So, you’re thinking about leasing a car? That’s a smart move for a lot of folks! Leasing can offer lower monthly payments than buying and lets you drive a new vehicle every few years. But before you sign on the dotted line, you need to understand the agreement. A car lease agreement is a legally binding contract between you (the lessee) and the leasing company (the lessor). It outlines all the terms and conditions of your lease, including the monthly payment, the lease term, mileage limits, and responsibilities for maintenance and repairs. Getting familiar with a sample car lease agreement template beforehand can save you headaches later on.

Think of a car lease agreement as a roadmap for your entire leasing journey. It spells out exactly what’s expected of both you and the leasing company. Ignoring or misunderstanding this document could lead to unexpected fees, penalties, or even legal issues down the road. That’s why it’s crucial to review every clause carefully, ask questions about anything you don’t understand, and even consider having a legal professional look it over. After all, a little preparation goes a long way. It’s also essential to be aware that these agreements can vary depending on the leasing company and the state you live in, making a general understanding and scrutiny of your specific document even more important.

In this article, we’ll break down the key components of a sample car lease agreement template, helping you navigate the fine print and lease your next car with confidence. We’ll look at common clauses, important considerations, and some tips to ensure you get the best possible deal. Remember, knowledge is power, and the more you understand the lease agreement, the better equipped you’ll be to make informed decisions. Let’s dive in and demystify the world of car leasing!

Understanding the Core Components of a Car Lease Agreement

A car lease agreement isn’t just a piece of paper; it’s a detailed outline of your rights and responsibilities. It’s crucial to understand what each section means before you sign anything. Let’s break down some of the most important components you’ll find in a typical sample car lease agreement template.

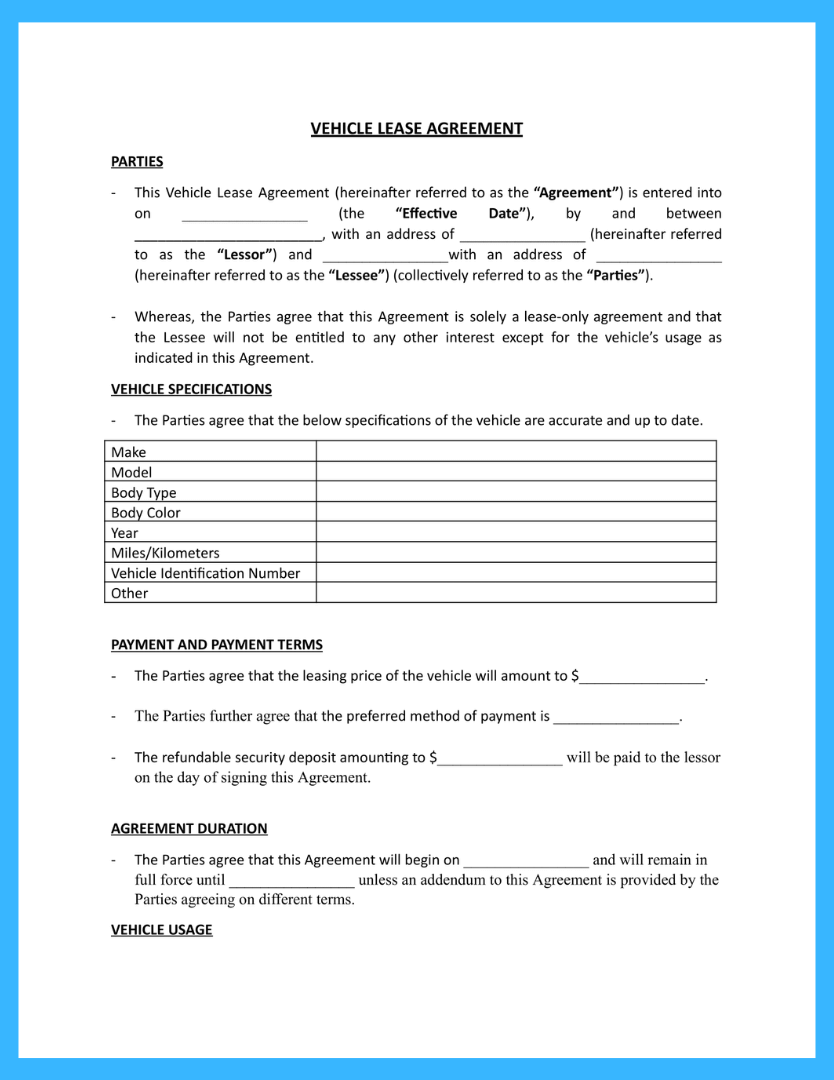

First, you’ll find information about the parties involved: the lessor (the leasing company) and the lessee (that’s you!). This section will clearly identify both parties and their contact information. Then, there’s the vehicle description. This section provides specific details about the car you’re leasing, including the make, model, year, vehicle identification number (VIN), and any optional features. Make sure all the information is accurate to avoid any disputes later on.

The heart of the agreement lies in the financial terms. This is where you’ll find the crucial details about your monthly payment, the lease term (the length of the lease, usually expressed in months), the capitalized cost (the agreed-upon value of the car), and the residual value (the estimated value of the car at the end of the lease). Pay close attention to how these numbers are calculated, as they directly impact your overall cost. Furthermore, be vigilant about the initial fees, down payment, taxes, and any other charges associated with signing the lease. It is very important to understand that the fees should be clearly listed and explained in the agreement.

Mileage limits are another critical factor. Leases typically restrict the number of miles you can drive per year. If you exceed this limit, you’ll be charged a per-mile fee, which can add up quickly. Carefully estimate your annual driving needs and choose a lease with a mileage allowance that comfortably covers your usage. It is important to factor in any long trips or unexpected driving needs that may arise. The agreement should clearly state the per-mile fee for exceeding the limit.

Finally, the agreement will address maintenance and repairs. Typically, you are responsible for routine maintenance, such as oil changes and tire rotations. The leasing company usually covers major repairs due to mechanical failures. However, you’re generally responsible for damage caused by accidents or negligence. The agreement should outline the specific responsibilities of both parties in detail. Some leases may also require you to maintain specific insurance coverage, which will also be outlined in this section.

Additional Considerations Within the Agreement

Beyond the core components, you’ll find clauses detailing what happens if you want to end the lease early. Early termination fees can be substantial, so carefully consider whether you’re comfortable with the length of the lease. The agreement will also address what happens at the end of the lease. You’ll typically have the option to return the car, purchase it at the residual value, or extend the lease. Understand your options and plan accordingly.

Tips for Reviewing a Sample Car Lease Agreement

Now that you know what to look for in a sample car lease agreement template, let’s talk about how to review it effectively. Don’t rush through the process; take your time and carefully examine each clause. Read the entire document carefully, not just the headline figures like the monthly payment. The devil is often in the details.

Ask questions about anything you don’t understand. Don’t be afraid to seek clarification from the dealer or leasing company. If they can’t or won’t provide clear answers, it’s a red flag. If you’re still unsure, consider consulting with a lawyer or financial advisor. They can help you understand the legal and financial implications of the lease agreement.

Negotiate the terms of the lease. Just like buying a car, you can often negotiate the capitalized cost, mileage allowance, and other terms. Do your research to understand the fair market value of the car and don’t be afraid to walk away if you’re not getting a good deal. Remember, the sticker price is just a starting point, not the final word.

Pay close attention to any fees or charges that are not clearly explained. Don’t be afraid to ask for a detailed breakdown of all costs associated with the lease. Hidden fees can significantly increase your overall expense. Compare lease offers from multiple dealers or leasing companies. This will help you get a better understanding of the market and identify the best deal for your needs.

Before signing, make sure all the agreed-upon terms are documented in writing. Verbal agreements are difficult to enforce. Everything should be clearly stated in the lease agreement. Finally, keep a copy of the signed lease agreement for your records. You’ll need it for reference throughout the lease term. Taking these steps will help you protect yourself and ensure a smooth leasing experience.

Leasing a car can be a great option, especially if you enjoy driving a new vehicle every few years and don’t want the hassle of ownership. But remember to do your due diligence. Take the time to understand the lease agreement thoroughly. Consider using a sample car lease agreement template to help familiarize yourself with the common terms and conditions.

Ultimately, a well-informed decision is the best decision. By understanding the ins and outs of the leasing process, you can ensure that you get a fair deal and avoid any unpleasant surprises down the road. So, go ahead, explore your leasing options with confidence!