So, you’re starting an LLC in the great state of New York, huh? Congratulations! That’s a fantastic move for protecting your personal assets and giving your business a solid foundation. But before you dive headfirst into chasing your entrepreneurial dreams, there’s a crucial document you need to get your hands on: an operating agreement. And if you’re like most people, you’re probably searching for a nys llc operating agreement template to get started. Well, you’ve come to the right place.

Think of your LLC operating agreement as the internal rulebook for your company. It outlines how your LLC will be structured, how decisions will be made, and what happens if a member leaves or if you decide to dissolve the business. While New York doesn’t legally require LLCs to have an operating agreement, it’s incredibly beneficial. It’s like having a prenuptial agreement for your business – hopefully, you’ll never need it, but you’ll be incredibly grateful you have it if things get complicated down the road.

Finding the right nys llc operating agreement template can feel overwhelming. There are tons of options online, and it’s tough to know which ones are reliable and tailored to New York law. Don’t worry, we’re here to break it down for you, explaining why you need one, what to include, and where to find a solid template to get you started on the right foot. This article is designed to provide you with everything you need to feel confident about creating a strong and legally sound operating agreement for your New York LLC.

Why You Absolutely Need an Operating Agreement (Even if NYS Doesn’t Require It)

Even though New York State doesn’t mandate an operating agreement for LLCs, operating without one is like navigating a ship without a compass. Sure, you might eventually reach your destination, but the journey will be a lot more uncertain and potentially fraught with peril. Let’s delve into the specifics of why this document is so indispensable, even if it’s not legally compulsory.

First and foremost, an operating agreement clearly defines the ownership structure of your LLC. It spells out each member’s percentage of ownership, how profits and losses will be distributed, and each member’s rights and responsibilities. Without this clarity, disputes can easily arise among members regarding who owns what and who is responsible for which tasks. Imagine trying to split profits equally when one member contributed significantly more capital or effort. The operating agreement prevents these kinds of misunderstandings by establishing clear guidelines from the outset.

Another critical function of the operating agreement is to protect your limited liability status. This is arguably the most important reason to form an LLC in the first place. By documenting that your LLC is a separate legal entity from its owners, you create a shield that protects your personal assets from business debts and lawsuits. An operating agreement helps demonstrate that your LLC is a legitimate business entity and not just an extension of yourself, reinforcing the separation between your personal and business finances. This is especially important if you are the sole member of your LLC.

Furthermore, an operating agreement allows you to customize the rules and procedures for your LLC. New York law provides default rules for LLCs, but these default rules may not be suitable for your specific business. For example, the default rules might dictate how decisions are made or how a member can transfer their ownership interest. An operating agreement lets you tailor these rules to fit your unique circumstances and the specific needs of your business. This flexibility is invaluable for ensuring that your LLC operates smoothly and efficiently.

Finally, having an operating agreement can prevent future disputes and disagreements among members. It serves as a clear reference point for resolving conflicts and making decisions. By addressing potential issues upfront in the operating agreement, you can minimize the risk of costly litigation or damaged relationships down the road. A well-drafted operating agreement can be a valuable tool for maintaining harmony and stability within your LLC.

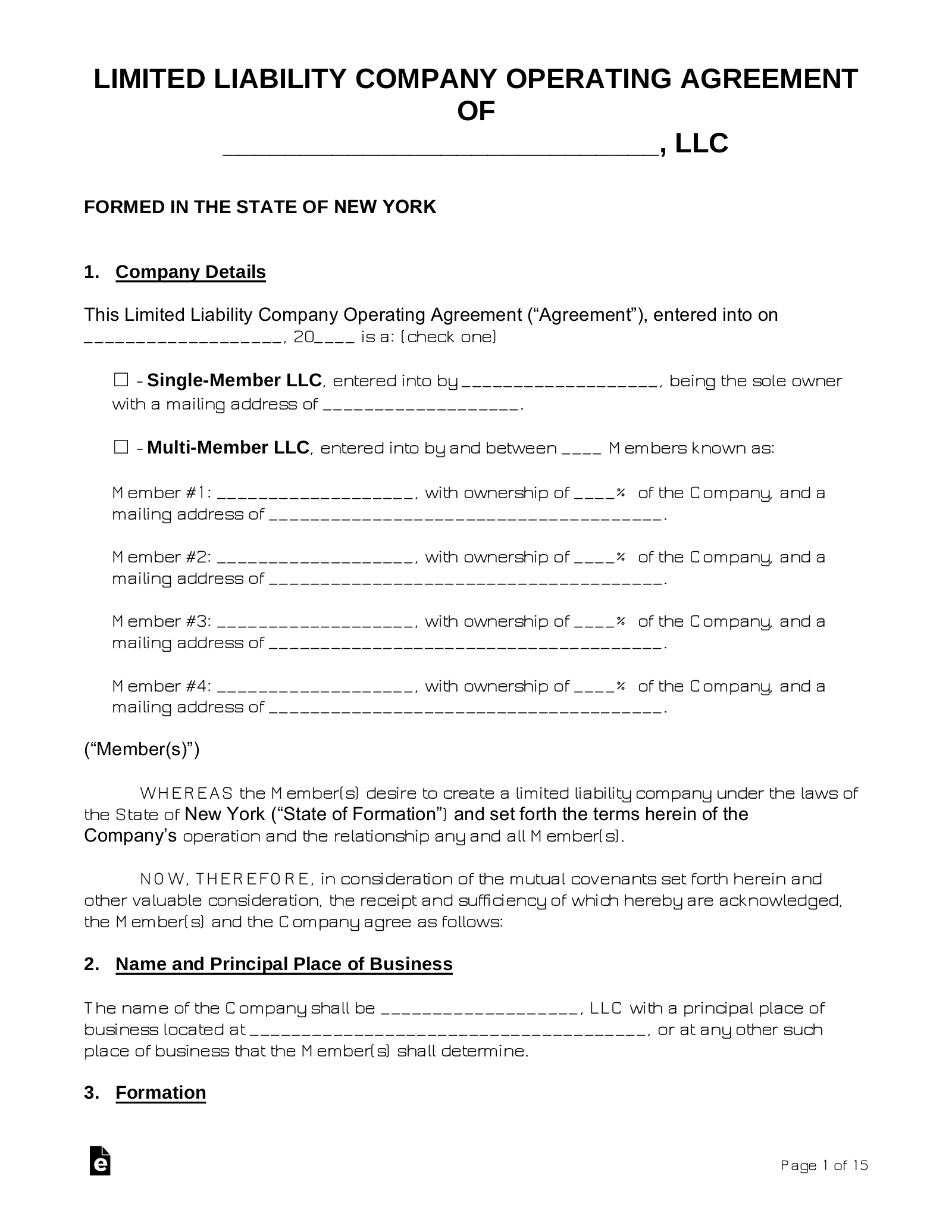

What To Include in Your Nys Llc Operating Agreement Template

Okay, so you’re convinced you need an operating agreement. Great! Now, what exactly should it include? A comprehensive operating agreement covers a range of essential topics to ensure the smooth operation and legal protection of your LLC. Here’s a breakdown of the key components you should consider incorporating into your nys llc operating agreement template:

Basic Information: This section should include the name of your LLC, its principal place of business, its purpose, and the date it was formed. It should also specify the registered agent’s name and address. This information clearly identifies your LLC and establishes its legal identity.

Membership Details: This is where you list the names and addresses of all the members of the LLC, along with their respective ownership percentages. It should also outline each member’s rights, responsibilities, and contributions to the business. Be specific and detailed to avoid any potential misunderstandings.

Management Structure: Your operating agreement needs to define how the LLC will be managed. Will it be member-managed, where all members participate in day-to-day operations, or manager-managed, where one or more designated managers make the decisions? This section should clearly outline the responsibilities and authority of each management role.

Capital Contributions: This section details the initial contributions each member has made to the LLC, whether in the form of cash, property, or services. It should also outline the process for making additional capital contributions in the future and how those contributions will affect ownership percentages.

Profit and Loss Allocation: This section specifies how profits and losses will be distributed among the members. The most common approach is to allocate profits and losses based on each member’s ownership percentage, but you can also choose a different allocation method if it better suits your business. Whatever you decide, be sure to clearly document it in the operating agreement.

Distributions: In addition to allocating profits and losses, your operating agreement should also outline how and when distributions will be made to the members. Will distributions be made on a regular basis, or only when the LLC has sufficient cash flow? This section should also address the process for making distributions and any limitations on distributions.

Membership Changes: This section outlines the process for adding or removing members from the LLC. It should address issues such as transferring ownership interests, admitting new members, and handling the departure of existing members, whether due to resignation, death, or other reasons. Having a clear process for membership changes can prevent disputes and ensure a smooth transition.

Dissolution: Finally, your operating agreement should address the process for dissolving the LLC. It should specify the events that will trigger dissolution, such as the agreement of all members or the occurrence of a specific event. It should also outline the procedures for winding up the LLC’s affairs and distributing its assets.

Creating a company requires consideration and careful planning. A comprehensive understanding of the nuances of company procedure ensures a higher likelihood of success.

Building a strong company often involves more than just registering an LLC. It involves understanding the legal requirements and the underlying business principles.