So, you’re lending money to another business, or perhaps you’re the one borrowing. Either way, you’re smart enough to know a handshake deal isn’t going to cut it. You need something solid, something legally binding that protects both parties. That’s where a business to business loan agreement template comes in. It’s your roadmap for a successful and mutually beneficial financial transaction.

Think of a loan agreement template as a fill-in-the-blanks contract. Instead of paying a lawyer hundreds (or thousands!) to draft something from scratch, you can leverage a pre-built structure and customize it to fit your specific situation. This saves time, money, and potentially a whole lot of future headaches if things don’t go exactly as planned. It ensures clarity and understanding from the get-go.

This article will walk you through why a business to business loan agreement template is essential, what key elements it should contain, and how to use it effectively. We’ll break down the legal jargon into plain English, so you can confidently navigate the process and secure your business interests. Let’s dive in and get you on the path to a secure loan agreement.

Why a Business to Business Loan Agreement Template is Crucial

Imagine lending a significant amount of money to another company based solely on a verbal agreement. Sounds risky, right? A business to business loan agreement template provides a written record of the loan terms, leaving no room for ambiguity or misinterpretations. It clearly outlines the amount borrowed, the interest rate (if any), the repayment schedule, and any consequences for late or missed payments. This is vital for maintaining a professional relationship and preventing disputes down the line.

Furthermore, a well-drafted template can protect your business from potential legal issues. By clearly defining the rights and responsibilities of both the lender and the borrower, you’re creating a legally enforceable contract. This means that if the borrower fails to repay the loan as agreed, you have recourse through the legal system to recover your funds. Without a written agreement, pursuing legal action can be significantly more challenging and expensive.

Beyond legal protection, a loan agreement template fosters transparency and trust between the businesses involved. It demonstrates a commitment to professionalism and ensures that both parties are on the same page regarding the loan terms. This can strengthen the business relationship and pave the way for future collaborations.

Think about it – a documented agreement shows good faith. It says, “We’re serious about this, and we want to ensure everything is clear and fair for everyone involved.” This is especially important when dealing with relatively new business partners or in situations where the loan amount is substantial.

Consider the reverse situation, if you are the borrower. Having a loan agreement template in place gives you a clear understanding of your obligations. You know exactly when payments are due, the interest rate, and the repercussions of default. This allows you to plan your finances accordingly and avoid any unpleasant surprises. It’s about responsibility and accountability on both sides of the transaction.

Key Elements of a Business to Business Loan Agreement Template

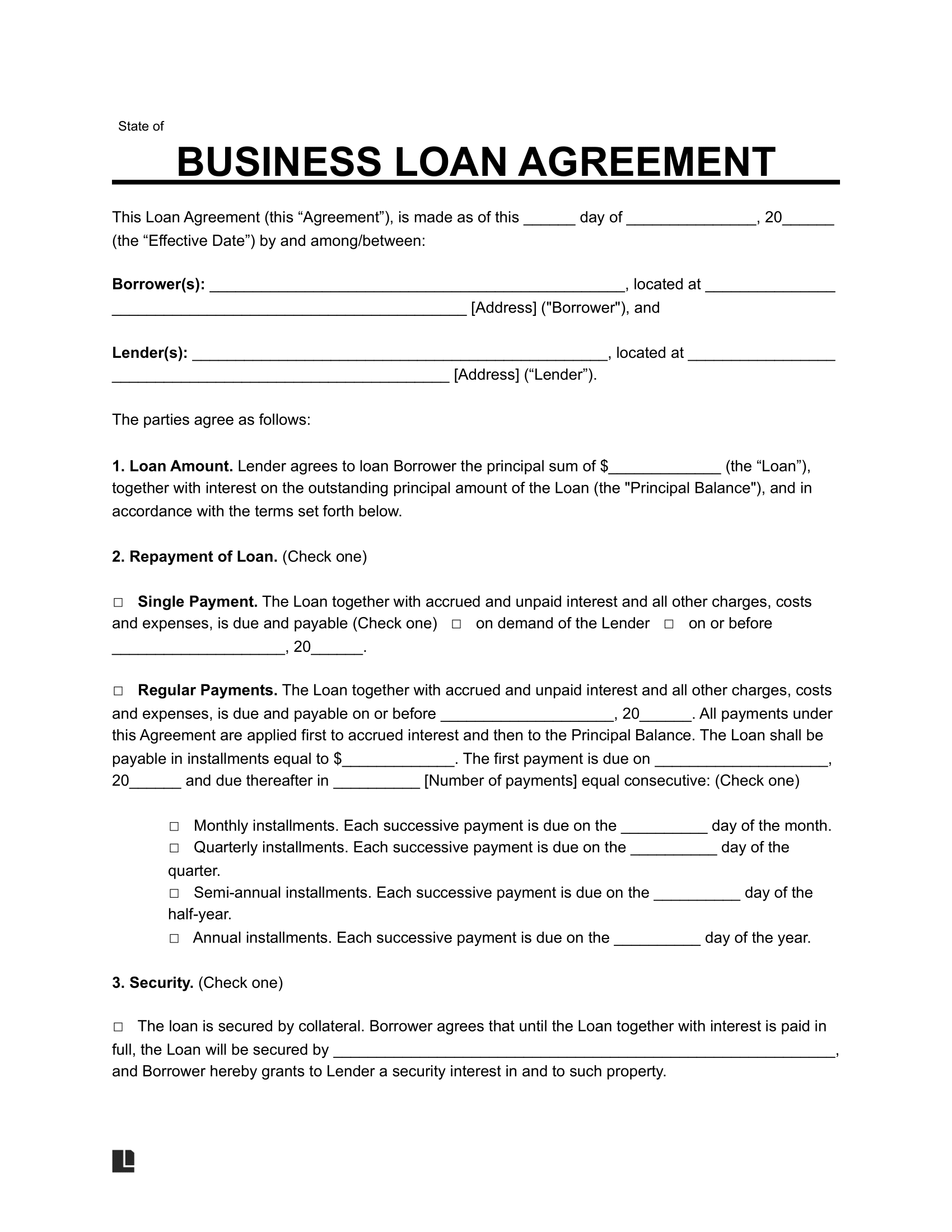

A comprehensive business to business loan agreement template should include several key elements to ensure it’s legally sound and protects both parties. First and foremost, it should clearly identify the lender and the borrower, including their legal names and addresses. This might seem obvious, but it’s crucial for establishing the parties involved in the contract.

The agreement must explicitly state the principal loan amount – the exact sum of money being lent. This should be written out in both numerical and written form (e.g., $10,000, ten thousand dollars). This helps prevent any ambiguity and ensures there is no dispute over the actual amount being borrowed.

Interest rates and repayment schedules are also extremely important. If interest is being charged, the agreement should specify the interest rate, whether it’s fixed or variable, and how it’s calculated. The repayment schedule should detail the frequency of payments (e.g., monthly, quarterly), the amount of each payment, and the due date. It is critical to add a late payment clause outlining the penalties for failing to pay on time.

Collateral, if any, needs to be clearly described. If the loan is secured by collateral (such as equipment or inventory), the agreement should include a detailed description of the collateral, its value, and the lender’s rights in case of default. This gives the lender a security interest in the collateral, providing additional protection in the event that the borrower fails to repay the loan. This can involve filing a UCC-1 (Uniform Commercial Code) filing to publicly record the lender’s security interest. You should consult with a legal professional to ensure proper filing.

Finally, the agreement should include clauses addressing default, governing law, and dispute resolution. A default clause defines what constitutes a default (e.g., failure to make payments, bankruptcy) and outlines the lender’s remedies in such a situation. The governing law clause specifies the jurisdiction whose laws will govern the agreement. A dispute resolution clause outlines how any disputes will be resolved (e.g., through mediation, arbitration, or litigation).

It is always advisable to seek legal counsel when creating any business agreement template. This is to ensure that it adheres to all the local and federal laws.

Using a business to business loan agreement template is a practical and prudent approach to formalizing financial transactions between companies. It’s about protecting your interests, fostering transparency, and building strong business relationships.

While a template provides a solid foundation, remember that every loan is unique. Customize the template to accurately reflect the specific terms of your agreement. This attention to detail can save you headaches and disagreements later on.