So, you’re about to embark on the exciting journey of buying or selling property? Congratulations! But before you pop the champagne, there’s a crucial piece of paperwork you need to get your head around: the purchase and sale agreement. Think of it as the roadmap that guides you from initial offer to handing over the keys (or receiving the payment!). It’s a legally binding contract that outlines the terms and conditions of the sale, protecting both the buyer and the seller.

Navigating the real estate world can feel like trying to decipher a foreign language, especially when legal documents are involved. Don’t worry, you’re not alone! While every transaction is unique, a standard purchase and sale agreement template provides a solid foundation for your deal. It helps ensure that all the important details are covered, from the purchase price and closing date to contingencies and disclosures.

The beauty of using a template is that it saves you time and effort. Instead of starting from scratch, you have a pre-built framework that you can customize to fit your specific circumstances. This article will explore the ins and outs of a standard purchase and sale agreement template, helping you understand its key components and how to use it effectively. Let’s dive in and demystify this essential real estate document!

Understanding the Core Components of a Standard Purchase and Sale Agreement Template

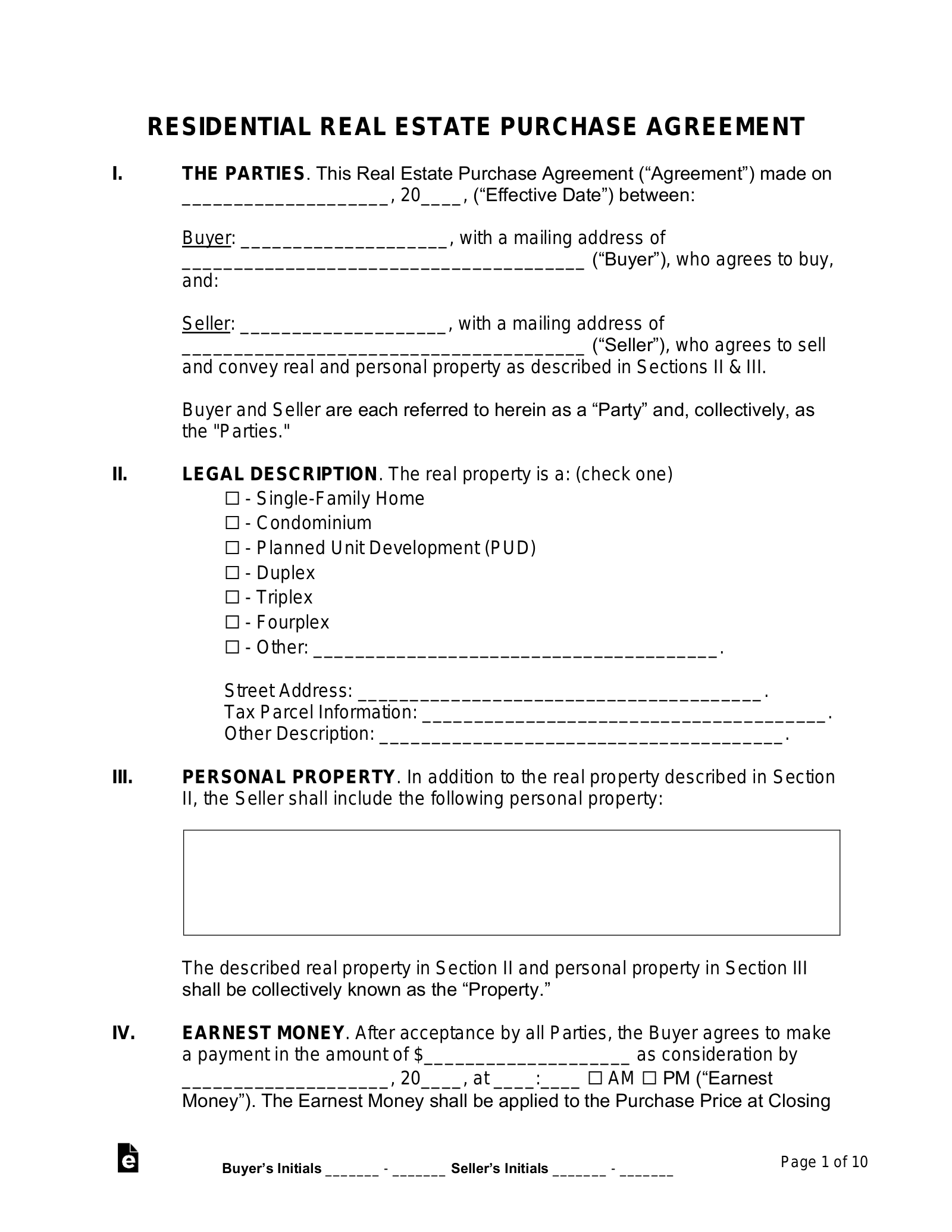

A standard purchase and sale agreement template is more than just a form; it’s a comprehensive document that details every aspect of the real estate transaction. Let’s break down some of its most critical sections:

First, you’ll find the identification of the parties involved. This clearly states the names of the buyer and seller, ensuring there’s no confusion about who is entering into the agreement. Accuracy here is paramount, as any errors could potentially invalidate the contract.

Next comes the property description. This section provides a detailed description of the property being sold, including its address, legal description (often found on the deed), and any included fixtures or personal property. Be as specific as possible to avoid any future disputes about what is included in the sale.

The purchase price and payment terms are also crucial. This clearly states the agreed-upon purchase price, the amount of the earnest money deposit, how the remaining balance will be financed (e.g., mortgage, cash), and the schedule for payments. It also outlines what happens if the buyer is unable to secure financing.

Then there are contingencies. These are conditions that must be met for the sale to proceed. Common contingencies include financing contingency (the buyer needs to get a mortgage), inspection contingency (the buyer needs to have the property inspected and approve the results), and appraisal contingency (the property needs to appraise at or above the purchase price). Contingencies protect the buyer by allowing them to back out of the deal if certain conditions aren’t met.

Finally, the closing date and other important details are provided. This specifies the date when the ownership of the property will be transferred to the buyer. It also includes other important details such as who is responsible for paying closing costs, how property taxes will be prorated, and what happens if either party breaches the agreement.

Key Clauses to Consider When Using a Standard Purchase and Sale Agreement Template

While a standard purchase and sale agreement template provides a solid foundation, it’s essential to understand the implications of each clause and customize it to your specific needs. Here are a few key clauses to pay close attention to:

The “as-is” clause is particularly important. If the property is being sold “as-is,” it means the seller is not making any warranties or guarantees about the property’s condition. The buyer is responsible for conducting their own due diligence and accepting the property in its current state. This clause can significantly impact the buyer’s rights and responsibilities.

Another crucial aspect is the handling of disputes. The agreement should clearly outline the process for resolving any disagreements that may arise between the buyer and seller. This might involve mediation, arbitration, or litigation. Having a well-defined dispute resolution process can save time and money in the long run.

Furthermore, consider the provisions for default. What happens if the buyer or seller fails to fulfill their obligations under the agreement? The agreement should specify the remedies available to the non-breaching party, such as the right to sue for damages or to terminate the agreement. Understanding these provisions is essential for protecting your interests.

Don’t forget about personal property. If there are any items of personal property that are included in the sale (e.g., appliances, furniture), make sure they are specifically listed in the agreement. This can prevent misunderstandings and disputes later on.

Ultimately, a standard purchase and sale agreement template is a valuable tool, but it’s not a substitute for professional legal advice. Consult with a real estate attorney to ensure that the agreement adequately protects your interests and complies with all applicable laws.

Buying or selling property is a big decision, and getting the paperwork right is paramount. A properly executed purchase and sale agreement protects everyone involved and paves the way for a smooth transaction.

Remember, a standard purchase and sale agreement template is a starting point. Tailor it to fit your unique situation, and don’t hesitate to seek professional advice when needed. With careful planning and attention to detail, you can navigate the real estate process with confidence.