So, you’re thinking about buying or selling a small business? That’s a huge step! It’s exciting, a little daunting, and definitely requires careful planning. One of the most critical pieces of the puzzle is a solid business purchase agreement. Think of it as the roadmap for the entire transaction, outlining all the important details and protecting both the buyer and the seller.

Negotiating the sale or purchase of a business can feel like navigating a maze. There are so many moving parts: assets, liabilities, inventory, customer relationships, and more. Without a clear, well-defined agreement, misunderstandings can arise, disputes can occur, and the whole deal could potentially fall apart. That’s where a small business business purchase agreement template comes in handy. It provides a framework for documenting all aspects of the transaction, ensuring everyone is on the same page.

While you can always hire a lawyer to draft a customized agreement from scratch, using a template can save you time and money. A well-crafted template provides a solid starting point, allowing you to tailor the document to the specific circumstances of your deal. Plus, it helps you think through all the essential elements that need to be addressed, ensuring you don’t overlook anything crucial. Let’s dive deeper into what makes a great business purchase agreement template and how you can use it effectively.

Understanding the Essential Components of a Business Purchase Agreement

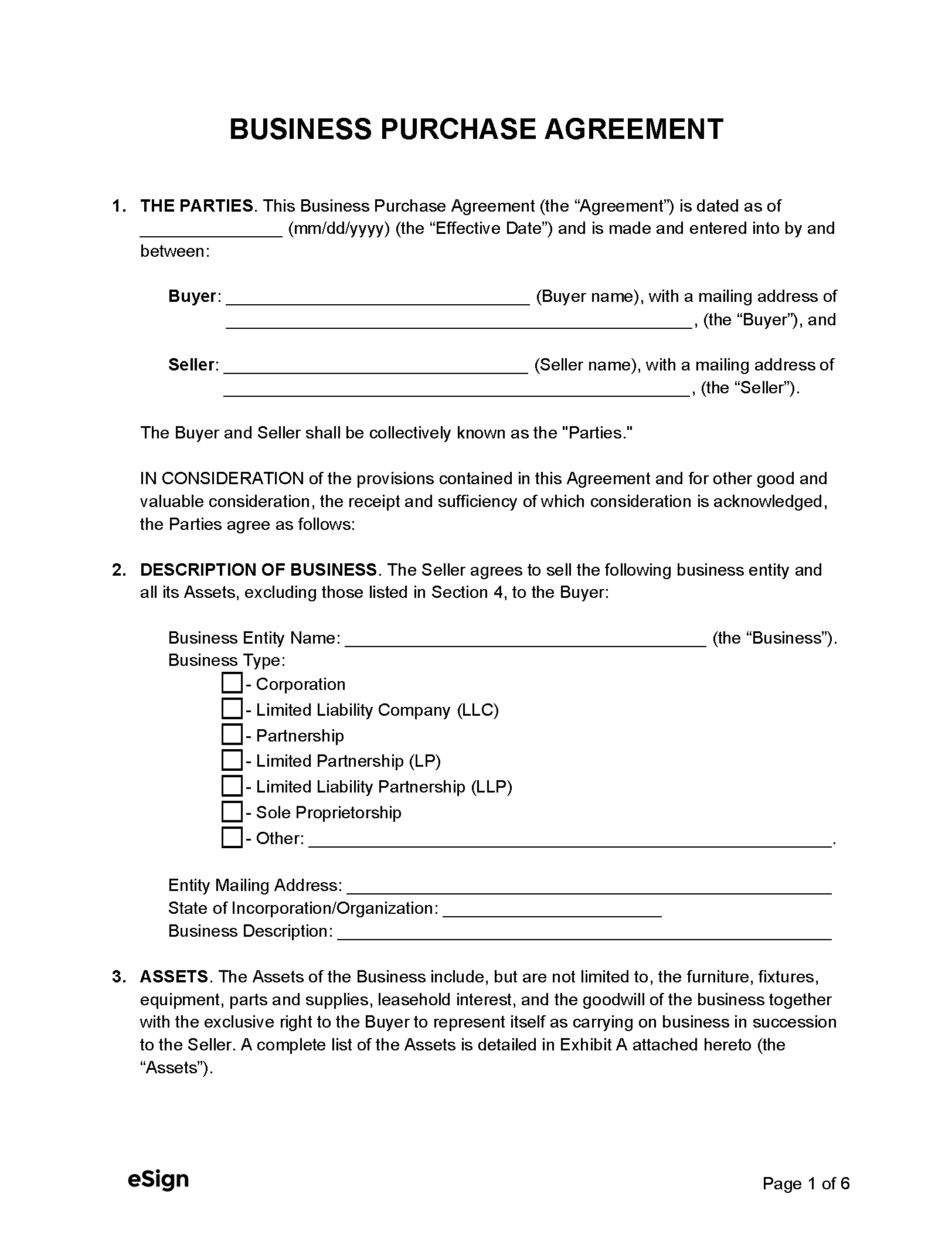

A business purchase agreement, at its core, is a legally binding contract that outlines the terms and conditions of a business sale. It’s more than just a simple document; it’s a comprehensive record of everything that both the buyer and the seller have agreed upon. A well-structured agreement clearly defines what is being sold (the assets, the business itself, etc.), the purchase price, how the payment will be made, and what happens if things don’t go as planned.

Several key sections are commonly found in a business purchase agreement. The first is the identification of the parties involved: who is the buyer and who is the seller? This section also includes their legal names and addresses. Next, there’s the description of the business being sold. Is it the entire business entity, or just specific assets? This part needs to be extremely clear to avoid any future ambiguity. Then comes the purchase price and payment terms, which specify the total amount of money being exchanged, the method of payment (cash, financing, etc.), and the timeline for payments.

Another vital part of the agreement is the section on representations and warranties. Here, both the buyer and the seller make certain promises about the state of the business. For example, the seller might warrant that the financial statements are accurate, or that there are no undisclosed liabilities. The buyer might warrant that they have the financial capacity to complete the purchase. These representations and warranties are crucial because they can form the basis for legal action if they turn out to be false.

The agreement should also address the transfer of assets, including tangible items like equipment and inventory, as well as intangible assets like goodwill, trademarks, and customer lists. This section should specify exactly what assets are included in the sale and how they will be transferred to the buyer. Additionally, the agreement should cover the issue of liabilities. Is the buyer assuming any of the seller’s debts or obligations? If so, the agreement should clearly define which liabilities are being transferred and which remain the responsibility of the seller.

Finally, it’s important to include clauses that address what happens if the deal falls through. These clauses, often called termination clauses, outline the circumstances under which either party can terminate the agreement, as well as the consequences of termination. Common reasons for termination include a failure to obtain financing, a material breach of the agreement, or the discovery of undisclosed liabilities. Including all these components in your small business business purchase agreement template will help ensure a smoother transaction.

Benefits of Using a Small Business Business Purchase Agreement Template

Choosing to use a small business business purchase agreement template offers a multitude of advantages, especially for those who are new to the process of buying or selling a business. Templates can be a real lifesaver, providing structure, clarity, and a degree of legal protection without the hefty price tag of a fully customized contract.

One of the biggest benefits is the time savings. Instead of starting from scratch, you have a pre-built framework that you can adapt to your specific situation. This means you don’t have to spend hours researching legal jargon or trying to figure out what clauses to include. The template provides a starting point that you can then customize to fit your needs, saving you valuable time and effort. This is particularly helpful when you’re dealing with the many other tasks involved in buying or selling a business.

Cost is another significant advantage. Hiring a lawyer to draft a business purchase agreement can be expensive, especially for small businesses with limited budgets. A template offers a more affordable alternative, allowing you to get a solid legal document without breaking the bank. While it’s always a good idea to have a lawyer review the final agreement, using a template can significantly reduce the amount of billable hours required, saving you money in the long run.

Templates also help ensure you don’t overlook any crucial details. A well-designed template will prompt you to consider all the essential elements of the transaction, such as the purchase price, payment terms, asset transfer, and liabilities. By providing a comprehensive checklist, the template helps you avoid making costly mistakes or overlooking important considerations that could come back to haunt you later.

Finally, using a template can promote transparency and clarity in the negotiation process. By having a clear, well-defined agreement from the outset, both the buyer and the seller can have a shared understanding of the terms of the deal. This can help prevent misunderstandings, reduce the likelihood of disputes, and foster a more cooperative and productive negotiation environment. A well-crafted small business business purchase agreement template empowers you to approach the transaction with confidence, knowing that you have a solid foundation in place.

Navigating the world of business transactions requires a blend of caution and preparedness. Taking the time to ensure that all parties involved clearly understand the terms of the sale protects everyone in the long run.

Ultimately, a solid business purchase agreement lays the foundation for a successful transition, setting the stage for a thriving future for both the buyer and the seller.