Ever dreamed of owning a home but feel like you’re not quite ready for a mortgage? Or maybe you’re a landlord looking for a way to attract responsible tenants and potentially sell your property down the line? A lease to buy agreement template might just be the perfect solution for both of you. It’s a unique arrangement that combines elements of a traditional lease with an option to purchase the property at a later date. Think of it as a test drive for homeownership, allowing potential buyers to experience a property before committing to a full purchase.

This type of agreement can be a win win for both parties. For the tenant buyer, it provides an opportunity to improve their credit score, save for a down payment, and get a feel for the neighborhood and the house itself. For the landlord seller, it can mean a steady stream of rental income, a potentially higher sale price, and a pre qualified buyer already living in the property. It’s a flexible option that can be tailored to fit individual needs and circumstances, making it a popular choice in certain real estate markets.

However, like any legal agreement, it’s crucial to understand the intricacies of a lease to buy agreement template before signing on the dotted line. Knowing your rights and responsibilities, understanding the terms of the agreement, and having a clear exit strategy are essential for a smooth and successful transaction. So, let’s dive in and explore the world of lease to buy agreements, uncovering what they are, how they work, and what you need to know to make an informed decision.

Understanding the Lease to Buy Agreement Template: A Comprehensive Overview

A lease to buy agreement, also known as a lease option or rent to own agreement, is essentially a hybrid of a traditional lease and a purchase agreement. It gives the tenant the option, but not the obligation, to purchase the property at a predetermined price within a specified timeframe. This is a crucial distinction: the tenant isn’t required to buy the property at the end of the lease term.

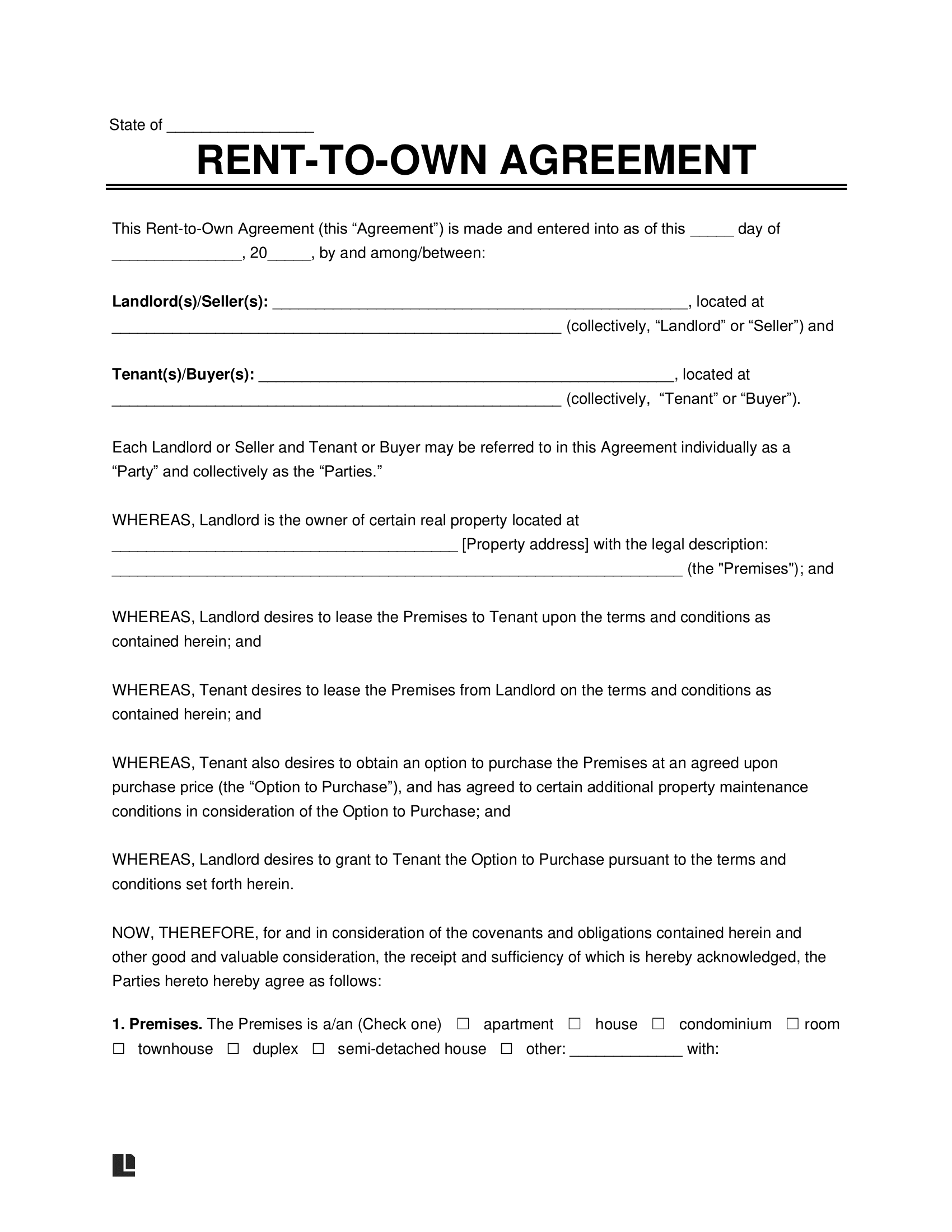

The agreement typically consists of two main parts: the lease agreement and the option to purchase. The lease agreement outlines the terms of the rental, including the monthly rent, the lease term, and the responsibilities of both the landlord and the tenant. The option to purchase details the purchase price, the option fee (a non refundable upfront payment for the right to buy the property), and the timeframe within which the tenant can exercise their option.

Several factors make a lease to buy agreement template attractive to both buyers and sellers. For potential buyers, it can be a stepping stone to homeownership, especially for those with less than perfect credit or a small down payment. It allows them to live in the property, build equity through rent credits (a portion of each month’s rent that is credited towards the purchase price), and improve their financial situation before committing to a mortgage. For sellers, it can be a way to attract a wider pool of potential buyers, secure a steady stream of income, and potentially sell the property at a higher price than they would in a traditional sale.

However, there are also potential downsides to consider. For buyers, the option fee is non refundable, so if they choose not to buy the property, they lose that money. They also need to be prepared for the possibility that they may not be able to secure a mortgage at the end of the lease term. For sellers, there is the risk that the buyer will not exercise their option, leaving them back at square one. It’s also crucial to ensure the tenant maintains the property according to the agreement to avoid potential disputes.

Therefore, before entering into a lease to buy agreement, it’s essential to carefully review the terms, seek legal advice, and understand the potential risks and rewards. A well drafted lease to buy agreement template can protect both parties and pave the way for a successful transaction.

Key Elements to Include in Your Lease to Buy Agreement Template

Creating a solid lease to buy agreement template involves several essential components. These elements ensure clarity, protect the interests of both parties, and minimize the potential for future disputes. It is always recommended to consult with a legal professional to customize the template to your specific situation.

First and foremost, the agreement must clearly identify the parties involved: the landlord (seller) and the tenant (buyer). Include their full legal names and addresses. The agreement should also provide a detailed description of the property being leased, including the address, legal description, and any included fixtures or appliances. This avoids any confusion about what is included in the agreement.

The lease term is another critical element. Specify the start and end dates of the lease, as well as any provisions for renewal or extension. Outline the monthly rent amount, the due date, and acceptable methods of payment. If rent credits are being offered, clearly state the percentage or dollar amount that will be credited towards the purchase price each month.

The purchase option is the heart of the agreement. Detail the agreed upon purchase price, the timeframe within which the tenant can exercise their option, and the procedure for exercising the option. Include any contingencies, such as the tenant’s ability to secure financing. State the amount of the option fee and clearly indicate that it is non refundable.

Finally, address responsibility for repairs and maintenance. Specify who is responsible for maintaining the property, making repairs, and paying for utilities. Include clauses regarding property insurance, property taxes, and potential default scenarios. A comprehensive lease to buy agreement template will address all of these essential elements, providing a clear framework for a successful transaction.

By understanding these essential aspects of a lease to buy agreement template, both landlords and potential tenants can navigate this complex area of real estate with more confidence.

Ultimately, deciding if a lease to buy agreement is right for you depends on your individual circumstances, financial situation, and long term goals. Weigh the pros and cons carefully, and seek professional advice to ensure you make an informed decision.