these clauses to your specific situation.

Crafting Your Take Over Payments Agreement Template

Creating a take over payments agreement template might seem daunting, but with careful planning and attention to detail, it can be a straightforward process. Start by clearly identifying all parties involved, including their full legal names and addresses. Next, thoroughly describe the original agreement that the payments are related to. This should include the date of the original agreement, the parties involved in the original agreement, and a detailed description of the underlying debt or obligation. The more specific you are, the less room there is for misinterpretation.

The core of the agreement lies in the assumption clause. This is where the new party explicitly agrees to take over the responsibility for making the payments. The clause should state clearly that the new party assumes all rights and obligations under the original agreement related to the payments. Be sure to specify the exact amount of the payments, the payment schedule, and the method of payment.

Another crucial element is the indemnification clause. This clause protects the original party from any liability arising from the new party’s failure to make payments. It essentially states that the new party will indemnify and hold harmless the original party from any claims, losses, or damages resulting from their breach of the agreement. This is your safety net in case things go wrong.

Consider adding a section addressing governing law and dispute resolution. Specify the jurisdiction whose laws will govern the agreement and outline the process for resolving any disputes that may arise. This could involve mediation, arbitration, or litigation. Having this in place from the outset can save time and money in the long run.

Finally, ensure that the agreement is properly signed and dated by all parties involved. It’s a good idea to have the signatures witnessed and notarized to further strengthen the agreement’s legal validity. While a take over payments agreement template can be a valuable resource, it’s always wise to consult with an attorney to ensure that the agreement is tailored to your specific circumstances and complies with all applicable laws. Using a template can get you started, but personalized legal advice is invaluable.

It’s important to remember that circumstances can change, and what seems like a straightforward agreement now might become complex later. Having everything documented provides a solid foundation for resolving any potential issues.

Taking over payments can be a win-win situation for everyone involved, providing financial relief or new opportunities.