So, you’re diving into the exciting world of real estate transactions! Whether you’re buying your dream home, selling an investment property, or navigating a complex commercial deal, one document stands paramount: the property buy sell agreement template. Think of it as the roadmap guiding you through the entire process, ensuring everyone is on the same page and protecting your interests along the way. Without it, things can quickly become confusing and costly.

This agreement, also known as a purchase agreement or sales contract, outlines the terms and conditions of the sale. It covers everything from the purchase price and closing date to contingencies and responsibilities of each party involved. In essence, it’s a legally binding contract that provides a framework for a smooth and successful property transfer. It’s not just a formality; it’s your shield against potential disputes and misunderstandings.

Finding the right property buy sell agreement template is crucial. While you can find generic templates online, it’s wise to tailor it to your specific situation and location. Laws and regulations regarding property transactions vary widely from state to state, and even from county to county. This article will explore the essential elements of a property buy sell agreement, helping you understand its purpose and ensure your agreement is comprehensive and legally sound.

Understanding the Key Components of a Property Buy Sell Agreement

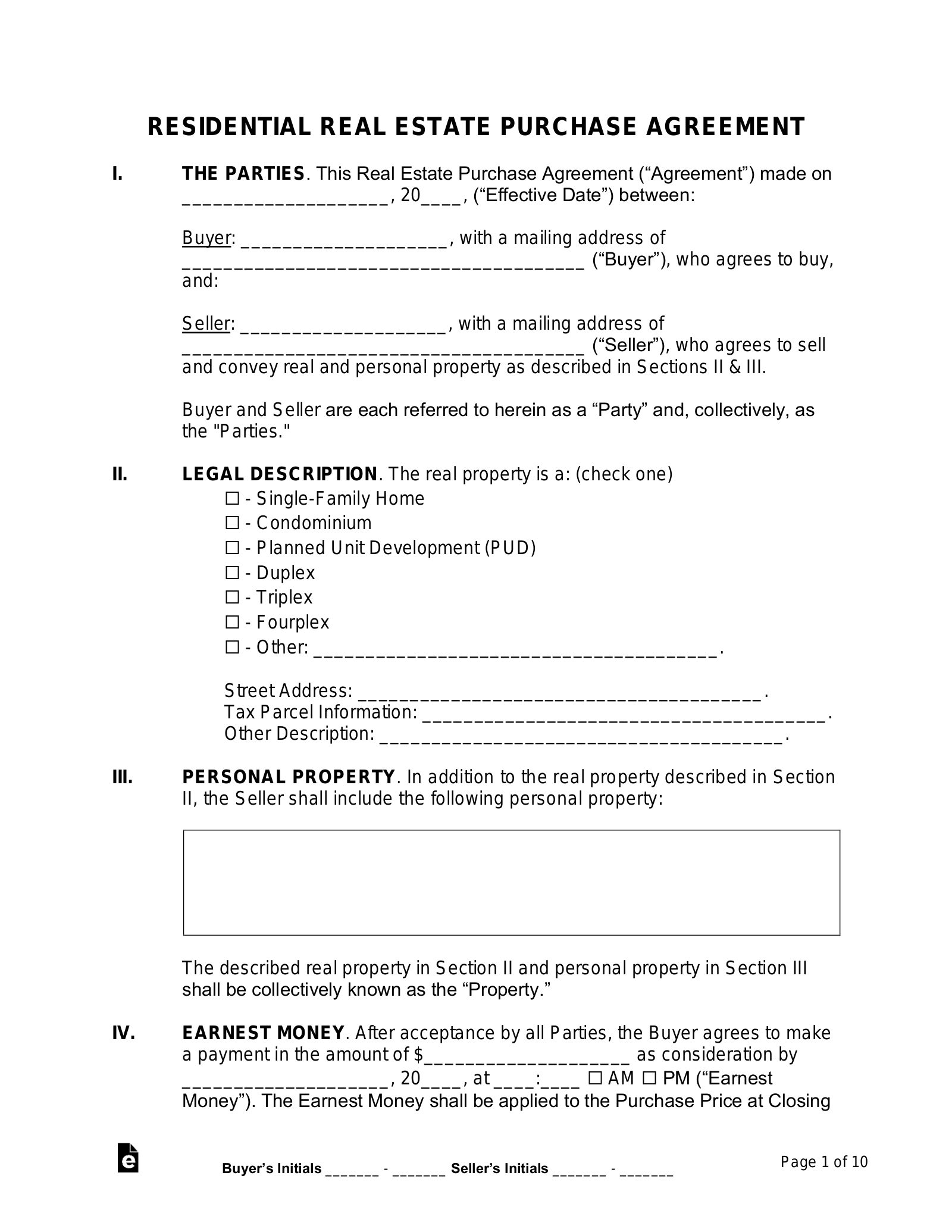

A robust property buy sell agreement isn’t just a simple form; it’s a detailed document addressing various critical aspects of the real estate transaction. Let’s break down some of the most important components you’ll likely encounter. First and foremost, you’ll find the identification of the parties involved – the buyer and the seller. This includes their full legal names and addresses, ensuring clear accountability throughout the process.

Next, a thorough description of the property is paramount. This goes beyond just the street address; it should include the legal description of the land, often found in the property deed. This ensures there’s no ambiguity about exactly what is being bought and sold. Then comes the agreed upon purchase price and the method of payment. How much is the buyer paying for the property, and what form will the payment take? This includes the initial deposit, financing details, and any seller financing arrangements.

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include a satisfactory property inspection, appraisal that meets the loan requirements, and the buyer obtaining financing. These contingencies protect the buyer by allowing them to back out of the deal if certain conditions aren’t met. Without them, a buyer could be stuck purchasing a property with significant hidden issues or be unable to secure the necessary funding.

The agreement will also specify the closing date, which is the date when ownership of the property officially transfers from the seller to the buyer. This date is crucial for planning purposes and coordinating the logistics of the move. Furthermore, it will outline which party is responsible for paying various closing costs, such as title insurance, escrow fees, and transfer taxes. Clear allocation of these costs prevents surprises and disputes later on.

Finally, the agreement should address what happens in case of a breach of contract. What remedies are available to the non-breaching party if the buyer or seller fails to fulfill their obligations? This section provides clarity and recourse in case things don’t go as planned. Carefully reviewing and understanding each of these components is essential to ensure you’re entering into a fair and legally sound agreement.

Navigating the Process: From Template to Final Agreement

So, you’ve got your property buy sell agreement template in hand, but what happens next? The first step is to meticulously review the template and ensure it covers all the necessary elements discussed earlier. Remember, a template is just a starting point, and it’s crucial to tailor it to your specific circumstances. Don’t be afraid to add or modify clauses to reflect the unique aspects of your transaction.

Once you’ve customized the template, it’s highly recommended to seek legal advice from a qualified real estate attorney. An attorney can review the agreement, identify any potential loopholes or ambiguities, and ensure it complies with all applicable laws and regulations in your jurisdiction. They can also help you negotiate the terms of the agreement with the other party, protecting your interests and ensuring a fair outcome.

Negotiation is a key part of the process. The buyer and seller may have different priorities and preferences, and it’s important to be open to compromise and find mutually acceptable terms. Common points of negotiation include the purchase price, contingencies, and closing date. Clear and open communication is essential for reaching a successful agreement.

After both parties have agreed on all the terms, the agreement should be signed and dated by both the buyer and the seller. It’s also a good idea to have the signatures notarized to provide additional legal validity. Once signed, the agreement becomes a legally binding contract, and both parties are obligated to fulfill their respective obligations.

Finally, keep a copy of the fully executed agreement for your records. This document is crucial for tracking the progress of the transaction and resolving any disputes that may arise. Remember, a well-drafted property buy sell agreement template is your best protection throughout the real estate transaction process, providing clarity, security, and peace of mind.

It’s clear that this agreement isn’t just a piece of paper; it’s the bedrock of a successful property transfer.

Ultimately, taking the time to carefully craft and understand your property buy sell agreement template will pay dividends in the long run, ensuring a smooth and stress-free experience for everyone involved.