So, you’re looking into creating a stock buy sell agreement? Smart move! Whether you’re a seasoned entrepreneur or just starting a business with partners, having a clear agreement in place for when someone wants to exit the company is absolutely crucial. It can save you a ton of headaches, legal battles, and even preserve friendships down the line. Think of it as a prenuptial agreement for your business – nobody *wants* to think about the bad stuff, but being prepared is just good business.

This agreement essentially dictates what happens to the shares of a business owner should they decide to leave, retire, pass away, or become disabled. It spells out who can buy the shares, at what price, and under what terms. Without it, you could end up with unwanted shareholders (think ex-spouses or estranged family members), valuation disputes, and a whole lot of uncertainty surrounding the future of your company. In short, it’s a protective shield for the business and its remaining owners.

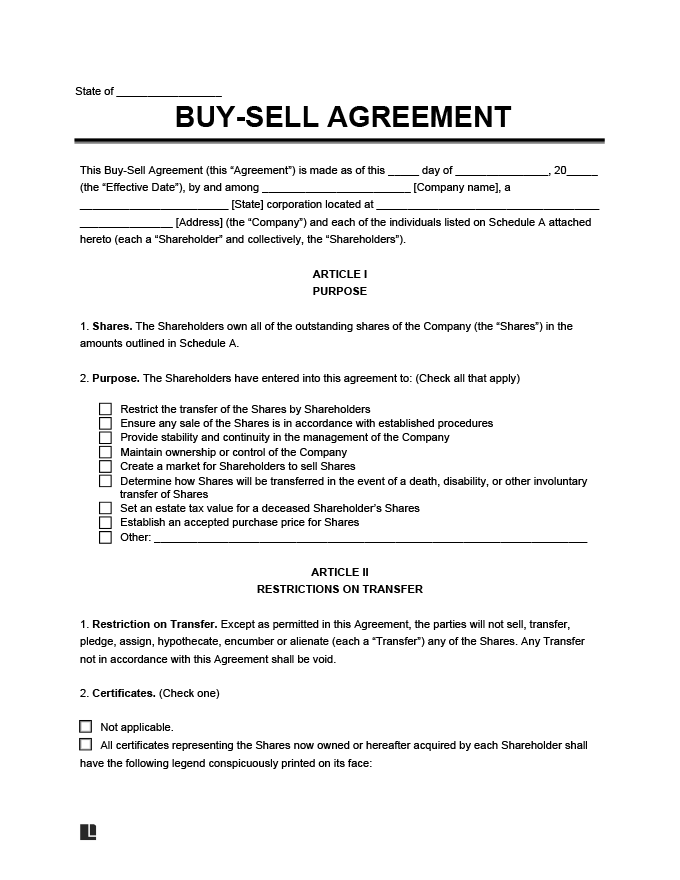

Now, the good news is you don’t have to start from scratch. A stock buy sell agreement template can provide a solid foundation, outlining all the essential clauses and considerations. However, it’s essential to understand what goes into these templates and tailor them to your specific circumstances. Let’s dive in and explore what makes these agreements so important and how you can effectively use a template to safeguard your business.

Why a Stock Buy Sell Agreement is Your Business’s Best Friend

Imagine this scenario: one of your partners decides to retire and wants to sell their shares. Without a buy sell agreement, you could be forced to scramble to find a buyer, potentially accepting a lower price than the shares are worth. Or worse, you could end up with a new shareholder you don’t want or trust, someone who doesn’t share your vision for the company. A well-drafted buy sell agreement avoids these nightmare scenarios by establishing a clear process for transferring ownership.

The primary purpose of a buy sell agreement is to provide a smooth transition of ownership in the event of a triggering event. These events typically include death, disability, retirement, termination of employment, or even personal bankruptcy of a shareholder. The agreement specifies who is eligible to purchase the departing shareholder’s shares, often giving the company or the remaining shareholders the first right of refusal. This prevents the shares from falling into the wrong hands and maintains control within the existing ownership group.

Another key benefit is price certainty. Buy sell agreements typically outline a pre-determined method for valuing the shares, such as a formula based on earnings, book value, or an independent appraisal. This avoids potentially costly and time-consuming valuation disputes, ensuring a fair price for both the seller and the buyer. It eliminates emotional bargaining and provides a clear, objective way to determine the value of the shares. This is especially important in closely held companies where market values are difficult to establish.

Moreover, a buy sell agreement can help to preserve the company’s legal status. For instance, if the company is an S corporation, the agreement can prevent shares from being transferred to ineligible shareholders, which could jeopardize the company’s tax status. It ensures that the ownership structure remains compliant with all applicable regulations.

In essence, a stock buy sell agreement provides peace of mind. It allows business owners to focus on running their companies without constantly worrying about what might happen if a shareholder unexpectedly leaves. It’s a proactive step that protects the interests of all parties involved and contributes to the long-term stability and success of the business.

Key Considerations When Using a Stock Buy Sell Agreement Template

Alright, so you’ve decided to use a stock buy sell agreement template – great choice! But don’t just download the first one you find and call it a day. Templates are a fantastic starting point, but they need to be carefully reviewed and customized to fit your specific situation. Think of it like buying a suit off the rack – it might look good, but it needs tailoring to fit perfectly.

First and foremost, carefully consider the triggering events. The template likely includes common triggers like death, disability, and retirement, but you might want to add others, such as divorce, termination of employment for cause, or even an offer from a third party to purchase the shares. The more comprehensive your list of triggers, the better protected you’ll be. Discuss these scenarios openly and honestly with your partners to ensure everyone is on the same page.

Next, focus on the valuation method. The template might suggest a specific formula, but is it really the best way to value your company? Consider factors like your industry, growth potential, and financial performance. You might need to adjust the formula or opt for an independent appraisal to ensure a fair and accurate valuation. Remember, the goal is to find a method that is both equitable and practical.

Funding the purchase of shares is another critical consideration. How will the company or the remaining shareholders finance the buyout? Common options include using company profits, obtaining a loan, or purchasing life insurance policies on the shareholders. The agreement should clearly outline the funding mechanism and the payment terms. Failure to address this can lead to significant financial strain and potential disputes.

Finally, make sure the agreement is legally sound. While a template can provide a good foundation, it’s always wise to have it reviewed by an attorney. An attorney can ensure that the agreement complies with all applicable laws and regulations, and that it accurately reflects the intentions of all parties involved. This is especially important if your company is complex or if you have unique circumstances.

Using a stock buy sell agreement template is a smart way to get started, but remember that it’s just a starting point. Take the time to carefully review and customize the template to fit your specific needs, and don’t hesitate to seek professional advice. A well-drafted agreement is an investment in the future of your business, one that can pay dividends for years to come. Using the correct stock buy sell agreement template can make all the difference.

It’s easy to see that a well-crafted arrangement like this is more than just a formality; it’s a cornerstone of a successful and enduring business partnership. So, take the time to understand its importance and tailor it to your unique business needs.

Putting one of these plans in place is vital for the health and future of your company. Getting it right from the start can save a lot of issues later.