So, you’re selling your car privately? That’s fantastic! You’re probably hoping to get a better price than trading it in, and you’re right, you often can. But selling a car privately also means handling the paperwork, and more importantly, making sure you get paid. That’s where a solid private vehicle payment agreement template comes in. It’s your safety net, your peace of mind, and your legal protection all rolled into one handy document.

Think of it this way: you wouldn’t hand over the keys to your house without a legally binding sales agreement, would you? Your car, for many of us, is a significant asset. A comprehensive payment agreement lays out the terms of the sale, including the agreed-upon price, the payment schedule (if applicable), and what happens if things go south. It protects both you, the seller, and the buyer.

This article will walk you through why using a private vehicle payment agreement template is essential, what it should include, and how it helps ensure a smooth and secure transaction. We’ll also discuss some common pitfalls to avoid and offer tips for completing the agreement correctly. Let’s get started!

Why You Absolutely Need a Private Vehicle Payment Agreement

Let’s face it: buying or selling anything privately can feel a little risky. You’re dealing directly with another individual, not a big corporation with layers of legal protection. That’s why having a clearly written and legally sound agreement is so important. It sets expectations, clarifies responsibilities, and provides recourse if either party doesn’t hold up their end of the deal. Without a proper payment agreement, you’re essentially relying on a handshake and a prayer. While a handshake is nice, it doesn’t hold up in court.

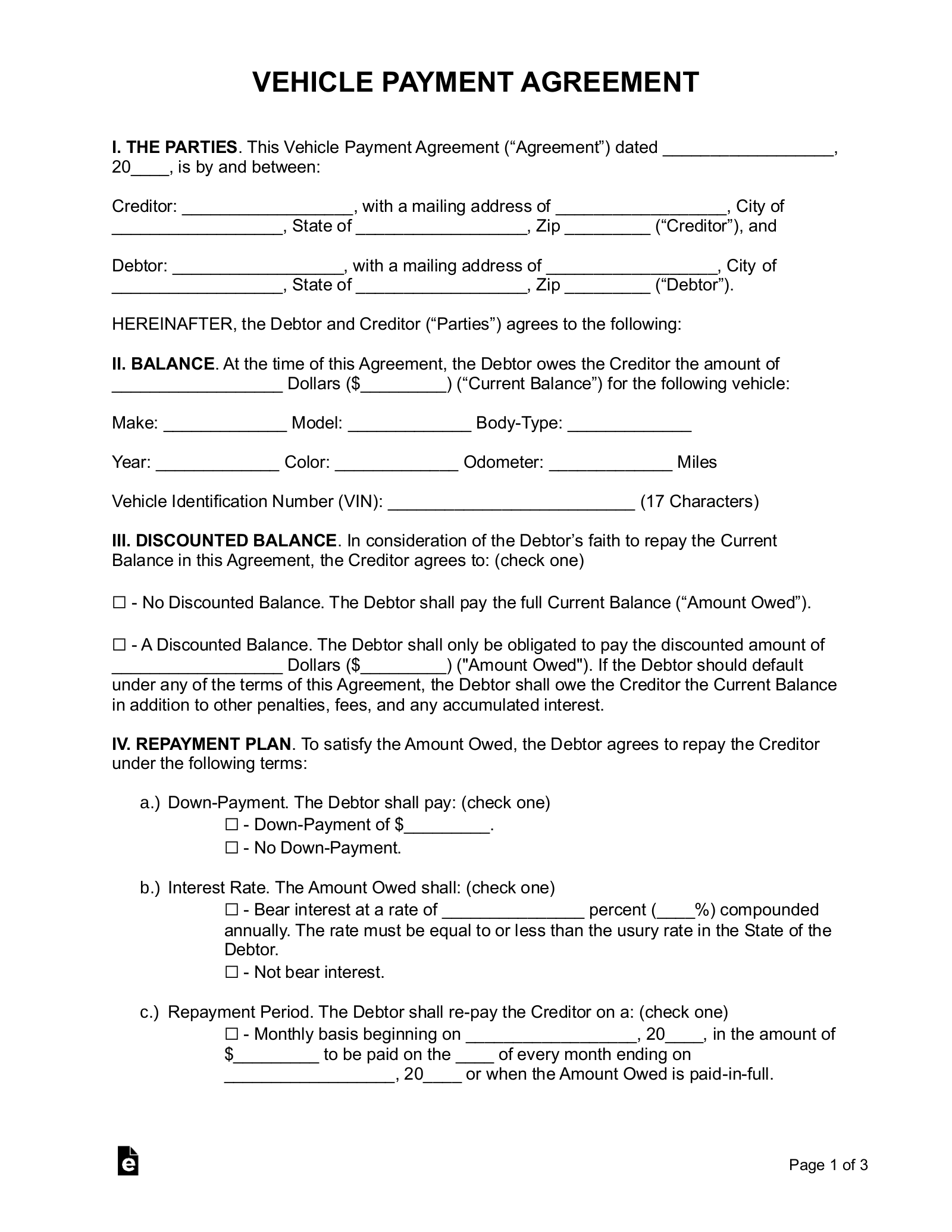

A solid agreement clearly outlines the vehicle’s details, including the make, model, year, VIN (Vehicle Identification Number), and odometer reading. This prevents any future disputes about the car’s identity or condition. It also specifies the total purchase price and how that price will be paid. Will it be a lump sum? Will there be installments? If so, what are the dates and amounts of each payment? This level of detail leaves no room for ambiguity. Think of it as preventative medicine for potential headaches down the road.

Beyond just the payment schedule, a private vehicle payment agreement template also covers what happens if the buyer defaults on their payments. What are the penalties? Does the seller have the right to repossess the vehicle? These are crucial questions to address upfront. Having these clauses written down ensures that both parties understand the consequences of non-payment and provides a clear path forward if things don’t go as planned.

Furthermore, a good payment agreement addresses the transfer of ownership. It clarifies when the title will be transferred to the buyer. This is particularly important in installment payment scenarios. Will the title be transferred immediately, or only after the final payment is made? This detail needs to be clearly stated to avoid confusion and potential legal issues.

Finally, a properly executed private vehicle payment agreement template serves as crucial documentation for both the seller and the buyer. It provides a clear record of the transaction, which can be helpful for tax purposes, insurance claims, or any future disputes that may arise. Keeping a copy of the signed agreement is essential for protecting your interests. Think of it as your receipt and your insurance policy all in one!

Key Elements of a Comprehensive Payment Agreement

So, what exactly should be included in a stellar private vehicle payment agreement template? Let’s break it down into its essential components. First and foremost, you’ll need to include the full legal names and addresses of both the seller and the buyer. This seems obvious, but it’s crucial for identifying the parties involved and ensuring the agreement is legally binding.

Next comes the vehicle details. As mentioned earlier, this section should be as specific as possible. Include the make, model, year, VIN, odometer reading, and any other relevant information that identifies the vehicle. It’s also a good idea to include a brief description of the vehicle’s condition. This can help prevent disputes about pre-existing damage.

The payment terms are, of course, the heart of the agreement. Clearly state the total purchase price, the amount of any down payment, and the payment schedule if installments are involved. Include the dates and amounts of each payment, as well as the acceptable methods of payment (e.g., cash, certified check, electronic transfer). Also, specify what happens if a payment is late or missed. Will there be late fees? Will the seller have the right to repossess the vehicle?

The agreement should also address the transfer of ownership. Clearly state when the title will be transferred to the buyer. If the title is not transferred until the final payment is made, this needs to be explicitly stated. You may also want to include a clause that outlines the buyer’s responsibility to register the vehicle and obtain insurance.

Finally, include a section for signatures. Both the seller and the buyer should sign and date the agreement. It’s also a good idea to have the signatures notarized. While notarization isn’t always required, it adds an extra layer of legal protection and can make the agreement more difficult to challenge in court. This step provides additional validity to the document.

Navigating the world of private car sales can seem daunting, but remember, you’re not alone. There are numerous resources available to help you create a solid agreement and protect your interests. Remember to thoroughly read and understand the agreement before signing it, and don’t hesitate to seek legal advice if you have any questions or concerns.

Ultimately, taking the time to create and execute a comprehensive payment agreement is an investment in your peace of mind. It ensures a fair and transparent transaction, protects you from potential legal issues, and helps you enjoy the satisfaction of a successful private car sale.