Starting a single-member LLC is an exciting step toward entrepreneurial freedom. You’re taking control of your business and personal liability, which is fantastic! But navigating the legal landscape can sometimes feel daunting. One of the most crucial documents you’ll need is a single member LLC operating agreement. Think of it as the blueprint for how your LLC will function, even if you’re the only member.

Many people wonder if a single member LLC operating agreement is even necessary. After all, you’re the only member, right? Well, while it might seem like an extra step, it’s incredibly important. It solidifies the separation between you as an individual and your business as a separate legal entity. This distinction is crucial for liability protection. It proves your LLC is a legitimate business, not just an extension of yourself.

This article will walk you through why you need a single member LLC operating agreement template, what it should include, and where you can find a reliable one. We’ll break down the legal jargon and make it easy to understand so you can confidently protect your business and yourself.

Why You Absolutely Need a Single Member LLC Operating Agreement

Even though you’re the only owner, an operating agreement is not just a formality. It serves several vital purposes that protect you and your business. Think of it as the constitution of your LLC, outlining the rules and regulations for its operation. Without it, you’re leaving yourself vulnerable to potential legal challenges and financial setbacks.

First and foremost, it reinforces the limited liability protection that an LLC provides. By clearly defining the LLC as a separate entity from yourself, you strengthen the barrier between your personal assets and your business debts or lawsuits. This is paramount if your business were to face financial difficulties or legal action. The operating agreement serves as documented proof that you treat your LLC as a distinct entity.

Secondly, a single member LLC operating agreement template can clarify your business structure and operating procedures. Even if you’re the only member, specifying details like your business’s purpose, your role, and how profits and losses are distributed can be beneficial. It provides a clear record of your intentions and operating structure, which can be helpful for internal organization and external communication.

Furthermore, an operating agreement can assist in opening a business bank account. Many banks require proof of the LLC’s existence and operational framework before opening an account under the LLC’s name. A well-drafted operating agreement fulfills this requirement and streamlines the process.

Finally, an operating agreement can address future scenarios, such as what happens if you become incapacitated or decide to sell the business. It can outline a succession plan, ensuring a smooth transition of ownership or management. This forward-thinking approach can save you and your loved ones significant time and stress in the long run.

Key Elements of a Single Member LLC Operating Agreement

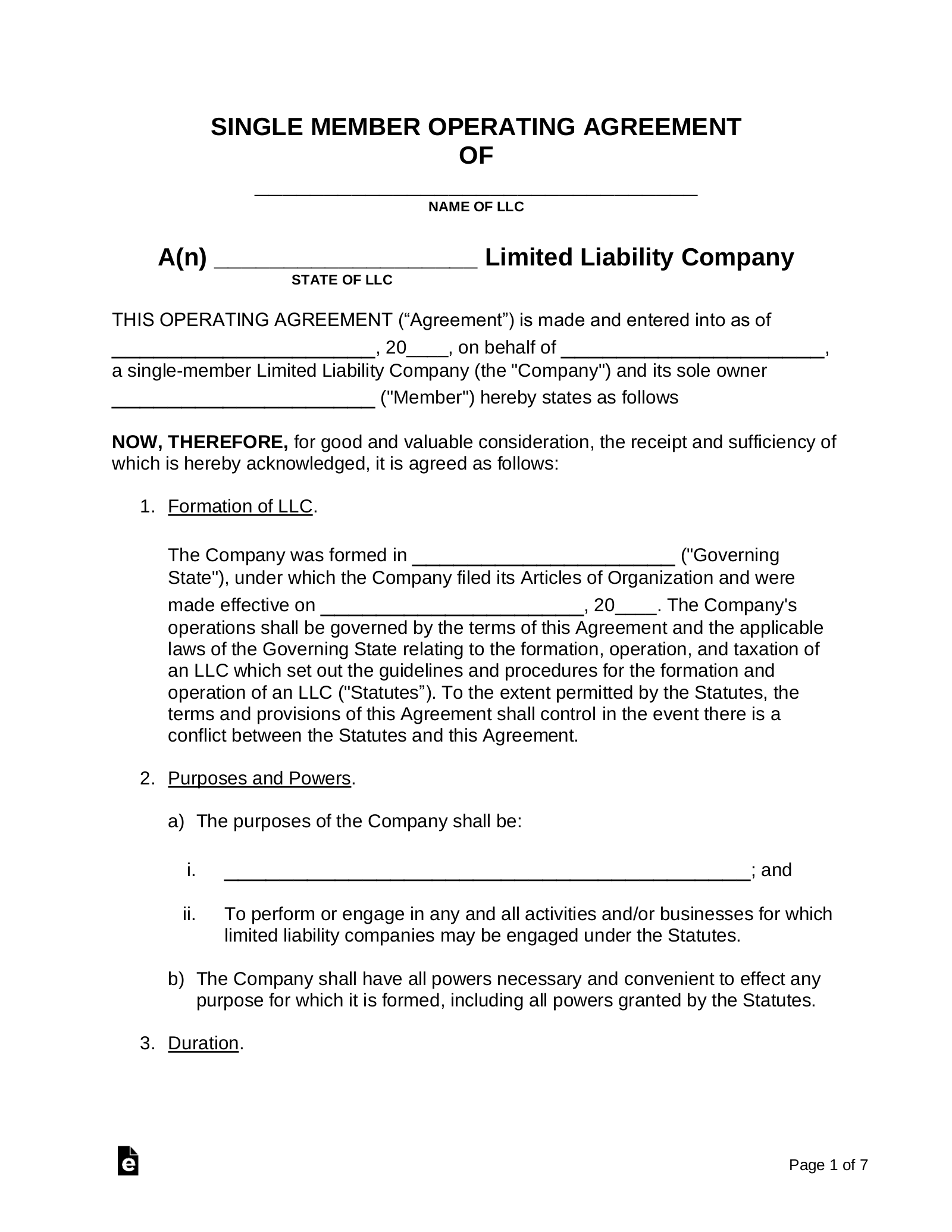

A comprehensive single member LLC operating agreement covers several essential areas. Let’s break down the key elements you’ll typically find in a well-structured template. It’s important to remember that specific requirements can vary depending on your state, so always consult with legal professionals if needed.

The first section usually covers basic information about your LLC, including its name, principal business address, and the name and address of the registered agent. The registered agent is the person or entity designated to receive official legal and tax documents on behalf of the LLC.

Next, the agreement should clearly state the purpose of your LLC. This section describes the type of business activities your LLC will engage in. While you can generally state a broad purpose, it’s helpful to be specific enough to accurately reflect your business operations. Include information about initial contributions. This refers to the assets you, as the member, contribute to the LLC to get it started. These contributions can be cash, property, or services.

Another crucial section outlines the management structure of the LLC. In a single member LLC, this is straightforward: you, as the sole member, are responsible for managing the business. The operating agreement should state this clearly and define your powers and responsibilities.

Finally, the agreement should address profit and loss allocation. Since you’re the only member, all profits and losses flow directly to you. The operating agreement should confirm this and specify how these profits and losses will be reported for tax purposes. It’s always wise to review a single member LLC operating agreement template with a legal professional, or use legal document services, to ensure it complies with local and state laws and meets the specific needs of your business.

Understanding these elements will help you select an appropriate single member LLC operating agreement template and customize it to your specific needs, ensuring your business operates smoothly and is well-protected.

Taking the time to draft and implement a solid single member LLC operating agreement is one of the smartest things you can do when starting your business. This legal document provides essential protection and clarity.

Don’t underestimate the importance of having a well-drafted single member LLC operating agreement. It’s an investment in the future security and success of your business.