Starting a Limited Liability Company (LLC) is an exciting step for any entrepreneur. It offers liability protection and flexibility, making it a popular choice for small businesses. But before you dive headfirst into the world of LLC ownership, there’s a crucial document you need to have in place: the operating agreement. Think of it as the internal rulebook for your LLC, outlining how it will be run, managed, and owned.

While not legally required in every state, having an operating agreement is highly recommended for all LLCs, regardless of whether you’re a single-member operation or have multiple partners. It helps to clarify roles, responsibilities, and ownership percentages, preventing potential disputes and misunderstandings down the road. It’s all about establishing a clear framework from the get-go.

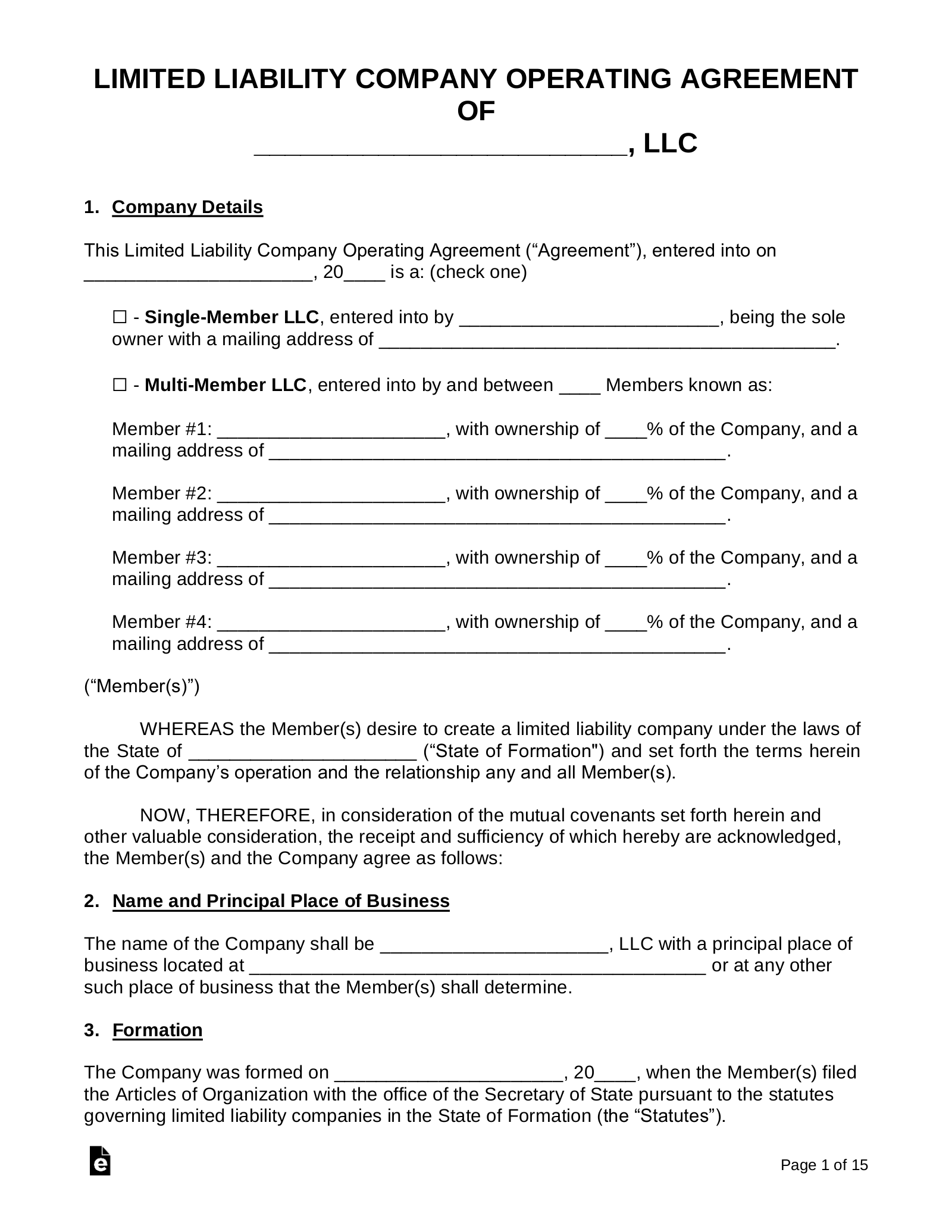

Creating an operating agreement from scratch might seem daunting, but fear not! There are many resources available to help you craft a professional and comprehensive document. One of the most convenient options is to use an operating agreement template for llc. These templates provide a solid foundation, outlining essential provisions and allowing you to customize the agreement to fit your specific business needs. It’s like having a roadmap to ensure everyone is on the same page.

Why You Absolutely Need an Operating Agreement

Okay, so we’ve established that an operating agreement is a good idea. But let’s delve into the nitty-gritty of why it’s practically essential for the long-term success and stability of your LLC. Think of it this way: it’s like having a prenuptial agreement for your business partnership. You hope you’ll never need it, but you’ll be incredibly grateful to have it if things go south.

First and foremost, an operating agreement helps protect your limited liability status. While forming an LLC inherently separates your personal assets from business debts, a well-drafted operating agreement reinforces this separation. Without one, a court might question the legitimacy of your LLC, potentially piercing the corporate veil and exposing your personal assets to liability. By clearly defining the responsibilities and financial obligations of the members, the operating agreement acts as a shield against personal liability.

Beyond liability protection, an operating agreement provides clarity and structure to your business operations. It outlines the roles and responsibilities of each member, defines how decisions will be made, and establishes procedures for handling profits, losses, and distributions. This is especially crucial for multi-member LLCs, where conflicting opinions and management styles can easily lead to disagreements. The operating agreement serves as a roadmap, preventing misunderstandings and ensuring that everyone is on the same page.

Consider this scenario: imagine two partners in an LLC, each with a different vision for the company’s future. One wants to reinvest all profits back into the business for growth, while the other wants to take regular distributions for personal income. Without an operating agreement outlining the distribution policy, this disagreement could escalate into a major conflict, potentially damaging the business relationship and even leading to litigation. An operating agreement preemptively addresses such potential conflicts, providing a clear framework for resolving disputes and ensuring the smooth operation of the LLC.

Furthermore, an operating agreement provides flexibility and customization. While state laws govern LLCs, they often provide default rules that may not be suitable for every business. An operating agreement allows you to tailor the rules to fit your specific needs and circumstances. For example, you can specify how new members will be admitted, how members can transfer their ownership interests, and how the LLC will be dissolved. This customization ensures that your LLC operates in a way that aligns with your business goals and values.

Key Elements of a Solid Operating Agreement

So, what exactly should be included in your operating agreement? While the specific contents will vary depending on the nature of your business and your individual circumstances, there are certain key elements that should be included in every operating agreement. These elements provide a comprehensive framework for managing your LLC and preventing future disputes.

First, the agreement should clearly identify the members of the LLC, including their names, addresses, and ownership percentages. It should also specify the initial capital contributions of each member, outlining the amount of cash, property, or services each member contributed to the LLC. This information is essential for determining each member’s share of profits, losses, and distributions. Furthermore, it should detail how future capital contributions will be handled, including whether members are required to contribute additional capital and what happens if a member fails to do so.

Next, the operating agreement should outline the management structure of the LLC. Will it be member-managed, where the members directly manage the business? Or will it be manager-managed, where one or more designated managers are responsible for day-to-day operations? The agreement should clearly define the roles and responsibilities of the managers or members, specifying their authority and decision-making power. It should also establish procedures for electing or removing managers, as well as for resolving disputes among managers or members.

The agreement must also address the allocation of profits and losses. How will profits and losses be divided among the members? Will it be based on ownership percentages, capital contributions, or some other formula? The operating agreement should clearly define the allocation method and provide examples to illustrate how it works. It should also address the timing and frequency of distributions, specifying when and how profits will be distributed to the members. This is a critical aspect of the operating agreement, as it directly impacts each member’s financial stake in the LLC.

Furthermore, the operating agreement should include provisions for transferring membership interests. Can members freely transfer their interests to third parties? Or are there restrictions on transfers, such as requiring the consent of other members or offering a right of first refusal? The agreement should clearly define the transfer procedures and any restrictions that apply. It should also address what happens if a member dies, becomes disabled, or withdraws from the LLC. These provisions are crucial for ensuring the continuity of the business and preventing unwanted ownership changes.

Finally, the operating agreement should include procedures for amending the agreement and dissolving the LLC. How can the operating agreement be changed? Does it require unanimous consent of all members, or can it be amended with a majority vote? The agreement should clearly define the amendment process and any requirements that must be met. It should also outline the procedures for dissolving the LLC, including the steps for winding up the business and distributing assets. These provisions are essential for ensuring that the LLC can be terminated in an orderly and efficient manner.

Having this document ready will bring you a peace of mind. It is also beneficial if you are looking for external funding.

Ultimately, it helps with future scenarios that may or may not arise. It’s always a good idea to have it in writing so that all parties involved are protected and everyone knows their rights and responsibilities.