So, you’re thinking about diving into the world of real estate partnerships? That’s fantastic! Real estate can be a powerful wealth-building tool, and teaming up with the right partners can amplify your success. But before you start picturing yourself flipping houses or managing a sprawling apartment complex, there’s a crucial piece of paperwork you need to tackle: the partnership agreement. Think of it as the roadmap for your collaboration, ensuring everyone is on the same page and knows their roles, responsibilities, and how profits (and losses!) will be shared. It might seem daunting, but a well-crafted real estate partnership agreement template can make the process much smoother.

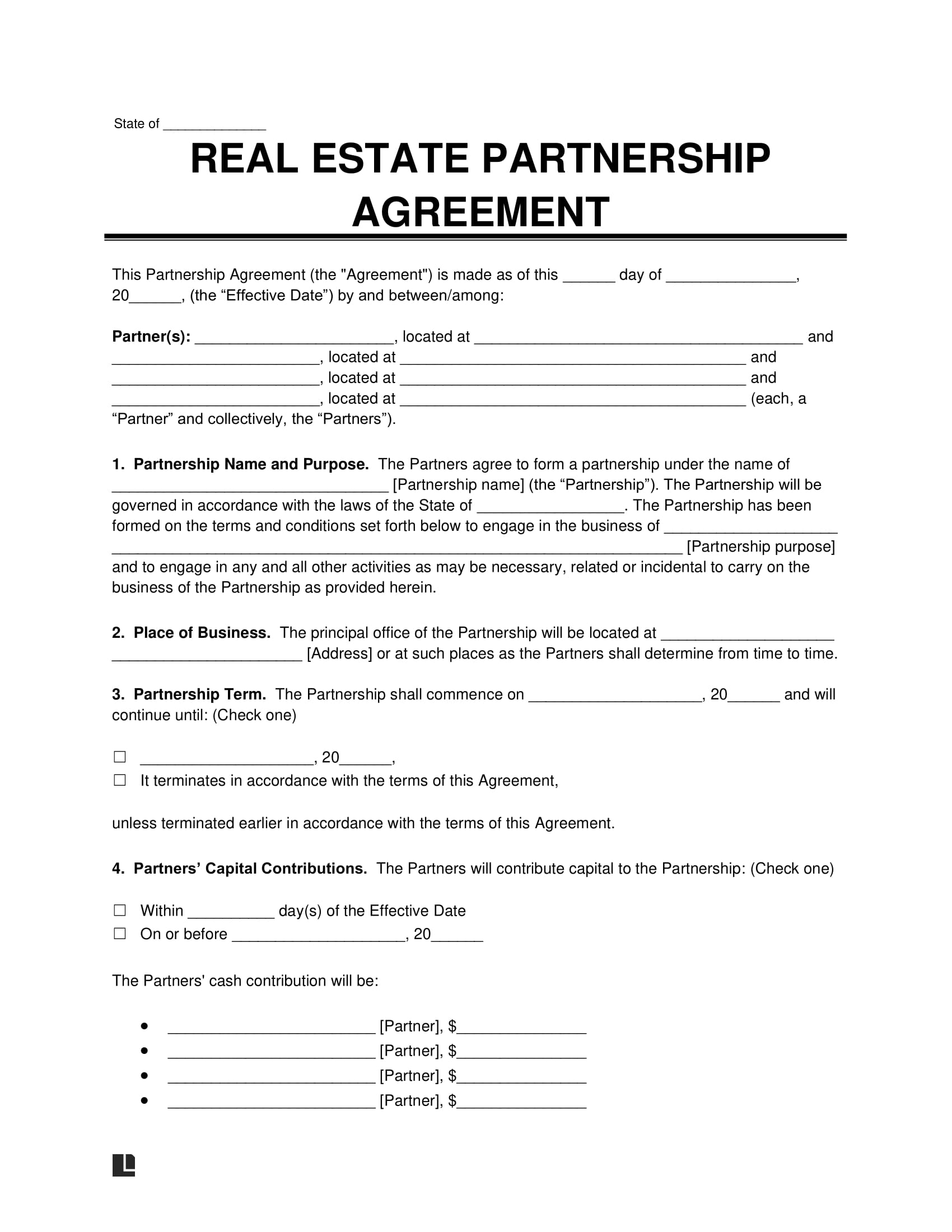

A real estate partnership agreement template isn’t just a formality; it’s the foundation upon which your business relationship is built. It outlines the specifics of your partnership, including the contributions each partner will make, the management structure, decision-making processes, and what happens if someone wants to leave or the partnership dissolves. Without a clear agreement, you’re leaving yourselves open to misunderstandings, disputes, and potentially even legal battles down the line. Trust me, a little upfront planning is worth its weight in gold (or real estate!).

This article will guide you through the key elements of a robust real estate partnership agreement template, explaining why each section is important and offering tips on how to customize it to fit your specific needs. We’ll break down the legal jargon and provide practical examples, so you can approach your partnership with confidence and peace of mind. After all, the goal is to build a successful real estate venture, not a legal headache! Think of this as your friendly guide to navigating the sometimes-complex world of real estate partnership agreements.

Key Elements of a Solid Real Estate Partnership Agreement

Crafting a comprehensive real estate partnership agreement is essential for a successful and harmonious collaboration. It’s not just about filling in the blanks on a template; it’s about carefully considering the specific details of your partnership and clearly articulating them in writing. A well-defined agreement minimizes the potential for disputes and provides a framework for resolving any issues that may arise. Let’s delve into the crucial elements that should be included in your agreement.

First and foremost, the agreement should clearly identify all partners involved, including their full legal names, addresses, and contact information. This might seem obvious, but it’s a foundational element that establishes who is party to the agreement. Furthermore, you’ll need to specify the partnership’s name, purpose, and duration. What type of real estate activities will the partnership engage in? Will it focus on residential properties, commercial buildings, or land development? How long will the partnership last? Will it have a fixed term or continue indefinitely? Answering these questions upfront will provide clarity and prevent future disagreements.

Another critical aspect is outlining the contributions of each partner. This includes not only financial contributions (initial capital investments, ongoing expenses) but also non-financial contributions such as time, expertise, and resources. Will one partner be responsible for finding properties, while another manages the finances? Will one partner contribute specialized knowledge, such as construction management or legal expertise? Clearly defining each partner’s responsibilities and contributions is crucial for maintaining fairness and accountability. The agreement should also specify how profits and losses will be allocated among the partners. Will it be based on their initial capital contributions, their time invested, or some other formula? A transparent and equitable distribution model is essential for fostering trust and ensuring that everyone feels fairly compensated for their efforts.

The agreement should also address the management structure of the partnership. Who will have the authority to make decisions? Will decisions be made by unanimous consent, majority vote, or will certain partners have specific areas of responsibility and authority? Clearly defining the decision-making process is crucial for avoiding gridlock and ensuring efficient operation of the partnership. Furthermore, the agreement should outline the procedure for handling disputes that may arise among the partners. Will you use mediation, arbitration, or litigation to resolve disagreements? Specifying a dispute resolution mechanism upfront can save time, money, and emotional distress in the event of a conflict.

Finally, the agreement should address the process for dissolution of the partnership. What happens if one partner wants to leave, becomes incapacitated, or dies? How will the partnership assets be valued and distributed? What happens to existing projects or investments? Addressing these issues upfront can prevent significant complications and ensure a smooth transition in the event of a dissolution. Remember, a well-drafted real estate partnership agreement template is not just a legal document; it’s a reflection of your commitment to open communication, mutual respect, and shared success.

Navigating the Legal and Financial Considerations

Beyond the operational aspects, a robust real estate partnership agreement template should also carefully address the legal and financial implications of the partnership. This includes defining the legal structure of the partnership, addressing liability issues, and outlining the accounting and tax treatment of the partnership.

The legal structure of the partnership is a critical consideration. Will it be a general partnership, a limited partnership, or a limited liability company (LLC)? Each structure has different implications for liability, management, and taxation. A general partnership offers simplicity but exposes all partners to personal liability for the debts and obligations of the partnership. A limited partnership provides some partners with limited liability, but it also requires a general partner who retains full liability. An LLC offers the best of both worlds, providing limited liability to all members while also offering flexibility in management and taxation. The choice of legal structure should be made in consultation with legal and financial professionals to ensure it aligns with the specific needs and goals of the partnership.

The agreement should also clearly define the liability of each partner. Who will be responsible for the debts and obligations of the partnership? Will the partners be jointly and severally liable, meaning that each partner is responsible for the entire debt, even if it was incurred by another partner? Or will their liability be limited to their capital contribution? Addressing these issues upfront can protect the personal assets of the partners in the event of a lawsuit or financial setback. Furthermore, the agreement should outline the insurance coverage that the partnership will maintain. This may include property insurance, liability insurance, and workers’ compensation insurance. Adequate insurance coverage can mitigate the risk of financial loss due to unforeseen events such as fire, theft, or accidents.

The accounting and tax treatment of the partnership is another important consideration. The agreement should specify how the partnership will maintain its financial records, prepare its tax returns, and distribute profits to the partners. Will the partnership use the cash method or the accrual method of accounting? Who will be responsible for preparing the tax returns? How will the partners handle depreciation, deductions, and other tax-related issues? Consulting with a qualified accountant or tax advisor is essential to ensure that the partnership complies with all applicable tax laws and regulations. A clear understanding of the tax implications of the partnership can help the partners minimize their tax liability and maximize their after-tax profits.

Ultimately, a well-crafted real estate partnership agreement template should provide a comprehensive framework for managing the legal and financial aspects of the partnership. It should address potential risks and liabilities, ensure compliance with applicable laws and regulations, and optimize the tax benefits of the partnership. By carefully considering these factors, the partners can create a solid foundation for a successful and sustainable real estate venture. Remember to always seek professional legal and financial advice to tailor the agreement to your specific circumstances.

Before finalizing any agreement, it’s crucial to have it reviewed by an attorney experienced in real estate and partnership law. This ensures the agreement is legally sound, protects your interests, and complies with local regulations. Treat the creation of your real estate partnership agreement template as an investment in your future success.

Starting a real estate partnership is a big step, and having the right documents in place is crucial. Utilizing a comprehensive real estate partnership agreement template is a fantastic way to set your partnership up for success from the get-go. A little preparation can save you a lot of headache down the line, allowing you to focus on growing your real estate portfolio.