Navigating a separation or divorce is never easy. Beyond the emotional toll, there’s the often complex matter of dividing assets and debts accumulated during the relationship. Trying to figure out who gets what can quickly become a source of conflict, especially when emotions are running high. That’s where a well-crafted division of property agreement can be a lifesaver, providing a clear roadmap for a fair and equitable distribution of your shared possessions.

Think of a division of property agreement as a customized contract between you and your former partner. It outlines exactly how you’ll split everything you own together, from real estate and vehicles to bank accounts, investments, and even personal belongings. It’s a formal, legally binding document that helps avoid future disputes and provides peace of mind knowing that everyone is on the same page. This document is essential for a smoother transition as you both move forward.

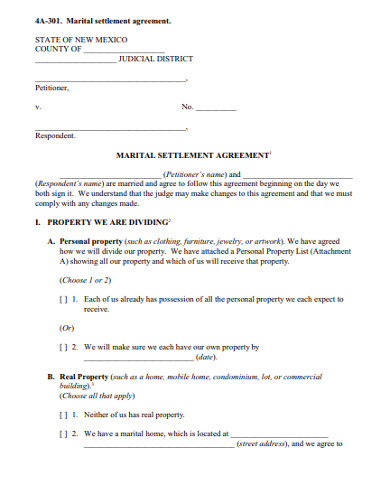

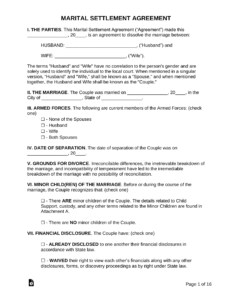

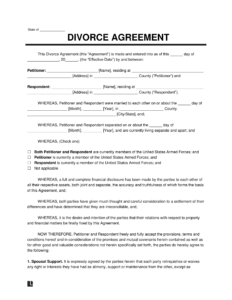

While hiring a lawyer to draft such an agreement is always a good idea, especially if you have significant assets or complex financial situations, a division of property agreement template can be a valuable starting point. It can help you understand the key elements that need to be addressed, guide your discussions with your partner, and potentially save on legal fees. Choosing the right template and understanding its limitations is key to creating a solid foundation for your agreement.

Understanding the Importance of a Division of Property Agreement

A division of property agreement, sometimes referred to as a property settlement agreement, is a legally binding contract that outlines how assets and debts will be divided between two parties who are separating or divorcing. Its core function is to provide clarity and prevent future disagreements. Without a clear agreement, the division of property can be a long, drawn-out, and expensive process, potentially involving court intervention and significant legal costs.

One of the primary benefits of using a division of property agreement template is its ability to promote a more amicable separation. By clearly outlining the terms of the property division, both parties can avoid misunderstandings and potential conflicts. This is especially important when children are involved, as a less contentious separation can create a more stable and supportive environment for them. Reaching a mutual agreement allows both individuals to maintain some control over the outcome, rather than leaving it to a judge.

Beyond simply dividing tangible assets, a comprehensive division of property agreement should also address other crucial aspects, such as the allocation of debts (credit card balances, loans, mortgages), spousal support (if applicable), and the division of retirement accounts or pensions. Ignoring these elements can lead to significant financial problems down the road. A template can serve as a checklist to ensure that all relevant factors are considered and addressed within the agreement.

It’s important to remember that a division of property agreement is not just a piece of paper; it’s a legally enforceable document. Once signed and potentially approved by a court, it becomes binding on both parties. This means that failure to comply with the terms of the agreement can have serious legal consequences. This reinforces the need to carefully review the document and, ideally, seek legal advice before signing, to ensure you fully understand its implications.

Using a division of property agreement template can be a cost-effective way to initiate the process of dividing property, but it’s crucial to approach it with caution. Templates are generic and may not fully address the specific circumstances of your situation. Think of the template as a starting point. You need to customize and tailor it to fit your needs. Seek assistance from legal professional to ensure your rights and interests are fully protected.

Key Elements to Include in Your Division of Property Agreement

Crafting an effective division of property agreement involves careful consideration of numerous factors. The goal is to create a document that is comprehensive, fair, and legally sound. While the specifics will vary depending on the individual circumstances, certain key elements should be included in every agreement.

First and foremost, the agreement should contain a complete and accurate inventory of all assets and debts owned by both parties, either individually or jointly. This includes real estate, vehicles, bank accounts, investments, retirement accounts, personal property, and outstanding loans or credit card balances. For each asset, the agreement should clearly state its value and how it will be divided (e.g., sold and proceeds split, one party retains ownership, etc.).

The agreement must explicitly outline the division of each asset and debt. This could involve one party receiving full ownership of certain assets, while the other party receives others. Alternatively, assets may be sold, and the proceeds divided according to a predetermined percentage. In the case of debts, the agreement should specify which party is responsible for paying each debt. Clarity is paramount to avoid future disputes.

In many cases, spousal support or alimony may be a relevant consideration. If one party will be paying spousal support to the other, the agreement should clearly state the amount, duration, and frequency of payments. The agreement should also address the circumstances under which spousal support may be modified or terminated. This protects both parties from future uncertainties.

The agreement should also include provisions for future contingencies. For example, if one party fails to comply with the terms of the agreement, the other party should have a clear legal recourse. Similarly, the agreement should address what happens if unforeseen circumstances arise that require modification of the terms. Including these provisions ensures that the agreement remains enforceable and adaptable to changing circumstances.

Finally, before signing a division of property agreement template, it’s highly recommended that both parties consult with independent legal counsel. An attorney can review the agreement to ensure that it is fair, legally sound, and protects your individual rights and interests. While using a template can save on initial costs, seeking legal advice is an investment that can prevent costly disputes and ensure a smoother separation process.

Looking back, having a clear plan for separating shared belongings is a kindness to yourselves and any family involved. It establishes boundaries and allows for a fresh start.

In essence, the process, while potentially difficult, is an opportunity to create a future where both individuals can thrive independently, without the weight of unresolved financial ties or lingering disputes.