Ever dreamed of owning a home but aren’t quite ready for a traditional mortgage? Or maybe you’re a landlord looking to offer a unique renting option? A lease to purchase agreement template could be your answer. It’s a fantastic tool that bridges the gap between renting and buying, offering flexibility and a potential path to homeownership for tenants, while providing landlords with a steady income stream and potentially a higher sale price down the line. Think of it as a test drive for homeownership, giving both parties a chance to assess compatibility before committing to a full purchase.

This agreement essentially combines a standard lease with an option to buy the property at a predetermined price within a specific timeframe. This provides the tenant with the right, but not the obligation, to purchase the property. It’s a win-win scenario when structured correctly, offering security and future potential for both the renter and the property owner. It is a legally binding agreement, so it is important to seek professional advice before entering into one.

The beauty of a lease to purchase agreement template lies in its adaptability. It can be tailored to fit various circumstances, allowing for negotiation on key aspects such as the purchase price, option fee, and rent credit. Understanding the nuances of these agreements is crucial for both tenants and landlords to ensure a fair and beneficial outcome. So, let’s dive deeper into what makes this template so powerful and how you can use it effectively.

Understanding the Components of a Lease to Purchase Agreement

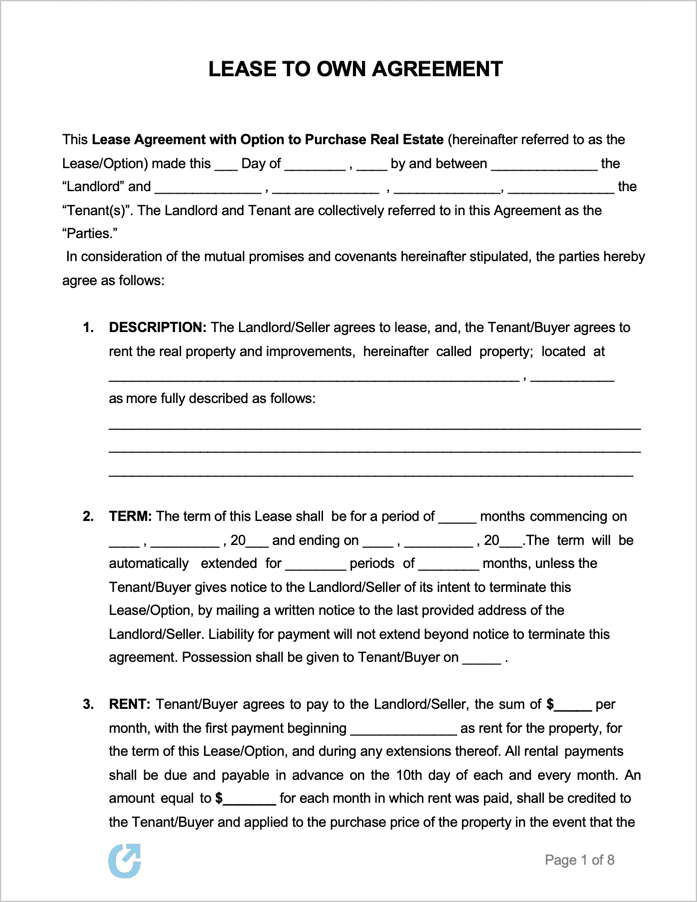

A lease to purchase agreement template is more than just a simple contract; it’s a roadmap outlining the terms of a rental agreement with a built-in option to buy. To fully grasp its significance, it’s essential to dissect its key components. These agreements typically include details about the property, the lease term, the monthly rent, the option fee, the purchase price, and how the rent will be applied toward the eventual purchase.

The lease term is the period during which the tenant rents the property. This period is crucial because it gives the tenant time to improve their financial situation, save for a down payment, and decide if the property is the right fit. The monthly rent is the amount the tenant pays to the landlord each month, just like in a standard lease agreement. However, a portion of this rent may be credited toward the purchase price, making it a significant factor in the overall agreement.

The option fee is a non-refundable fee paid by the tenant for the exclusive right to purchase the property within the specified timeframe. This fee is usually negotiated and can range from a small percentage of the purchase price to a more substantial amount. It’s important to understand that this fee is separate from the rent and is paid upfront for the option to buy.

The purchase price is the predetermined price at which the tenant can buy the property. This price is usually agreed upon at the beginning of the lease and remains fixed throughout the term. This provides the tenant with price security and protects them from potential market fluctuations. Negotiating this price carefully is essential for both parties.

Rent credit refers to the portion of the monthly rent that is credited towards the final purchase price of the home. Not all lease to purchase agreements include rent credit. If they do, this feature can significantly reduce the overall cost of purchasing the property, making it an attractive option for potential buyers. Understanding how the rent credit works is crucial for calculating the total cost of ownership.

Benefits and Considerations of Using a Lease to Purchase Agreement Template

Using a lease to purchase agreement template offers numerous advantages for both tenants and landlords, but it’s not without its considerations. For tenants, it presents a unique opportunity to potentially become homeowners, even if they don’t currently qualify for a traditional mortgage. It allows them to test drive a property before committing to a purchase, providing valuable insights into the neighborhood, the condition of the home, and their overall compatibility with the lifestyle it offers. Plus, the rent credit, if included, can contribute significantly to their down payment.

For landlords, a lease to purchase agreement can attract a wider pool of potential tenants, potentially leading to higher rental income. It also offers the possibility of selling the property at a premium price, especially if the market value increases during the lease term. Furthermore, the tenant is typically responsible for maintaining the property, reducing the landlord’s maintenance burden.

However, it’s crucial to consider the potential risks. For tenants, there’s the possibility of losing the option fee and any rent credits if they decide not to purchase the property. Additionally, if they fail to secure financing by the end of the lease term, they could lose their opportunity to buy. For landlords, there’s the risk that the tenant may not exercise their option to buy, leaving them with the responsibility of finding a new tenant. Also, legal counsel should be sought to ensure the lease to purchase agreement template is legally sound in your jurisdiction.

Navigating the legal complexities is also essential. Lease to purchase agreements can be intricate legal documents, and it’s crucial to ensure that all terms are clearly defined and legally enforceable. This includes outlining the responsibilities of both parties, specifying the consequences of default, and ensuring compliance with local laws and regulations. Seeking legal advice from a qualified real estate attorney can help mitigate potential risks and ensure a smooth transaction. A well-drafted lease to purchase agreement template can safeguard your interests and prevent future disputes.

Ultimately, a lease to purchase agreement template can be a powerful tool for both tenants and landlords, but it requires careful consideration, thorough due diligence, and a clear understanding of the terms and conditions. By weighing the benefits and risks, and seeking professional advice when needed, you can leverage this agreement to achieve your real estate goals.

Whether you’re a prospective homeowner looking for a stepping stone or a landlord seeking a unique rental strategy, the concept behind using a lease to purchase agreement template offers a flexible approach to real estate. The adaptable nature of these agreements allows for tailored solutions that can benefit both parties involved. From securing a future home to maximizing rental income, the possibilities are worth exploring.

By understanding the intricacies and seeking guidance, you can confidently navigate the world of lease to purchase agreements. Embrace the possibilities and unlock the potential that this versatile tool offers.