So, you’re looking to buy or sell shares in a company? That’s a big step! And like any significant transaction, you need to make sure everything is crystal clear and legally sound. That’s where a Share Purchase Agreement (SPA) comes in. Think of it as the roadmap for the entire deal, outlining all the crucial details to protect both the buyer and the seller. Navigating the legal world can be tricky, but having a solid agreement in place makes the whole process smoother and more secure.

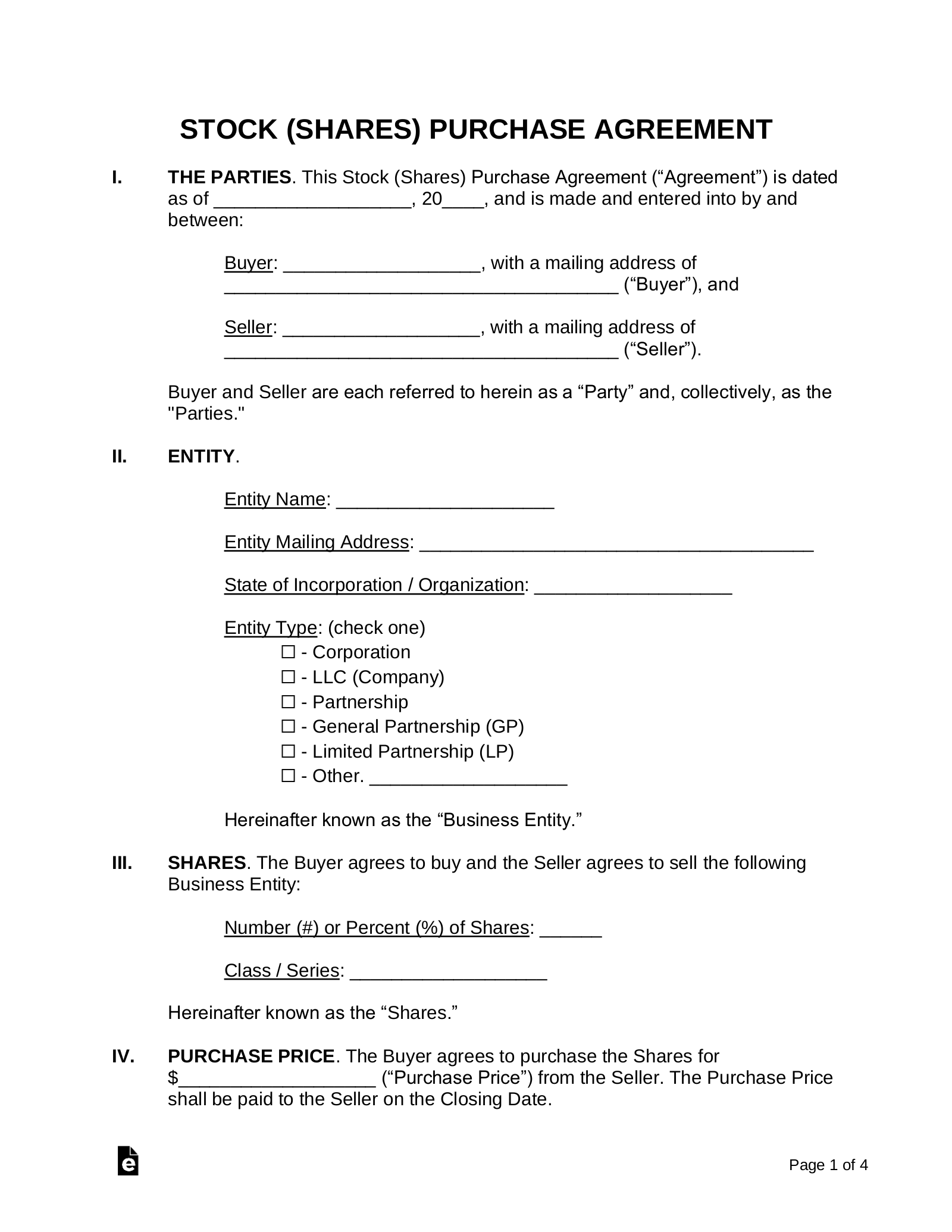

A Share Purchase Agreement, at its core, documents the specifics of transferring ownership of shares from one party to another. It’s not just about saying “I’ll sell you these shares for this price.” It delves into the nitty-gritty details such as the exact number of shares being sold, the price per share, the payment terms, any warranties or guarantees being made by the seller, and what happens if something goes wrong down the line. Basically, it aims to remove any ambiguity and create a legally binding contract that everyone can rely on.

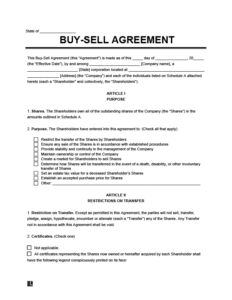

Finding a reliable sample share purchase agreement template can save you time and potentially a lot of money in legal fees. However, it’s crucial to remember that a template is just a starting point. Every transaction is unique, and you’ll likely need to adapt the template to fit your specific circumstances. We’ll walk you through some key aspects of a share purchase agreement and what you should look for in a good template.

Key Elements of a Robust Share Purchase Agreement

Crafting a solid Share Purchase Agreement involves several key elements that need careful consideration. These elements ensure both the buyer and seller are protected and understand their respective obligations. Let’s break down some of the most important aspects:

Detailed Description of the Shares: This section might seem obvious, but precision is key. Clearly define exactly which shares are being sold. Include the class of shares (e.g., common stock, preferred stock), the number of shares, and any unique identifiers associated with those shares. Ambiguity here can lead to disputes later on.

Purchase Price and Payment Terms: This is where the money changes hands. The agreement must clearly state the total purchase price for the shares and how that price will be paid. Will it be a lump sum payment at closing? Or will there be installments over time? If there are installments, specify the amounts, due dates, and any interest charges that may apply. Also, specify the currency of the transaction.

Representations and Warranties: This is a crucial section where the seller makes certain promises about the company and the shares being sold. For instance, the seller might warrant that they have the legal right to sell the shares, that the company’s financial statements are accurate, or that there are no undisclosed liabilities. These warranties provide the buyer with some assurance and recourse if the seller’s representations turn out to be false.

Closing Conditions: Before the sale can be finalized, certain conditions may need to be met. These could include things like obtaining regulatory approvals, completing due diligence to the buyer’s satisfaction, or securing consent from other shareholders. The agreement should clearly outline these conditions and what happens if they are not met. For example, the agreement might specify a termination date if the closing conditions are not fulfilled.

Governing Law and Dispute Resolution: Finally, the agreement should specify which jurisdiction’s laws will govern the agreement and how any disputes will be resolved. Will disputes be resolved through arbitration or litigation? Specifying these details upfront can save time and money in the event of a disagreement.

Finding and Adapting a Sample Share Purchase Agreement Template

Now that we’ve covered some of the key elements, let’s talk about finding and using a sample share purchase agreement template. The internet is awash with templates, but it’s important to choose wisely. Here’s what to keep in mind:

Source Matters: Look for templates from reputable sources, such as legal websites, law firms, or business organizations. Avoid using templates from unknown or unreliable sources, as they may be incomplete or inaccurate. Using such template carries bigger risks than finding a reputable sample share purchase agreement template.

Read Carefully: Don’t just download a template and assume it’s ready to go. Read the entire template carefully and make sure you understand each provision. If you’re not sure about something, seek legal advice.

Customize It: Remember that a template is just a starting point. You’ll need to customize it to fit your specific transaction. This might involve adding or deleting provisions, modifying the language, or including additional schedules or exhibits. Consider any specific aspects of the deal that are not covered in the template. For example, any non-compete clause.

Consider Your Specific Situation: The best template for you will depend on the specifics of your situation. Are you buying or selling a small number of shares in a private company, or are you dealing with a larger transaction involving a publicly traded company? The complexity of the agreement will vary depending on the circumstances. Also, the law may vary between jurisdictions so you need to ensure it’s right for your jurisdiction. Seek local legal advice.

Get Legal Advice: This cannot be stressed enough. While a template can save you time and money, it’s no substitute for professional legal advice. Before signing any Share Purchase Agreement, have it reviewed by an attorney who specializes in corporate law. They can help you identify any potential risks and ensure that the agreement protects your interests.

Ultimately, while finding and adapting a sample share purchase agreement template is a great starting point, remember that each deal has nuances that a generic template may not address. It is important to review the template carefully and consider whether it fits your business needs.

Navigating the world of share purchase agreements can seem daunting, but with the right approach and resources, you can protect your interests and ensure a smooth transaction. Remember, due diligence and professional advice are your best friends in this process.