So, you’re gearing up to buy or sell a home? That’s fantastic! It’s a significant milestone, and while exciting, it can also feel a little overwhelming, right? Don’t worry; you’re not alone. One of the most crucial documents you’ll encounter in this process is the home sale purchase agreement. Think of it as the blueprint for the entire transaction, outlining all the terms and conditions that both the buyer and seller agree upon.

This agreement is more than just a formality; it’s a legally binding contract that protects everyone involved. It clearly spells out the price, closing date, contingencies (like inspections and financing), and other essential details. Having a solid home sale purchase agreement template can save you a lot of headaches and potential legal disputes down the road.

In essence, the home sale purchase agreement template ensures everyone is on the same page, preventing misunderstandings and setting the stage for a smooth and successful real estate transaction. Let’s dive into what makes up a good template and how to navigate this essential document with confidence.

Understanding the Key Components of a Home Sale Purchase Agreement Template

A comprehensive home sale purchase agreement template covers numerous aspects of the property transaction. It’s crucial to understand these elements to ensure your interests are protected, whether you are buying or selling. Let’s break down some of the most critical components:

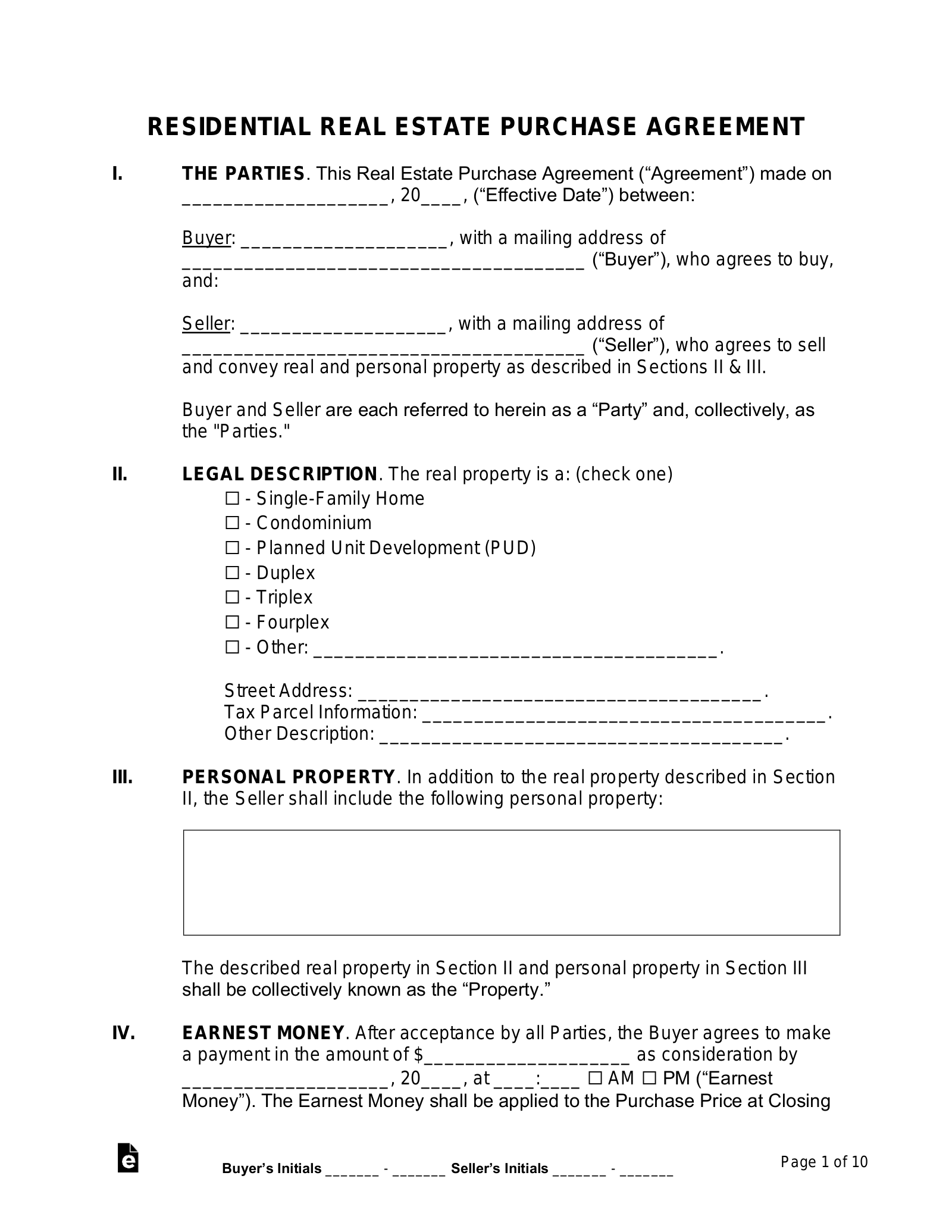

First and foremost, the agreement must clearly identify the parties involved. This means including the full legal names of both the buyer and the seller. The property description is equally important; this section must accurately describe the property being sold, usually including the street address, legal description, and any included fixtures or appliances.

The purchase price is, naturally, a central element. The agreement will state the agreed-upon sale price and how the buyer intends to pay for the property. This includes details about the initial deposit (earnest money), the amount financed, and any other sources of funding. Don’t forget to specify what happens to the earnest money if the deal falls through.

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include a satisfactory home inspection, appraisal, and financing approval. The agreement should outline the timeframe for fulfilling these contingencies and what happens if they are not met. For example, if the home inspection reveals significant issues, the buyer may have the right to renegotiate the price or back out of the deal entirely.

Finally, the closing date is the date when the property officially transfers from the seller to the buyer. The agreement will specify this date and outline the responsibilities of both parties leading up to the closing. This includes things like obtaining title insurance, conducting a final walkthrough, and signing all necessary documents. A well-drafted agreement will also address what happens if either party fails to meet their obligations by the closing date.

Navigating the Process with a Home Sale Purchase Agreement

Once you have a home sale purchase agreement template in hand, what’s the best way to use it? The first crucial step is to thoroughly read and understand every clause. Don’t hesitate to ask questions – whether from a real estate agent, attorney, or other qualified professional. It’s far better to clarify any doubts upfront than to encounter surprises later on.

Next, ensure all the information in the template is accurate and complete. Verify the property details, purchase price, and all other terms. If you need to make changes or additions, make sure they are clearly documented and agreed upon by all parties. Any amendments should be written, signed, and dated to avoid any misunderstandings.

Consider using a real estate attorney to review the agreement. While a template provides a solid foundation, an attorney can help identify potential risks and ensure the agreement is tailored to your specific situation and local laws. They can also assist with negotiations and provide guidance on any complex legal issues that may arise.

Remember, the home sale purchase agreement is a binding legal document. Once signed, both the buyer and seller are obligated to fulfill its terms. Therefore, it’s essential to approach the process with care and diligence. Take your time, seek professional advice when needed, and ensure you fully understand your rights and responsibilities.

Keep a copy of the signed agreement for your records. This document will be essential throughout the transaction and may be needed for tax purposes in the future. A well-managed home sale purchase agreement is the cornerstone of a successful real estate transaction, providing clarity, protection, and peace of mind for both buyers and sellers.

Ultimately, taking the time to understand this critical paperwork can empower you to navigate the real estate landscape with greater confidence and security, and it can really make a difference in your overall experience whether you are buying or selling.

Careful planning, attention to detail, and professional guidance are your best allies in ensuring a smooth and favorable outcome, so don’t hesitate to make use of them.