Navigating the world of loans can feel like wading through treacle, especially when you’re trying to ensure everything is legally sound and protects everyone involved. Whether you’re lending money to a friend, family member, or even a business associate, having a solid loan agreement in place is absolutely crucial. It’s not just about the money; it’s about clarity, trust, and maintaining healthy relationships. Nobody wants misunderstandings or disputes to sour personal or professional connections.

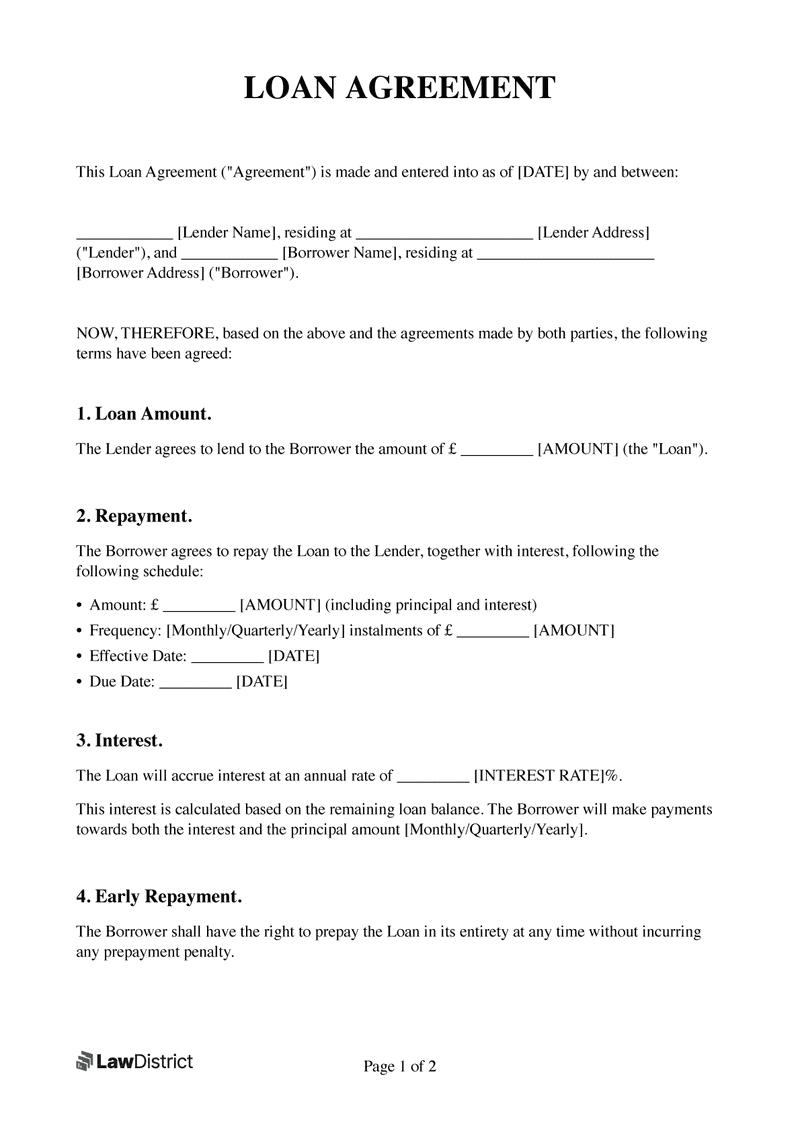

That’s where a standard loan agreement template uk comes in handy. Think of it as your friendly guide through the loan process, a framework that helps you define all the key terms and conditions upfront. From the principal amount and interest rate to the repayment schedule and default clauses, a well-structured template helps you cover all the bases, ensuring both the lender and borrower are on the same page. It’s all about creating a transparent and legally binding document that minimizes the risk of future disagreements.

So, why should you bother with a template instead of just scribbling something on a napkin? Well, a proper template, especially one designed for the UK legal system, provides a level of protection and clarity that a casual agreement simply can’t match. It’s a small investment of time and effort that can save you a lot of headaches (and potentially a lot of money) down the line. Plus, it demonstrates a level of professionalism that fosters trust and strengthens the lender-borrower relationship.

Why Use a Standard Loan Agreement Template Uk?

Let’s face it, borrowing and lending money can be a delicate subject. Even with the best intentions, things can get messy if the terms aren’t crystal clear from the start. Using a standard loan agreement template uk helps to avoid ambiguity and provides a solid foundation for a healthy financial arrangement. It’s more than just a formality; it’s a proactive step to protect both parties involved.

One of the key benefits of using a template is the sheer amount of time and effort it saves. Instead of starting from scratch, trying to remember every clause and legal requirement, you have a pre-built framework to work with. This allows you to focus on the specific details of your loan, such as the amount, interest rate, and repayment schedule, without getting bogged down in legal jargon.

Furthermore, a good loan agreement template will typically include all the essential clauses needed to protect your interests. This includes clauses covering default, late payment fees, acceleration (the right to demand immediate repayment of the entire loan balance under certain circumstances), and governing law. These clauses are designed to provide recourse in case things don’t go according to plan.

Beyond the legal protection, a well-drafted template also promotes transparency and understanding. By clearly outlining all the terms and conditions of the loan, both the lender and borrower can feel confident that they know exactly what they’re agreeing to. This can help to build trust and prevent misunderstandings down the road, leading to a smoother and more positive lending experience.

Finally, using a standard template can also make it easier to enforce the loan agreement in court, if necessary. While nobody wants to end up in litigation, having a professionally drafted document that complies with UK law can significantly increase your chances of success if you ever need to take legal action to recover your money. It provides concrete evidence of the agreement and its terms, making it harder for the borrower to dispute their obligations.

Key Elements of a Robust Loan Agreement

A solid loan agreement isn’t just a piece of paper; it’s a legally binding contract that outlines the rights and responsibilities of both the lender and the borrower. To ensure it’s effective, it needs to cover all the essential elements. Let’s break down some of the key components you should expect to find in a comprehensive loan agreement template uk.

Firstly, the agreement should clearly identify the parties involved: the lender and the borrower. This includes their full legal names and addresses. Next, it must state the principal amount of the loan – the exact sum of money being lent. This figure should be clearly written out in both numbers and words to avoid any ambiguity.

The interest rate is another crucial element. The agreement should specify the interest rate being charged on the loan, whether it’s fixed or variable, and how it’s calculated. It should also outline when and how interest payments are to be made. The repayment schedule is equally important. This section details the frequency and amount of each payment, as well as the date on which the loan is to be fully repaid. A clear and well-defined repayment schedule is essential for both parties to track their obligations.

Furthermore, the agreement should address what happens in case of default. A default clause outlines the circumstances under which the borrower is considered to be in default of the loan agreement. This might include missed payments, bankruptcy, or other breaches of the agreement. The clause should also specify the lender’s remedies in case of default, such as the right to demand immediate repayment of the entire loan balance, seize collateral, or take legal action.

Finally, a robust loan agreement should include clauses covering governing law, dispute resolution, and any other specific terms and conditions relevant to the loan. The governing law clause specifies which jurisdiction’s laws will govern the interpretation and enforcement of the agreement. The dispute resolution clause outlines the process for resolving any disputes that may arise between the parties, such as mediation or arbitration. Including these clauses can help to streamline the resolution process and avoid costly litigation.

Putting it all together, having a complete and correctly drafted loan agreement is beneficial. It’s a small price to pay for the security and clarity it brings.

When you take out a loan, you want to be sure of the arrangement. When lending, you want to ensure the money is paid back. A standard loan agreement template uk, is a safety net for both parties.