So, you’re a shareholder lending money to your company? That’s a pretty common situation for startups and small businesses. Maybe you’re bootstrapping, need a quick cash injection, or the bank isn’t playing ball. Whatever the reason, it’s crucial to get things right from the start. A verbal agreement just won’t cut it. You need a proper, legally sound document that protects both you as the shareholder and the company. That’s where a simple shareholder loan agreement template comes in handy.

Think of it like a roadmap for your financial arrangement. It clearly outlines the terms of the loan: the amount, the interest rate (if any), the repayment schedule, and what happens if things go sideways. It’s not about distrust; it’s about clarity and avoiding potential misunderstandings down the line. It’s also about making sure everyone is on the same page and that the loan is treated as a legitimate business transaction, especially when it comes to taxes and legal compliance. Having a well-defined loan agreement signals professionalism and good governance.

This article will guide you through understanding why a simple shareholder loan agreement template is essential, what key elements it should include, and where you can find a reliable template to adapt to your specific needs. We’ll also touch upon the potential pitfalls of not having one and how it can affect your business and your personal financial standing. Consider this your friendly guide to navigating the often-intimidating world of corporate finance, making it a little less scary and a lot more manageable. It’s all about setting yourself up for success!

Why You Absolutely Need a Shareholder Loan Agreement

Imagine lending a significant amount of money to your company based on a handshake agreement. Seems risky, right? Without a formal agreement, you’re essentially relying on trust alone, which can be problematic if disagreements arise or the company’s circumstances change. A simple shareholder loan agreement template acts as a written record of your agreement, providing clarity and security for both parties.

One of the biggest benefits of having a properly drafted loan agreement is its legal enforceability. If the company defaults on the loan, you, as the shareholder-lender, have a legal document to support your claim. This is particularly important if the company faces financial difficulties or enters bankruptcy proceedings. Without a formal agreement, your claim could be treated as equity rather than debt, placing you lower in the priority of creditors and reducing your chances of recovering your funds.

Moreover, a loan agreement helps to avoid potential conflicts of interest. As a shareholder, you have a vested interest in the company’s success. However, as a lender, you also have a right to be repaid. A clear and impartial agreement ensures that your interests as a lender are protected, even if they conflict with your interests as a shareholder. It sets out the rules of the game and helps to maintain transparency and fairness in the company’s financial dealings.

Beyond legal protection, a shareholder loan agreement template also simplifies accounting and tax reporting. The agreement clearly defines the interest rate (if any), the repayment schedule, and other key terms, which are essential for accurate financial record-keeping. This can help you avoid potential tax issues and ensure that the loan is treated correctly for tax purposes. Properly documenting the loan also makes it easier to track repayments and manage the loan’s balance over time.

Finally, having a documented shareholder loan agreement promotes good corporate governance. It demonstrates that the loan was made on commercially reasonable terms and that the company has properly accounted for the transaction. This can improve the company’s reputation with investors, lenders, and other stakeholders. It shows that the company is well-managed and that its financial affairs are conducted in a transparent and professional manner.

Key Elements of a Simple Shareholder Loan Agreement Template

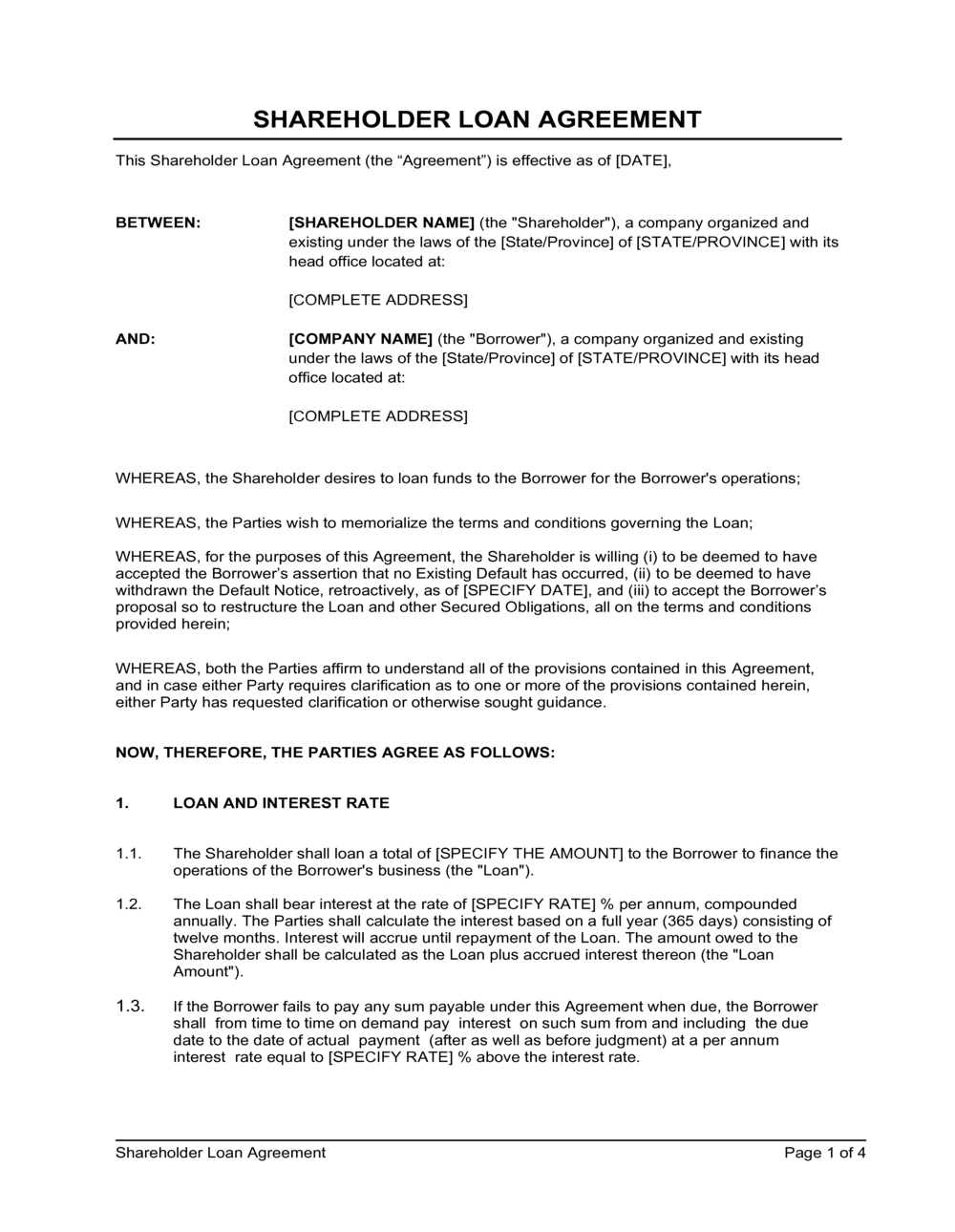

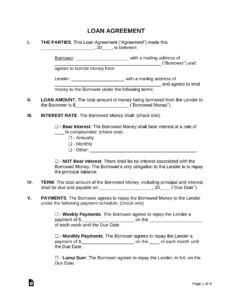

A good simple shareholder loan agreement template should cover all the essential aspects of the loan transaction. While the specific details may vary depending on your circumstances, there are certain key elements that should always be included. First and foremost, it needs to clearly identify the parties involved: the shareholder-lender and the company-borrower. This section should include their full legal names and addresses. Don’t skimp on the details.

The agreement should then specify the principal amount of the loan. This is the exact sum of money being lent to the company. Be precise! Avoid vague language or estimates. Next, it should outline the interest rate, if any. If interest is being charged, the agreement should clearly state the rate and how it is calculated. It should also specify when and how interest payments are due. If no interest is being charged, this should be explicitly stated.

A crucial section of the agreement is the repayment schedule. This outlines when and how the loan will be repaid. It should specify the amount of each payment, the frequency of payments (e.g., monthly, quarterly), and the date on which the first payment is due. The agreement should also address how payments will be applied (e.g., first to interest, then to principal). If the loan is to be repaid in a lump sum, the agreement should specify the date on which the full amount is due.

Another important element is the default clause. This section defines what constitutes a default on the loan. Common default events include failure to make timely payments, insolvency, or bankruptcy. The default clause should also specify the remedies available to the lender in the event of a default. This may include the right to accelerate the loan (i.e., demand immediate repayment of the entire balance), take possession of collateral (if any), or pursue legal action.

Finally, the agreement should include boilerplate clauses such as governing law, jurisdiction, and severability. The governing law clause specifies which state’s or country’s laws will govern the agreement. The jurisdiction clause specifies which court will have jurisdiction over any disputes arising from the agreement. The severability clause states that if any provision of the agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect. These clauses may seem like legal jargon, but they are important for ensuring that the agreement is legally sound and enforceable.

Making sure everything is well documented protects everyone from misunderstandings.

With a simple shareholder loan agreement template everyone can focus on growth and success, rather than worrying about the “what ifs”.