Buying a car is a significant investment, and for many of us, it involves securing a car loan. Whether you’re lending money to a friend, a family member, or even selling your car privately with a payment plan, having a clear and legally sound car loan agreement is absolutely crucial. It protects both the lender and the borrower, ensuring everyone understands the terms and conditions of the loan.

Think of it like this: a car loan agreement acts as a roadmap for the entire loan process. It outlines the loan amount, the interest rate, the repayment schedule, and what happens if payments are missed. Without this agreement, you’re essentially driving without a GPS, leaving yourself vulnerable to misunderstandings and potential disputes down the road. It also provides a clear record should any legal issues arise.

Creating a comprehensive car loan agreement doesn’t have to be complicated. In fact, a simple car loan agreement template can be incredibly effective in outlining the key aspects of the loan in a clear and concise manner. In this article, we will explore the important components of a car loan agreement and why utilizing a template can save you time, money, and a whole lot of headaches.

Why You Need a Car Loan Agreement

Imagine lending a significant amount of money to someone without any written record of the agreement. Sounds risky, right? That’s exactly what you’re doing when you skip the car loan agreement. This document serves as a legally binding contract, outlining the rights and responsibilities of both the lender and the borrower. It provides a clear framework for the entire loan process and helps to prevent misunderstandings or disputes down the line.

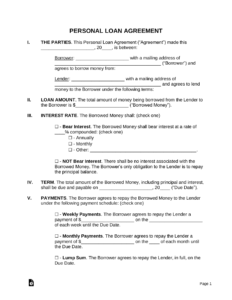

One of the most important benefits of a car loan agreement is that it clearly defines the terms of the loan. This includes the principal amount borrowed, the interest rate charged, the repayment schedule (frequency and amount of payments), and the loan term. Having these details explicitly stated ensures that both parties are on the same page and understand their financial obligations.

Furthermore, the agreement should address potential consequences of failing to adhere to the agreed-upon terms. For instance, what happens if the borrower misses a payment? Are there late fees involved? At what point does the lender have the right to repossess the vehicle? Addressing these scenarios proactively can prevent unpleasant surprises and legal battles later on.

From a legal standpoint, a well-drafted car loan agreement provides evidence of the debt and the terms under which it was issued. This is crucial if you ever need to take legal action to recover the outstanding loan amount. Without a written agreement, proving the existence of the loan and its specific terms can be incredibly difficult.

So, while a handshake agreement might seem sufficient when dealing with friends or family, it’s simply not worth the risk when it comes to a financial transaction as significant as a car loan. Utilizing a simple car loan agreement template ensures that both parties are protected and that the loan is handled in a professional and transparent manner.

Key Components of a Simple Car Loan Agreement Template

A comprehensive car loan agreement template should include several essential components to ensure clarity and legal soundness. Let’s break down some of the key elements you should consider incorporating into your agreement.

First and foremost, you’ll need to clearly identify the parties involved. This includes the full legal names, addresses, and contact information of both the lender and the borrower. This information ensures there’s no confusion about who is responsible for what.

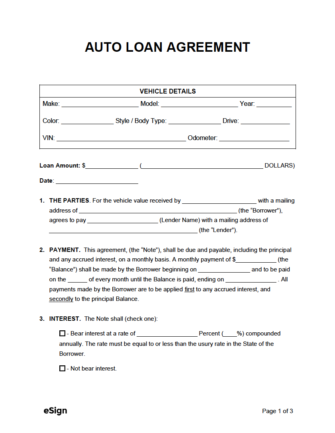

Next, you’ll need to specify the details of the car being financed. This should include the vehicle’s make, model, year, Vehicle Identification Number (VIN), and mileage. This information is crucial for identifying the specific asset securing the loan.

The financial terms of the loan are, of course, a critical component of the agreement. This section should clearly state the principal loan amount, the interest rate (expressed as an annual percentage rate or APR), the repayment schedule (frequency and amount of payments), the loan term (the length of time the borrower has to repay the loan), and any late payment fees or penalties.

The agreement should also outline the consequences of default, which refers to the borrower’s failure to make payments as agreed. This section should specify the lender’s rights in the event of default, which may include repossessing the vehicle and pursuing legal action to recover the outstanding debt. It’s also prudent to include clauses regarding insurance coverage and maintenance responsibilities for the vehicle.

Finally, the agreement should include a section outlining the governing law (the state or jurisdiction whose laws will govern the agreement) and a provision for dispute resolution (such as mediation or arbitration). Both the lender and the borrower should sign and date the agreement, and it’s always recommended to have it notarized for added legal validity.

Using a simple car loan agreement template can make the process much easier by providing a pre-formatted document that includes all of these essential components. Remember to carefully review and customize the template to fit your specific situation, and consider seeking legal advice if you have any questions or concerns.

Having a car loan agreement protects all parties involved. Using a template as a guide can simplify the process considerably.

Putting everything in writing ensures that the relationship between the lender and borrower remains positive. Clarity is key when dealing with financial matters.